Markets could be in for a hard landing this year as central banks ease off monetary tightening and throw economies into recession, according to Nicholas Ware, manager of the Janus Henderson Fixed Interest Monthly Income fund.

Intervening early on in an inflation cycle can have a significant impact on the eventual downturn but central banks were later to react this time around than any other recession.

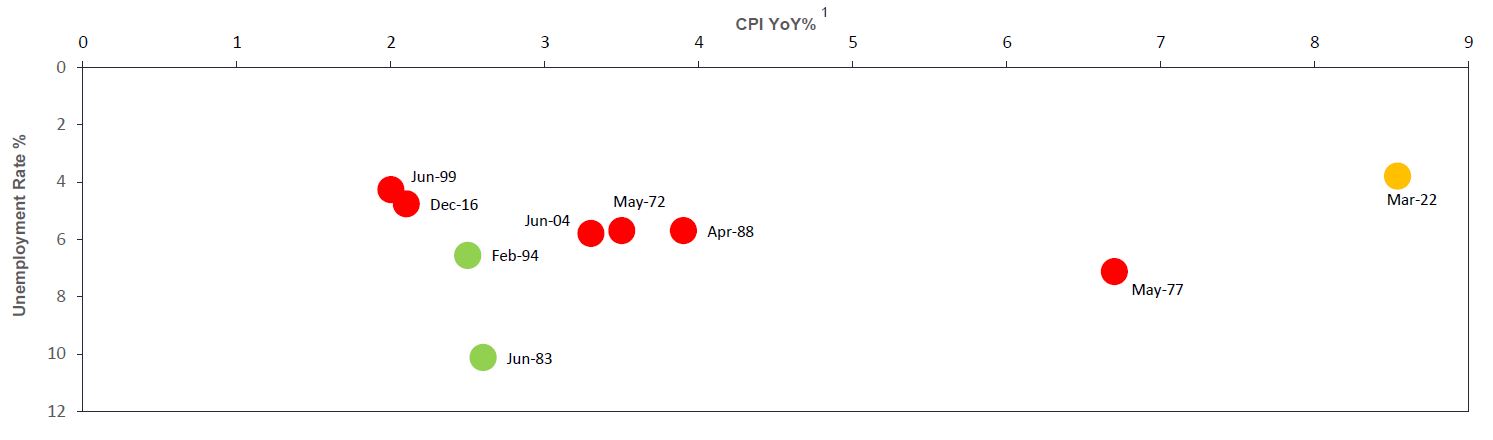

One leading indicator is the workforce. If there is high unemployment and inflation, central banks will have a lower ceiling for rate rises, as wage inflation is less likely to spike and demand is more likely to dry up quicker.

With low unemployment and high inflation – as we have today – central banks will hike rates, resulting in wage inflation, meaning increases are less likely to immediately impact inflation, which may lead to further and more aggressive uplifts.

This is highlighted in the graph below, with green dots signifying soft landings and red showing hard landings. The Federal Reserve’s (Fed) starting point last year – shown in yellow – was far less favourable than previous recessions, he argued.

Inflation and unemployment rates at the start of previous interest rate cycles

Source: Janus Henderson

Ware said: “We had high inflation and unemployment was low. That means the Fed has had a very difficult job slowing down the economy. Where you start from matters and that will play out through the year.”

A hard landing would involve central banks going too hard, too fast and pushing the economy into recession, while a soft landing would involve a balancing act that drives down inflation and minimises the damage on markets.

Central banks are attempting to raise interest rates enough to stop the economy from overheating while also averting a downturn, but that is “a lot easier to say than to do,” according to Tom Stevenson, investment director at Fidelity.

“In practice, the degree of monetary tightening required to tame inflation usually leads to a hard landing in the form of a recession and rising unemployment,” he said.

Indeed, most major central banks hiked interest rates to their highest levels in decades within the space of a few months and Ware does not think they’ve stopped yet.

He said: “The Fed is likely to hike a couple of times more – it shouldn’t but probably will.”

