Investors sticking with the traditional 60/40 approach need to reconsider how they are building their portfolio and embrace a wider range of investments, according to BlackRock strategists.

The 60/40 approach – whereby a portfolio allocates 60% to stocks for growth and 40% to bonds for protection – has long been a mainstay of portfolio construction but lacklustre performance last year has put question marks over the model.

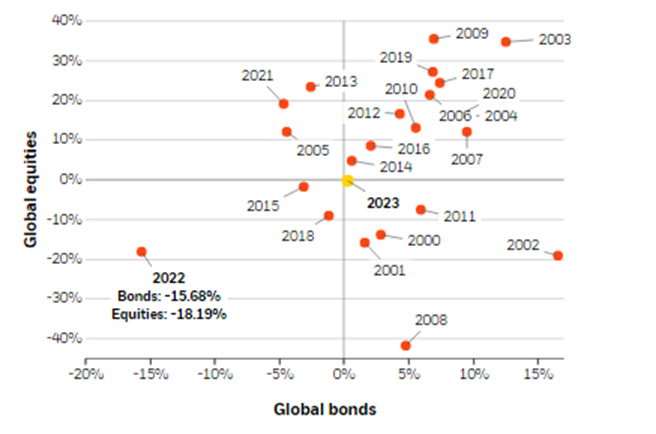

BlackRock says the traditional 60/40 equity-bond portfolio lost 17% in 2022, after high inflation, interest rate hikes and worries about weak economic growth caused an 18.2% fall in global stocks and 15.7% drop in bonds.

Annual global equity and bond returns since 1999

Source: Refinitiv Datastream, chart by BlackRock Investment Institute as at 3 Jan 2022. Based on MSCI AC World and Bloomberg Barclays Global Aggregate

Vivek Paul, head of portfolio research and UK chief investment strategist for the BlackRock Investment Institute, said: “During the ‘Great Moderation’, a period characterised by unusually steady growth and inflation, investors could rely on central banks riding to the rescue during growth crises – pushing down yields and making bonds a fantastic hedge during equity drawdowns. This ‘negative correlation’ between bonds and equity was at the cornerstone of why a 60/40 portfolio used to make so much sense.

“In the new regime characterised by higher volatility, higher inflation and supply constraints, bonds won’t work as well as a portfolio ballast compared to during the Great Moderation. Portfolios need to be built differently.”

Simona Paravani-Mellinghoff, global chief investment officer of BlackRock’s multi-asset strategies & solutions team, added that investors should be addressing two key themes at a strategic asset allocation level because of this new macroeconomic backdrop.

The first is portfolio resiliency to inflation, which in practice means more exposure than in the past to assets such as inflation-linked bonds, commodities and infrastructure.

The second theme is the importance of private markets. This is because BlackRock thinks higher macroeconomic uncertainty and more headwinds to growth means private markets have become an important way of accessing innovative companies in structural growth areas, such as digitalisation and the energy transition.

BlackRock therefore sees a number of changes in how professional investors actually go about building portfolios because of this new macroeconomic environment.

One of these is the increased adoption of index investing, which has already had a compound annual growth rate of 18% over the last 10 years.

Ursula Marchioni, head of BlackRock Portfolio Consulting EMEA, said the increase in the number of indexed products that can be used as portfolio “building blocks” reflects the need for investors to have plenty of options in the more uncertain macro regime.

Number of products required to express investment views

Source: BlackRock

Another change will be investors having to increasingly expand the range of asset classes held in their portfolios, as suggested in the table above. Marchioni said this is down to investors needing to be more dynamic and open to new opportunities in a changing market environment.

“Investors need to take a whole portfolio approach and consider their portfolio’s different building blocks; how they interact, complement and potentially neutralise each other,” she finished. “This is particularly critical in an environment driven by macro volatility, where the behavior of rates or inflation exposures will be huge determinants of overall portfolio outcomes.”