Just a handful equity funds in the Investment Association universe have managed to keep clear of the bottom quartile in every month so far this year, spending most of the time at the top of their sector during 2022’s turbulent conditions, Trustnet research has found.

The broad-based market sell-off that has dominated 2022 means that most investors have seen their funds fall this year, but it goes without saying that some have done a better job than others.

As such, we wanted to find the funds that have spent the least amount of time at the bottom of their sector’s performance rankings.

To do this, we looked across the 20 equity sectors for funds that have not spent a single month (and September to date) in the fourth quartile.

There are 325 equity funds that have managed to do this, including well-known names such as Liontrust Special Situations, Vanguard LifeStrategy 100% Equity and BNY Mellon Global Income.

In an indication of just how difficult 2022 has been for investors, only 43 of these funds that have stayed out of the bottom quartile have made a positive return this year.

However, 325 funds is too many to present here so we narrowed the list down further by looking for funds that have not only avoided the bottom quartile but have spent at least five of the year’s months in the top quartile.

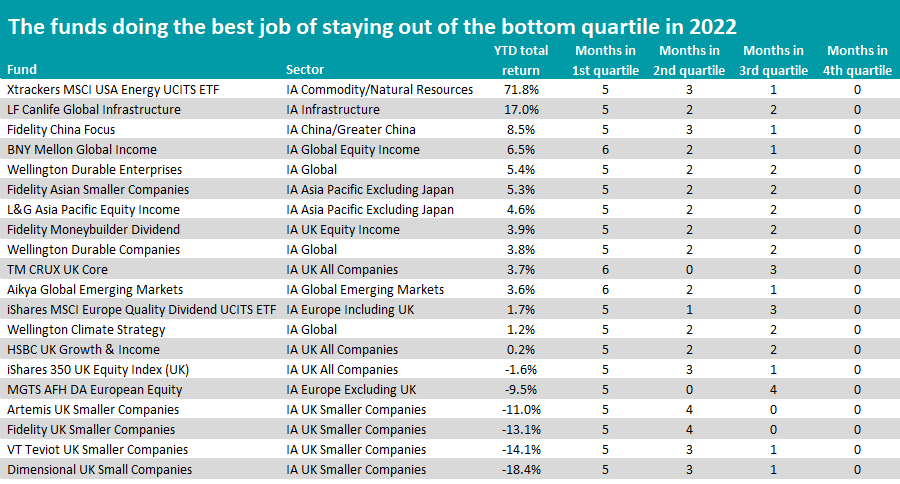

There were only 20 funds that were able to do this and they can be seen below, ranked in order of their 2022 total return (also, all of them are in the top quartile year-to-date).

Source: FE Analytics

Xtrackers MSCI USA Energy UCITS ETF is at the top of the list thanks to its 71.8% total return over 2022 so far. This is also the highest return of the entire Investment Association universe, after the price of energy commodities jumped because of increased demand, supply constraints and the war between Russia and Ukraine.

Indeed, all of the six highest returning funds of 2022 are energy ETFs although most of them did fall into the bottom quartile of their sector in June.

Fidelity has most funds on the list, with Fidelity China Focus, Fidelity Asian Smaller Companies, Fidelity Moneybuilder Dividend and Fidelity UK Smaller Companies making the cut.

These four funds hint at another trend that has been playing out in markets this year. All four of the above Fidelity funds take a value approach to investing, which was out of favour for some time but returned to the fore as inflation and interest rates started to rise.

Other funds that fit in with this theme include BNY Mellon Global Income and VT Teviot UK Smaller Companies.

While value has done relatively well this year and growth stocks have suffered (higher interest rates make investors less willing to pay up for future earnings), quality has been another area of focus.

During times of uncertainty – such as now, when higher rates and soaring energy costs threaten to push many countries into recession – investors have a preference for high-quality companies with strong balance sheets, good management teams and reliable cashflows.

The table above includes several funds that have avoided the bottom quartile this year by investing in quality stocks, such as TM CRUX UK Core, Wellington Durable Enterprises and iShares MSCI Europe Quality Dividend UCITS ETF.