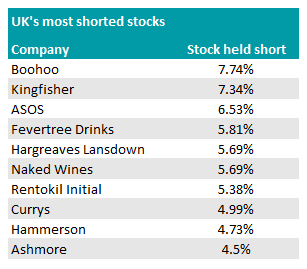

Investment platform, Hargreaves Lansdown, became one the UK’s most shorted companies in August after short sellers increased their positions in the company by 1.89 percentage points.

Shorted shares in the company reached 5.69% throughout the month after Blackrock and Citadel Advisors became the latest firms to bet against the company, with a combined position of 1.36%.

Marshal Wace, Hound Partners and Pelham Long/Short Master fund also increased their stakes in the company by 0.49 percentage points in total over August.

The lack of confidence in the company comes after it released its 2022 financial statement last month, which revealed that revenue was down 8% over the year ending 30 June, at £583m.

Likewise, assets under management dropped 9% to £123.8bn and new business inflows fell 37% to £5.5bn – these disappointing results may have painted a negative outlook for some investors.

Other financials services companies appeared among the UK’s most shorted stocks, such as abrdn and Metro Bank, which each have 4.49% and 4% of their shares shorted respectively.

Recent data from Brewin Dolphin revealed that market analysts downgraded their revenue estimates for many UK financial institutions over the past three months more than most other companies on the FTSE 100 index.

For example, analysts lowered their 2022 revenue predictions for abrdn by 3.8% on average as the company appeared less capable then anticipated at weathering stormy markets.

Share price of Metro Bank, abrdn and Hargreaves Lansdown in 2022

Source: Google Finance

Pest control company, Rentokil Initial, was another stock to enter the UK’s top 10 most shorted companies in August after bets against the business increased 1.26 percentage points.

Mirabella, Marshall Wace and Segantii became the latest firms to short the company after it revealed that its debt increased to £3.6bn from £2.7bn in the June the year before.

Despite this, Charlie Huggins, head of equities at Wealth Club, was positive about the company’s future due to its ability to withstand high inflation.

He said that Rentokil provides a crucial service that customers are unlikely to stop buying, even if it is tightening its budgets in response to higher operating costs.

Likewise, it holds many long-term contracts with customers, which could provide a consistent flow of income despite short-term volatility.

Huggins said: “Even if a customer in the catering sector wanted to risk the Food Standards Agency’s wrath and stop paying for pest control, it couldn’t, at least not until the contract expired.”

“This makes Rentokil’s business highly resilient, as became clear during the Covid-19 pandemic, when some of its customers’ premises were closed.”

He added that its recently announced merger with Terminix “should present an opportunity for significant cost savings - through merging branches and procurement savings, for example”.

Online retailer, Boohoo, became the UK’s most shorted company in August after hovering near the top position for a number of months.

Investor sentiment has remained low since the poor working conditions in its Leicester facility made headlines back in 2020, which was followed by many Environmental, Social and Governance (ESG) culling the stock.

Likewise, sales have been lower than their pandemic highs and Boohoo’s share price has suffered a 61.4% decline since the start of the year.

Share price of Boohoo in 2022

Source: Google Finance

Although it reached the top position in August, the number of shorted shares in Boohoo actually dropped by 0.15 percentage points to 7.74%.

Similarly, short positions for the two closest companies, Kingfisher and ASOS, also fell by 1.84 and 0.83 percentage points respectively.

The largest drop in short positions, however, came from Cineworld, with bets against the company falling from 7.96% to 3.37% over August.