Last week, Luiz Inácio Lula da Silva (Lula) won the Brazilian elections against his opponent and former president Jair Bolsonaro.

Around 50.9% of the voters have moved away from Bolsonaro’s far-right policies and chose Lula’s propositions of social justice, protection of the environment and democracy.

Lula’s victory might instil optimism in the market, but there isn’t much certainty around his economic policies, said Charles Gélinet, manager of the J. Stern & Co. Emerging Market Debt Stars Fund, who had questions over which Lula will take charge.

“Will he be the pragmatist who embraces economic orthodoxy, similar to the Lula who first took office in 2003, or the second-term leader who increased state intervention and spending in response to the global financial crisis?,” he asked.

“Some clues may come from the appointment of a finance minister, but until then, the immediate election impact on the Brazilian macro is likely to be limited, as any aggressive economic agenda will likely face gridlock given the composition of Congress.”

Given Brazil’s positive GDP data – when compared to other regions in South America, manoeuvres affecting corporations or an immediate impact from the election results aren’t likely, according to Gélinet, who instead worried more about government intervention into state-owned enterprises and the government-owned bank Banco Do Brasil.

However, it brings the country into the spotlight and sets it up on a different path to the one that it was on under Bolsanaro and some may see it now as an opportune time to invest.

Predominantly focused on commodities, Brazilian assets have done well since economies reopened after Covid and the war in Ukraine generated demand. If you believe the election result will further increase the tailwinds, Trustnet looks at the options available to investors wanting to gain exposure to the region.

Actively managed specialized funds

There are only three actively managed funds in the Investment Association universe that have a focus on Brazil: BNY Mellon Brazil Equity, HSBC GIF Brazil Equity and JPM Brazil Equity.

They have erratic track records, but all three delivered positive returns over one year, while BNY Mellon’s and JPM’s funds also fared positively over 10 and five years.

They all have similar weightings to the finance, consumer product and utilities sectors (30%, 17% and 8% of holdings, respectively), but differ in their allocation in basic materials and industrials.

Exchange-traded funds (ETFs)

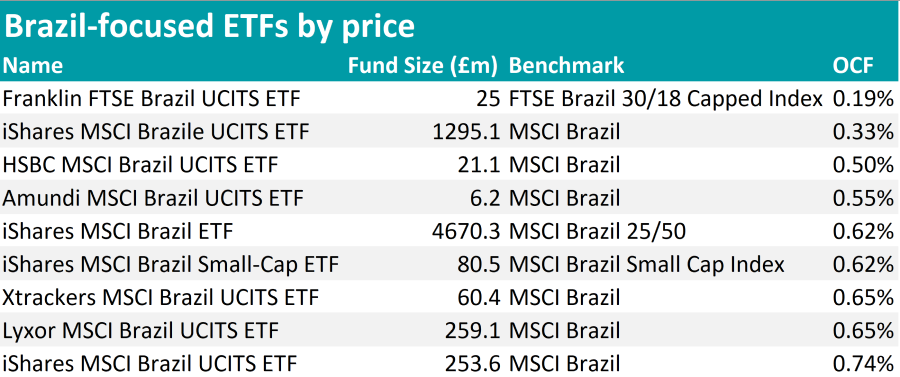

More options open up in the realm of ETFs – a liquid and flexible option that can be used to gain ad-hoc exposure at a cheap price.

Source: FE Analytics

With an ongoing charge figure of 0.19%, the title of cheapest Brazilian ETF goes to Franklin FTSE Brazil UCITS, which mirrors the performance of the FTSE Brazil 30/18 Capped Index, providing exposure to large and mid-capitalisation stocks such as mining company Vale, oil multinational Petróleo Brasileiro and financial services company Itaú Unibanco.

First by size is the £4.5bn iShares MSCI Brazil ETF, which tracks the MSCI Brazil 25/50 index and charges 0.62% annually.

Scoring second-best both on a price-based and a size-based ranking is the £1.3bn iShares MSCI Brazil UCITS ETF, which in turn reflects the wider MSCI Brazil index and has an ongoing charge figure of 0.33%.

For investors who prefer a small cap focus, the iShares MSCI Brazil Small-Cap ETF tracks the MSCI Brazil Small Cap Index and comes with an annual fee of 0.62%.

HSBC, Amundi and Xtrackers also offer ETFs benchmarked against the MSCI Brazil index.

