UK small-caps have proven to be the place to be for much of the past decade as they have far outstripped their domestic peers.

Funds within the IA UK Smaller Companies sector have surged ahead of other sectors over the past decade as a growth-supportive environment boosted returns 161.9%, making it a top quartile performer among the 58 Investment Association peer groups.

Investors who held these funds in their portfolio would have been 67.8 percentage points better off than if they had bought into the IA UK All Companies sector.

However, UK smaller company funds dropped 24.4% on average since the start of the year as rising inflation and harsher monetary policy pushed investors away from growth investing and into value.

Total return of UK sectors over the past 10 years

Source: FE Analytics

Despite dropping to the bottom quartile over the past year among all IA sectors, the asset class may still be lucrative over the long term due to the high levels of innovation that bloom in the small-cap area.

However, with markets falling investors will have a keen eye on costs, as these have more of an impact during down periods. As such, as part of an ongoing series, Trustnet looked at the funds that managed to beat their rivals and the market while also not costing the earth.

To do this we looked at alpha, which is a measurement of a fund’s returns above its benchmark, and highlighted the top 10% of the sector over the past half a decade.

We also filtered out those with top-decile information ratios and returns over the past five years, while removing any that had above-average ongoing charges figures (OCFs), so that investors can see which beat the market at the cheapest price.

The cheapest fund that met these requirements was the Thesis Stonehage Fleming AIM fund, which charged investors 0.67%.

Although it is quite a small fund with assets under management (AUM) of £110m, it managed to outperform its peer group by 153 percentage points over the past decade with a total return on 314.9%.

Total return of fund vs sector over the past 10 years

Source: FE Analytics

Managers Paul Mumford and Nick Burchett have allocated the highest exposure to information technology, healthcare and industrials, which jointly account for 63.3% of assets.

It had a one of the worst max drawdowns in the sector over the past 10 years, sinking 40.6% in its worst period, but alpha stood at a respectable 5.6.

Additionally, its Sharpe ratio of 0.8 ranked within the top quartile, meaning this steep downturn was worth it for above average returns.

Another option for investors wanting to buy high alpha for a cheaper price could be the Marlborough Nano-Cap Growth, which has a slightly higher price of 0.81%.

It climbed 139.3% since it launched in 2013 but sunk along with the rest of the sector in the short term, down 24.9% over the past 12 months.

This may be partially due to its high exposure to technology stocks, which accounts for just over a quarter of the portfolio.

Total return of fund vs sector since launch

Source: FE Analytics

Guy Feld has steered the portfolio from inception, while FE Alpha manager, Eustace Santa Barbara, joined the fund in January last year.

In terms of alpha, the fund scored lower than Thesis Stonehage Fleming AIM at 4.1, but its max drawdown of 36.1% was less severe.

The Liontrust UK Micro Cap fund was also within the top 10% for alpha, information ratio and total returns in the IA UK Smaller Companies sector, but had one of the most expensive charges.

It was launched by FE Alpha managers Anthony Cross and Julian Fosh along with the rest of the Liontrust Economic Advantage team in 2016.

Although it cost more, charging investors 1.35%, its alpha was higher than that of any other funds in the sector over the past five years at 8.4.

Furthermore, it made the highest return over the period, up 75.4%, and had best Sharpe ratio of 0.6 meaning investors in the fund had a decent balance of risk and reward.

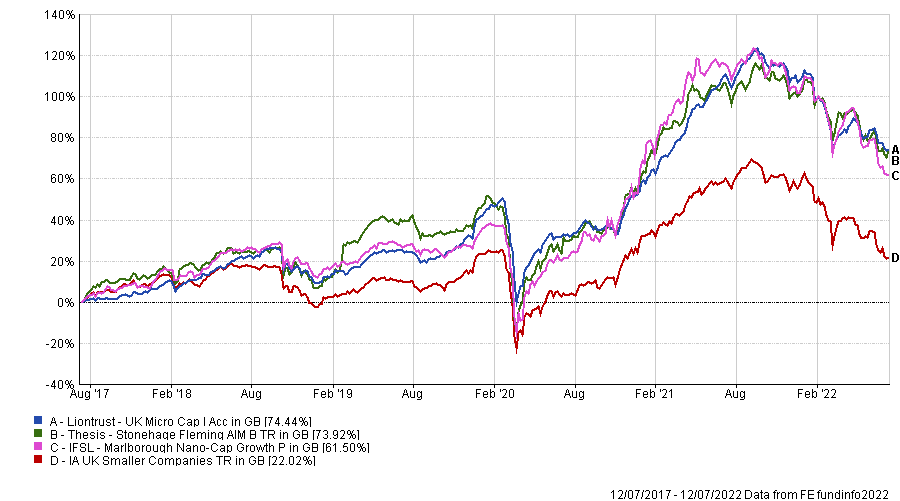

Total return of funds vs sector over the past five years

Source: FE Analytics

Similarly, it had the least number of negative months over the past five years, so investors could rest easy knowing that their savings were increasing more often than not.

In periods of difficulty, its maximum drawdown was one of the shallowest at 30.8%, so it kept losses quite low over the past five years relative to others in the IA UK Smaller Companies sector.

Although its OCF is significantly higher than the other two funds, some investors might not mind paying more for higher and more consistent returns.