The raging cost-of-living crisis is forcing Britons to cut costs where they can and one way to save cash when investing is through the fees charged by funds.

Although passives are cheapest, some investors prefer active managers and their potential to beat the market over time.

In this new series, Trustnet combines the best of both, looking for the best active managers (as represented by those with a FE fundinfo Alpha Manager rating) that have a below-average ongoing charges figure (OCF). We start with the IA UK All Companies sector.

Source: FE Analytics

With a sector OCF averaging 0.69%, only four funds made it to the ranking, as shown in the table above.

The first in the list is HL Select UK Growth, a £300m fund with a FE Crown rating of five, managed by Charlie Huggins and Alpha Manager Steve Clayton. With an OCF of 0.6%, it is the cheapest on an annual basis and the team achieved 14.4 percentage points higher returns than its peers over five years.

At the end of last month, portfolio manager James Jamieson said that inflation would remain at the forefront of the conversation and noted that the team had made changes to manage risk.

“Until now earnings have remained surprisingly resilient thanks to full employment on the demand side and corporates pulling levers to help protect profitability on the supply side,” he said.

“The outlook commentaries from companies suggest that this is beginning to change and with our expectation for softening conditions going forward and a deterioration in sentiment, we anticipate downward revisions to earnings estimates which have remarkably remained in positive territory.”

In second position is Nick Train’s Lindsell Train UK Equity, which charges 0.64% annually. Square Mile researchers said that “in Nick Train, this fund benefits from a highly experienced, articulate and thoughtful manager who has proven to be a responsible steward of investors' capital”.

The fund has “successfully navigated its way through a reasonably challenging period of outflow and relative underperformance”, having dropped from the first to the third quartile of its sector over three years.

All in all “this fund offers very good value for money, as it provides investors with access to a very well-regarded and well-managed franchise, which has achieved a highly compelling success rate,” concluded Square Mile.

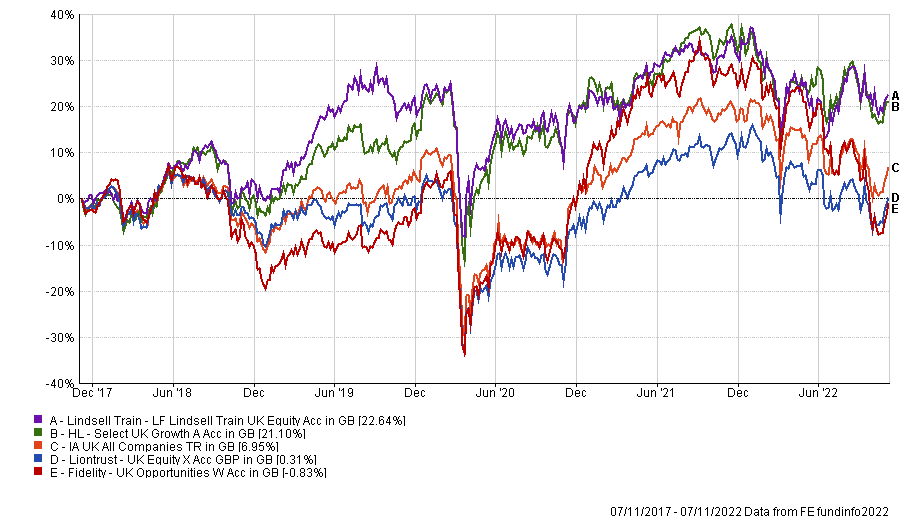

Performance of funds over 5yrs against sector

Source: FE Analytics

Liontrust UK Equity took the third place in the ranking, with the total cost of investment being both “fair and competitive” according to Square Mile analysts.

The fund's transaction costs, which are associated with trading activity, are also negative. This, they explained, is possible because of slippage, or the difference between the stock price quoted and the price at trade execution, which is often inferior to the quoted amount.

The continuous involvement of founding partners James de Uphaugh and FE fundinfo Alpha Manager Chris Field in the fund's management structure is reassuring to Square Mile, especially as there have been considerable changes at both a corporate and team level following Liontrust’s purchase of fund group Majedie Asset Management.

“While we recognise that it may take some time for the changes to embed in, we continue to retain conviction in the long standing investment approach employed, and believe that the current structure should serve investors well over the long term,” they said.

Lastly, Fidelity UK Opportunities is managed by Leigh Himsworth and charges 0.67% a year.

It aims to invest in “unrecognised growth opportunities”, which are often small and medium-sized businesses that have an attractive long-term niche growth opportunity, defined by “growing levels of demand, a compelling customer proposition, and a sustainable competitive advantage”.

Alongside this core part of the portfolio, Himsworth will also invest tactically in macro-opportunities and short-term value opportunities, with a view to providing more balance to the portfolio.

Currently, the portfolio is around 37% in FTSE 100 names and the same in the mid-cap FTSE 250 space while 18% invested in non FTSE stocks.

Despite an 8% position to energy companies, it has no exposure to Shell or BP preferring smaller producers, while the largest weighting in the fund is to financials at 21.1%.