There are just a few days left before the end of the tax year, leaving investors with very little time to make the most of their £20,000 ISA allowance.

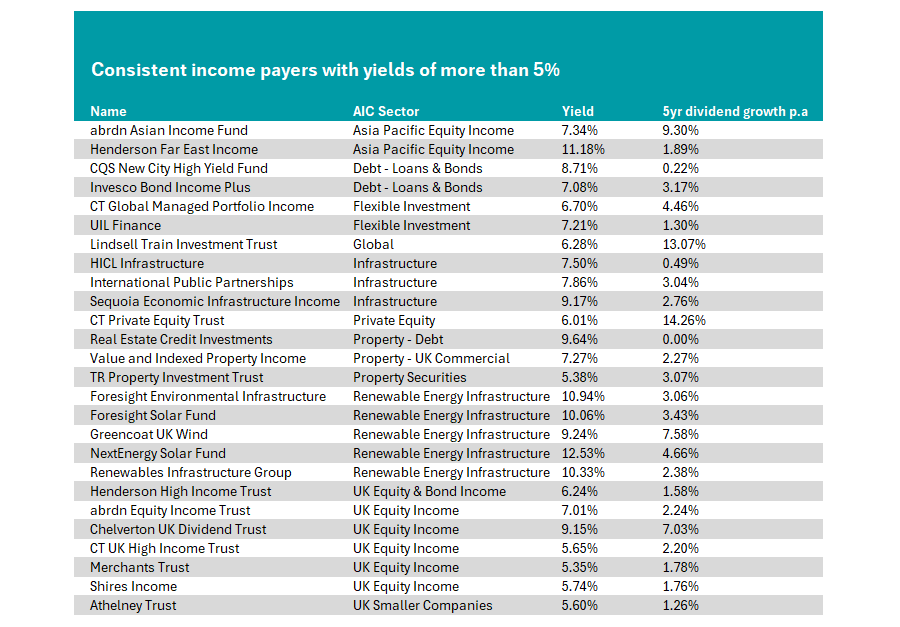

For investors looking for last-minute trust additions to their portfolios, the Association of Investment Companies (AIC) has highlighted 26 investment trusts that consistently pay the highest yields.

To make the list, trusts needed a yield of at least 5%, a 10-year history with no year-on-year dividend cuts and a positive total return over the past decade.

Source: The Association of Investment Companies, data accurate as of 25 Mar 2025

Nick Britton, research director at the AIC, said: “These trusts show that high yields and consistent income can go together. While dividends are never guaranteed, this list could make a useful starting point for investors interested in a yield that’s higher than average – much higher in some cases – but still want to see a good track record of dividend payments.”

Britton added that the list is extremely broad in scope, “spanning asset classes from UK and global equities to infrastructure, debt, renewable energy, property and even private equity” and so might be helpful for investors looking for diversification.

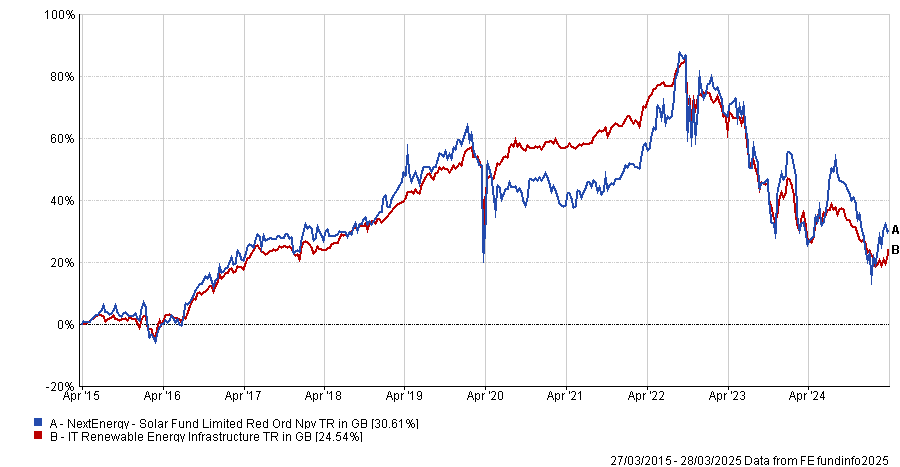

The highest-yielding trust to match the AIC’s criteria was the NextEnergy Solar Fund, which had a dividend yield of 12.5%. It is up by 30.6% over the past 10 years.

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

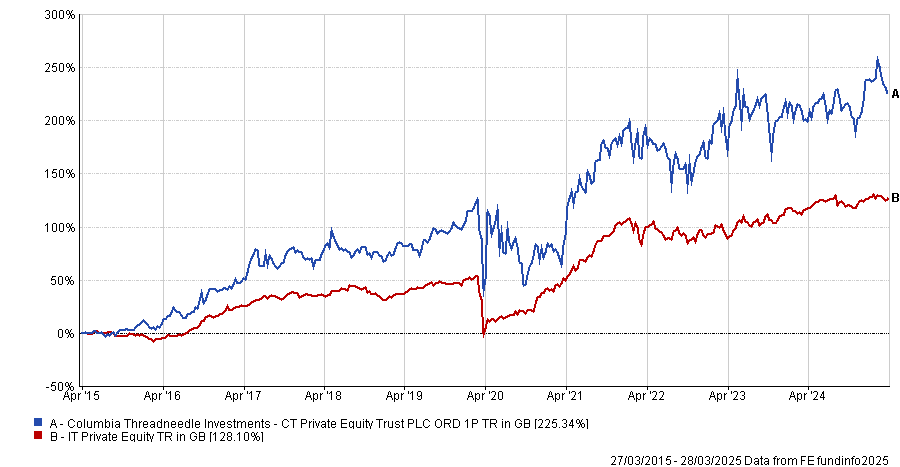

Meanwhile, the trust with the fastest five-year dividend growth was CT Private Equity, which grew its dividend by 14.3%. Over the past decade, the trust surged by 225.3%, a second-quartile result in the IT Private Equity sector.