Latin American funds

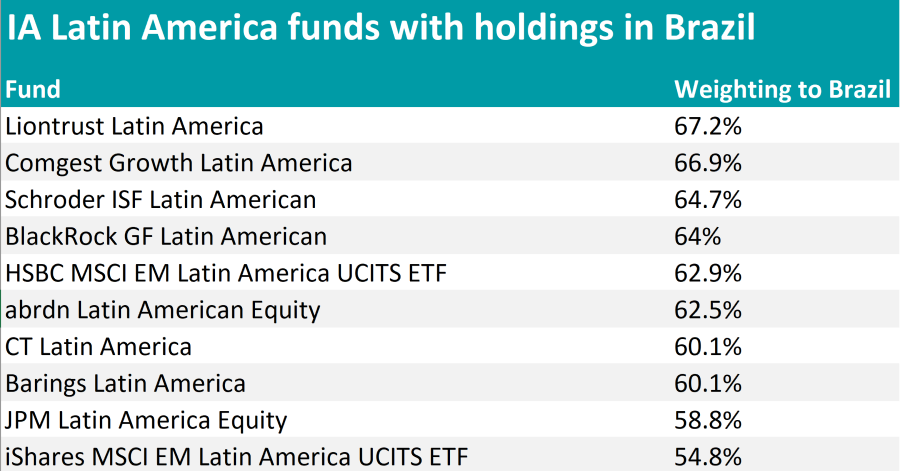

There are 10 funds within the IA Latin American sector that own Brazilian stocks and all of them allocate more than 50% of their portfolio to the region.

Source: FE Analytics

Liontrust Latin America has the most with some 67.2% invested here and four of its top five holdings are Brazilian companies.

The fund plummeted in March 2020 and has been on a steady recovery course since then.

Comgest Growth Latin America also has a 67% exposure to Brazilian assets, although it avoids holding commodity players and prefers the likes of insurance company BB Seguridade, shoe stores company Arezzo Industria, the Brazilian stock exchange B3 and electric engineering, power and automation technology company Weg Industries.

The fund didn’t benefit from the higher commodity prices and also suffered from investors’ switch to value strategies over growth.

With a portfolio more favoured by the cycle, focusing on commodities and financials, Schroder’s ISF Latin American has fared better and achieved first-quartile performance over five and three years, falling to the second over one year. The rest of the funds are highlighted in the table above.

Emerging market funds

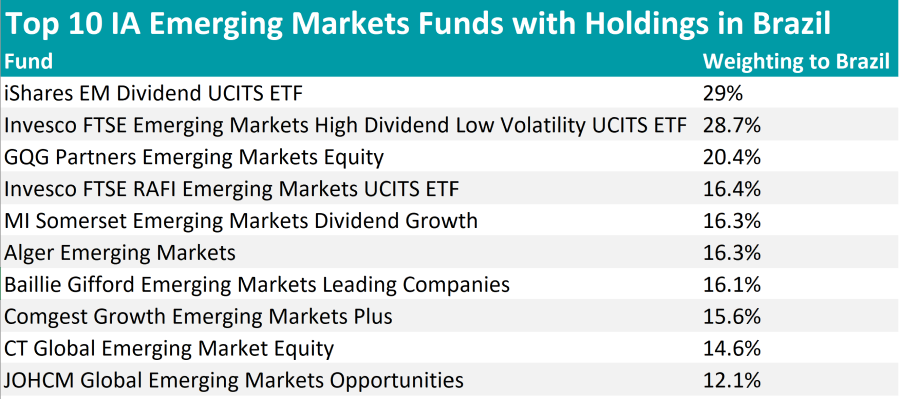

More defensive investors might find it less risky to zoom out from Latin America and consider broader emerging market exposure instead.

Around 114 of the 160 funds in the IA Global Emerging Markets sector have allocations in Brazil, with the percentages of holdings ranging up to 29%.

Source: FE Analytics

The top-10 in the list above includes both ETFs and mutual funds. iShares’ and Invesco’s ETFs, together with MI Somerset Emerging Markets Dividend Growth, focus on global income. Out of these three, only Invesco beat the sector over the long and short term.

Within the top-10 funds with the most exposure to Brazil, the most consistent returns over most timeframes were delivered by GQG Partners Emerging Markets Equity, which is a top-decile performer in the sector over five and three years and has never lost its first-quartile position since its launch in 2017. It is run by FE fundinfo Alpha Manager Rajiv Jain.