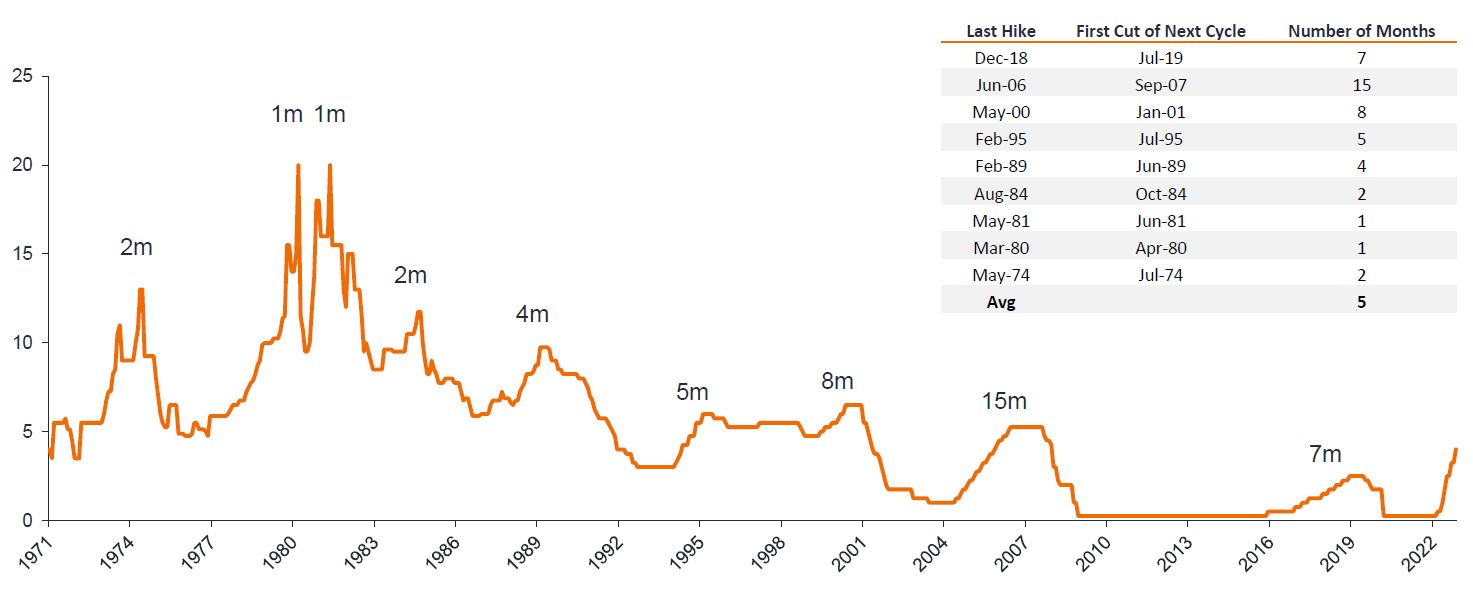

However, when it does finally unwind, the drop in rates is likely to be as hard and fast as it was on the way up, just as it has been in past cycles.

The number of months from the Fed’s last hike to its first cut

Source: Janus Henderson

Ware said: “In the 70s and 80s, which is the most relevant history, they were quick to cut them off and I think we’re going to see something similar this year.”

Many central banks in emerging markets were more pre-emptive in tackling inflation, which has allowed them to unwind monetary policy while developed nations are still hiking.

BlackRock announced recently that it would be allocating more towards emerging market equities over the short-term for this very reason, with the firm taking a tactical underweight position on developed markets as a troubling recession looms.

The leading indicators that suggest a recession have not bottomed yet, which “signals a deep recession ahead,” according to Ware.

In anticipation, he has increased exposure to investment grade bonds within the Henderson Diversified Income Trust, as he expects these assets to be the most resilient in a hard landing scenario.

From then on, Ware intends to allocate towards high yield corporate bonds “when the economy starts troughing”. Investment grade bonds currently account for 48.8% of the trust’s assets while high yield corporate bonds are 41.3%.

He said: “We’ve moved between investment grade and high yield in the past and both of those instances served us very well.”

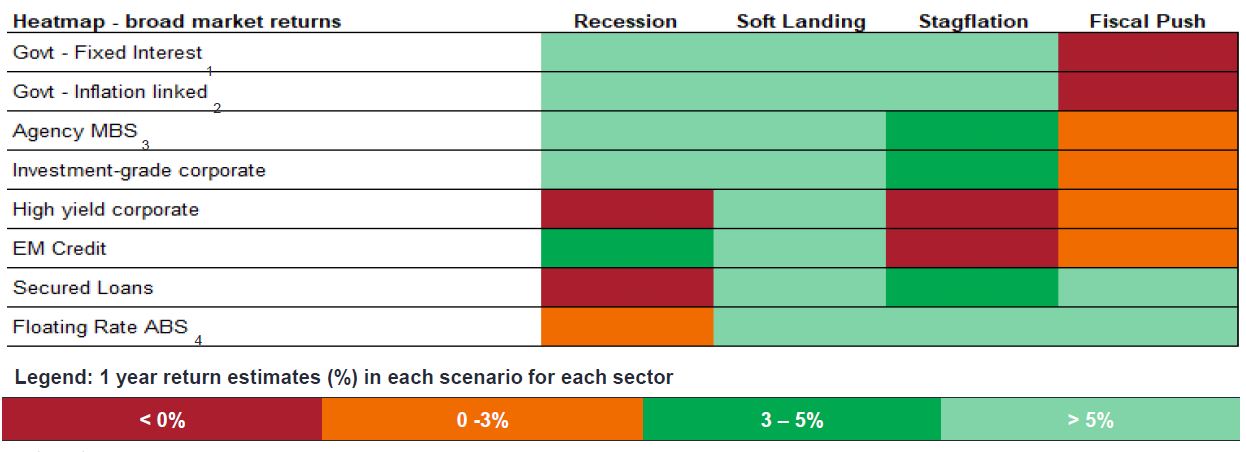

However, where an investor allocates at this stage is dependent on where they see the global economy moving, with different areas of fixed income moving contrarily in various potential outcomes, as displayed below.

Scenario analysis for fixed income returns

Source: Janus Henderson

Ware said: “If your view is that we’re heading into recession, you should be allocating towards the top end of the fixed income market.

“If you think we’re heading for a soft landing you can simply buy the whole market because everything is going to do well. The problem is a soft and hard landing looks the same to begin with.”

The debate on how the economy will land will likely be ongoing, but Johanna Kyrklund, chief investment officer of Schroders, said that there are indictors that investors can look out for if they are trying to judge the general direction.

“I think at this point there’s potential upside risks for 2023, particularly if the Federal Reserve is able to engineer a soft landing,” she said.

“The key thing to watch is the direction of inflation – the more inflation falls, the more room for manoeuvre they will have and the more potential there is for markets to move higher.”