Earlier this month, the AIC identified this trust as one of its ’next generation dividend heroes’ for growing its dividends for more than 10 consecutive years but fewer than 20.

Performance of the trust vs the sector and benchmark over 10yrs

Source: FE Analytics

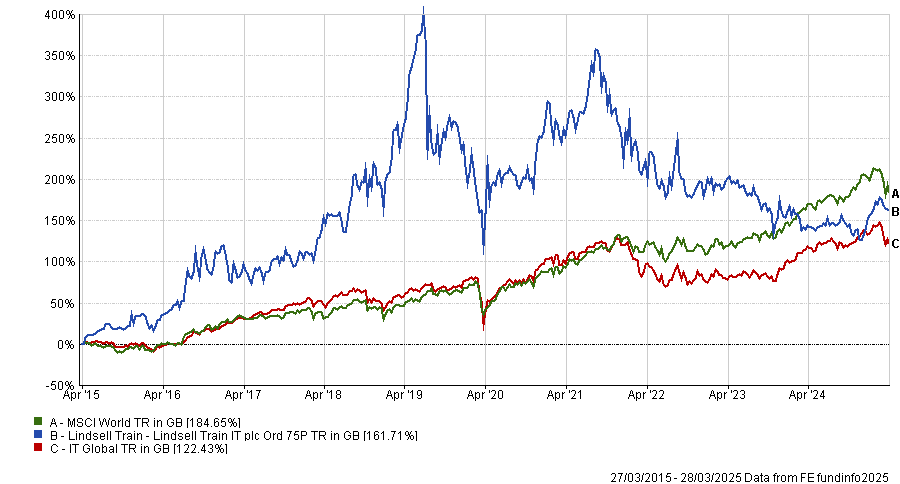

The only trust to match the AIC's criteria from the IT Global sector was the Lindsell Train Investment Trust, led by veteran manager Nick Train. It currently has a dividend yield of 6.3% and a five-year dividend growth of 13.1%.

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

Over the past 10 years, it has delivered a 161.7% return. Despite bottom-quartile results over the past five and three years, it has rallied recently, with the second-best performance in the peer group over the past 12 months.

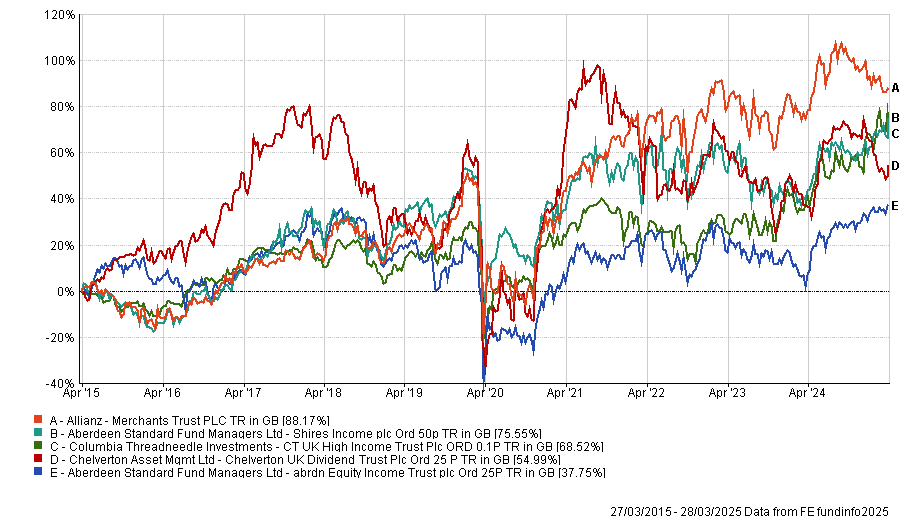

Elsewhere, there are five trusts in the UK Equity Income sector which qualified. The largest and most well-known is the £787m Allianz Merchants Trust, led by Simon Gergel.

Over the past 10 years, it has risen by 75.6% and it ranked within the top quartile of the sector over the past 12 months.

Recommended by RSMR analysts, Gergel was praised for his contrarian, value-orientated and income-biased approach. The trust is one of the AIC’s dividend heroes, having successfully grown its dividend for the past 42 years.

Performance of trusts over past 10 years

Source: FE Analytics

Another dividend hero to make the cut was the abrdn Equity Income Trust, which has successfully grown its dividend for 24 years. It currently has a yield of 7% but its 10-year return of 37.8% was the worst in the sector.

Nevertheless, both it and Merchants Trust remained popular with experts, demonstrated by analysts at Stifel earlier this month, who identified both as compelling UK equity income trusts.

Another strategy from Columbia Threadneedle Investments, the CT UK High Income Trust, also qualified. It delivered a return of 68.5% over the past decade, with top-quartile returns over the past one and three years.

It has a long track record of successfully growing the dividend, with more than 20 years of continuous dividend growth, making it another AIC dividend hero.

Shires Income and Chelverton UK Dividend Trust were the two smallest trusts in the sector to qualify, with just £103m and £60.5m in assets under management (AUM), respectively.

Finally, one IT UK Smaller Companies trust qualified, the Athelney Trust, which holds just £3.3m in AUM. Despite its small size, it was another of the AIC’s dividend heroes, having successfully grown its dividend for the past 21 years.