Currency weightings within portfolios are not typically monitored that closely by investors, but those with high allocations to the pound may be more cautious of their exposures after its purchasing power dropped so sharply.

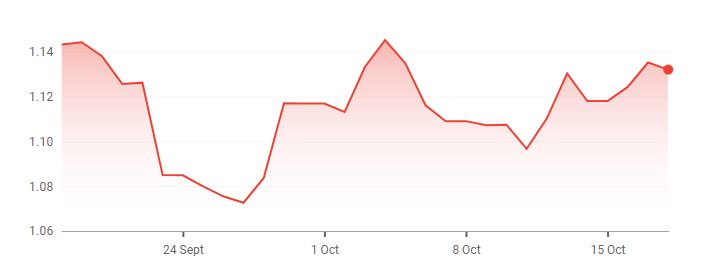

Indeed, the value of sterling dropped dramatically after former chancellor, Kwasi Kwarteng, announced his tax-slashing mini-Budget on 23rd September, which frightened off investors.

His policies, which would have cost the UK around £45bn, was intended to attract international investment but instead led to the pound dropping to its lowest value against the US dollar in more than 30 years.

Although Kwarteng has since resigned and new chancellor, Jeremy Hunt, has reversed many of the initial budget’s borrowing, Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown, said that “significant damage has been done” to the UK market’s credibility.

“There will be a long way to go and significant bridge building ahead before the UK risk premium disappears,” she added.

Seema Shah, chief global strategist at Principal Asset Management, agreed, noting that the continued weakness in the pound versus the dollar should not be ignored.

She said: “To be back where we were – but with a potential mortgage crisis now baked into the cake – is hardly a triumph.”

Value of pound sterling vs US dollar over the past month

Source: Google Finance

Whether sterling recovers or not, Paul Markham, manager of the BNY Mellon Global Equity fund, said that the turbulence in markets following the mini-Budget announcement was “a stark reminder to global investors that currency plays a key role in stock selection and portfolio construction”.

Deviation between currency values remained fairly unchanged throughout much of the past decade due to consistent market conditions, but this era of predictability could be coming to an end, Markham warned.

Central banks around the globe have taken action in the face of rampant inflation but differing approaches to monetary policy could lead to fluctuations in currency market norms.

He said: “As governments wrestle with both slowing growth and rising prices, central banks have the unenviable task of spoiling the party by tightening monetary policy. And this is where divergences in approach have led to more varied outcomes in a relatively short space of time.”

These widening changes in currencies may lead investors to pay a closer eye on their currency exposures than they have for much of the past decade.

For example, Markham said that those with overweights to the US dollar (or companies with high revenue exposure to the currency) could be rewarded from the Federal Reserve’s monetary policy. Here, he said the Fed has “acted the most quickly and decisively of all global central banks”.

One option for investors who want to make a dedicated play on this could be to look at the hedged and unhedged share classes of funds, according to James Penny, chief investment officer at TAM Asset Management, who noted that the difference in returns between the share classes of one global fund so far this year is as much as 16%.

He said: “Managing currency exposure in a portfolio remains a critical element of both volatility and risk management. Too much exposure to a single currency and one risks reversing all the hard work in blending different investment styles, strategies and geographies.”