Three new companies entered the UK’s top 10 most shorted stocks in November, but hedge funds generally reduced their positions over the month, according to data from the Financial Conduct Authority.

ASOS, Boohoo and Naked Wines took up the top spots for the second month running, but firms only increased bets on he former. In November, short positions in ASOS increased 1.4 percentage points while those in Boohoo and Naked Wines shrank by 1.2 and 0.6 percentage points respectively.

The only other stock on the list to have a higher number of short positions over the month was energy storage and clean fuel company, ITM Power.

Source: Financial Conduct Authority

It leapt into the top 10 as firms increased their bets by 2.5 percentage points throughout November, bringing the total number of short positions up to 5.8%.

The electrolysis equipment producer scrapped plans to build a second UK factory in September after its annual report revealed a gross loss of £23.5m, compared to £6.5m the year before.

This was followed shortly by the announcement that chief executive Graham Cooley would be stepping down from the role after 13 years as head of the company.

Cooley left in November and was succeeded by Dennis Schulz at the start of this month, with the company delaying its trading update from 8th December to late January.

The postponement was intended to give the new CEO time to evaluate ITM Power’s future strategy and untangle manufacturing issues that have disrupted the supply chain.

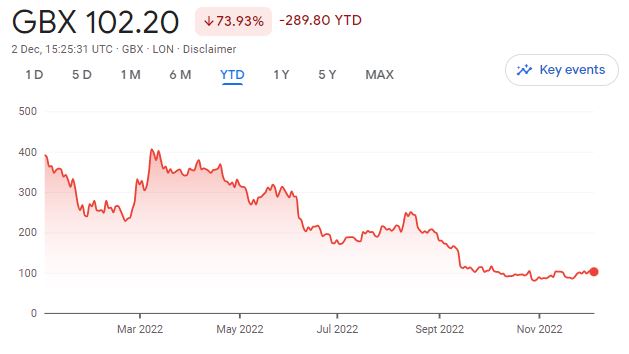

Its share price has dropped 73.9% in 2022, down 84.8% from its highs in January last year when environmental, social and governance (ESG) investing was still very much in vogue.

Share price of ITM Power in 2022

Source: Google Finance

Home improvements company, Victoria, and airline, easyJet also re-entered the top 10 over the past month despite short positions in both companies falling throughout November.

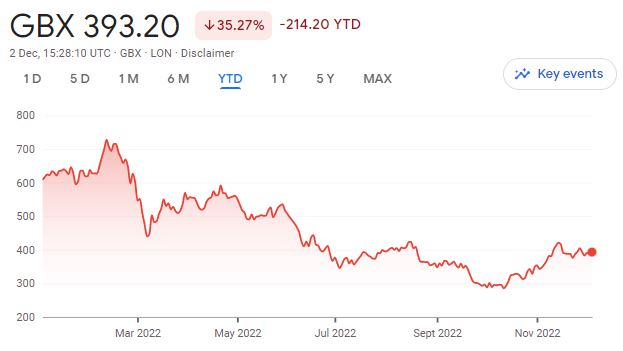

Strike action and flight cancellations caused some commotion for easyJet’s share price in 2022, which is down 35.4% since the start of the year.

However, its trading update for the fourth quarter showed that the number of people flying was returning to pre-pandemic levels.

Flight capacity was at 88% its 2019 levels, with the airline making a £535m profit over the period, resulting in a 0.6 percentage point drop in short positions.

Its share price bounced 14.5% over the past month, but Russ Mould, investment director at AJ Bell reminded investors that it was still early to call a recovery.

He said: “The shares are still barely above where they were 10 years ago, thanks to lingering concerns about Covid, as well as lofty oil prices, fierce competition, the war in Ukraine and the possibility that a recession will dampen consumers’ willingness to book holidays.”

Share price of easyJet in 2022

Source: Google Finance

Likewise, Victoria joined the top 10 list in November even though short positions in the company fell 0.3 percentage points.

Revenues were down after the flurry of customers spending their lockdown savings on home improvements scattered, with its share price dropping 62.3% since the start of the year.

Victoria’s financial statement last month gave investors some hope for improvement, with revenues reaching £776.1m in the six months leading to October, compared to £489m over the same period last year.