Investment company abrdn became one of the UK’s most shorted stocks in October as six new firms placed bets on the business’ future.

Short positions in the company rose by 2.7 percentage points throughout the month, bringing the total amount up to 6.8%.

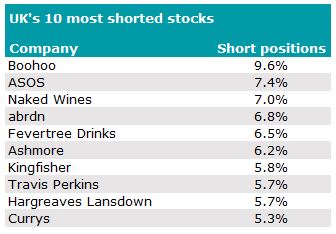

This spike boosted it to become the fourth most shorted stock in the country, with Boohoo and ASOS keeping the top spots for another month running.

Top 10 most shorted UK stocks

Source: Financial Conduct Authority

Investors turn against abrdn started after the Standard Life and Aberdeen Asset Management merger in 2017, which created a business with a combined market cap of £11bn.

Its share price has since declined 63.4% from when the merger was completed in August 2017, while the company’s short-term performance has also suffered on the back of market volatility.

Shares in abrdn are down 30.1% this year as volatile market conditions have led concerned investors to withdraw money across the firm’s 314 portfolios.

Share price of abrdn in 2022

Source: Google Finance

Indeed, the asset manager’s lack of environmental, social and governance (ESG) funds will struggle to capture the interest of increasingly sustainable-conscious investors, according to Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown.

She said: “Its ESG options currently lag peers, and demand for ethical investments is on the rise, which puts it in a tricky position.”

In its half-year report this August, abrn announced that it had made a £581m loss on adjusted operating expenses and a £320m loss on profit before tax.

Due to these shortfalls, the firm downgraded its cost-income ratio forecast of 70% in 2023 to a more achievable level.

Abrdn said in the report that “current market uncertainty means our ambitions for revenue growth and improved cost/income ratio are likely to take longer than originally expected”.

Additionally, allegations of aggressive and intimidating behaviour by abrdn’s chief executive Stephen Bird last month could pile more doubt onto the firm’s governance.

However, the company’s acquisition of online investment service, interactive investor (ii) for £1.5bn in May could provide a much-needed boost to revenue, according to Streeter.

“It’s been trying to keep revenue moving in the right direction through acquisitions,” she said. “It now owns interactive investor, which should provide a relatively stable source of assets for the group given its one of the UK's biggest direct-to-consumer investment platforms.”

Another new entrant to the UK’s top 10 most shorted stocks was Travis Perkins, a company that provides products to trade professionals through brands such as Toolstation and Keyline.

Short positions in the company rose 1.8 percentage points in October, bringing the total number of shorted shares up to 5.7%.

Although five firms are currently betting against the company, Travis Perkins announced that growth revenue had increased 10.7% in its third-quarter report released last month.

Despite these resilient revenue streams, the company said that it would “tightly manage the operating cost base” moving forward.

Nick Roberts, chief executive of Travis Perkins, said: “During the second half of the year we have seen growing macroeconomic uncertainty.

“We are focused on maintaining cost discipline in our businesses and the actions taken to simplify our operating structure in recent years have created the flexibility to adapt to changing market conditions.”

Some of the firms woes may be related to declining interest in home improvement, as other building materials businesses such as Kingfisher (which has 5.8% of its shares in short positions) have been hit since home improvement projects fell from their pandemic highs.

Now, homeowners are more concerned about enduring the cost-of-living crisis than they are about throwing cash at home revamps, according to Streeter.

She said: “The number of amateur builders, painters and carpenters hanging up their tool kits is growing as homeowners scramble around for savings, intently focused on finding ways to cut their energy bills.”

Meanwhile, pest-control business, Rentokil, dropped from the top 10 list as short positions in the company fell a sizable 4 percentage points.

It comes after the company completed its $8bn (£7bn) acquisition of US-based Terminix last month, making it the largest pest-control business in the North America.

Steve Clayton, fund manager on the HL Select range, said that this strategic purchase now gives it dominance in a crucial region, but investors will need more details on how it will be integrated into the existing business.

Likewise, numerous contracts that Rentokil had established in the pandemic are soon coming to an end, which could cause an unexpected impact on company.