Mid-caps polarise investors’ views, dividing those who are attracted to their long-term returns and those who aren’t too keen on taking on the added risk that they pose.

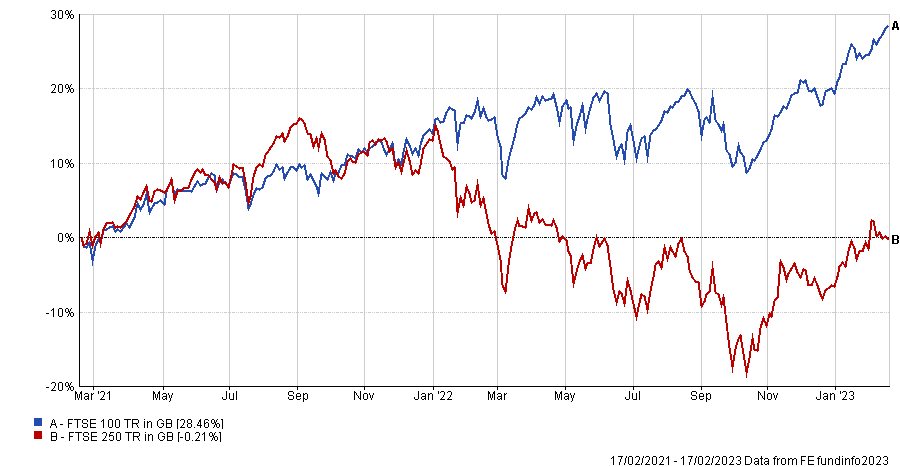

Recently, questions have arisen as to whether small and mid-caps are set to make a comeback or have further down to fall. Last week, the FTSE 100 reached 8,000 points for the first time in its history, widening the gap with its smaller sibling, the FTSE 250. Over the past two years, the divide between the two indices has reached 28 percentage points, and some might think it’s high time it closed.

Mid-caps have suffered from the double whammy of the Covid pandemic, when these stocks were perceived as too risky, and the market’s newfound preference for value investing (mid-caps are typically growth-based).

More recently, rising interest rates have impeded a resurgence of the asset class, but this might change as inflation expectations have now somewhat started to recede and caused hopes for a pivot by the Bank of England.

Performance of indices over the past 2 years

Source: FE Analytics

In a recent interview with Trustnet, VT Tyndall Real Income’s Simon Murphy revealed he is overweight mid-caps. “A lot of the areas of the UK market are quite badly beaten up, mid-caps in particular,” he said. “It's a great opportunity from a valuation perspective, but also because I personally don't think you're going to have the consensus degree of economic weakness.”

Another in favour of mid-caps was Rob Morgan, chief investment analyst at Charles Stanley, who predicted that UK merger and acquisitions (M&A) trends will pick up in 2023.

“In 2022, overseas buyers sat on the side lines with the value of inbound M&A for British companies declining to its lowest in four years. This trend looks set to reverse in 2023,” he said.

“Mid-cap companies in the FTSE 250 with international operations and businesses that could act as bolt-on acquisitions for a larger predator look like potential prey for international buyers.

“Acquirers of listed companies must pay a premium to the share price to entice holders into selling, and for boards of directors to agree, and this activity tends to bring a halo effect to other shares in the sector and a feel-good factor to the market more generally.”

On the other side of the argument was Daniel Lockyer, senior fund manager at Hawksmoor, who prefers to stick to multi-cap.

“Rather than mid-cap, I’d choose go-anywhere funds with no market cap restrictions and a couple of smaller companies funds, such as Teviot and Aberforth. Smaller companies are particularly cheap at the moment so this is not necessarily a permanent allocation,” he said.

“I’ve never understood why mid-cap funds are so popular given they restrict the manager to 250 companies. I believe the larger the opportunity set for a talented, alpha-generating manager, the better chance of performance.”

The market’s favourite UK mid-cap fund is Jupiter UK Mid Cap, the largest out of the 11 in the IA UK All Companies sector that use the FTSE 250 ex Investment Trusts Index as their benchmark. Using this fund as a proxy for this wider market, there is a pattern of investors leaving. Indeed, assets under management have shrunk from £2.8bn to £1bn in the space of 12 months.

According to FE Analytics, £666.4m were lost in performance, while £1.2bn for the effect of withdrawals. It also considerably underperformed the FTSE 250 index, as shown in the line chart below.

The fund was removed from Hargreaves Lansdown’s Wealth Shortlist in July 2022 for holding too high levels of unquoted assets, which Jupiter has recently addressed by deciding to cut its exposure to these companies in its open-ended funds.

This, however, was not enough for Ben Yearsley, director at Fairview Investing, who thought that investors who haven’t already done so, should consider selling Jupiter UK Mid Cap.

Performance of fund over 1yr against sector and index

Source: FE Analytics

“I can’t see many reasons to keep holding this fund,” he said. “Performance has been poor and there are unquoted holdings in the portfolio – if you want unquoted stick to investment trusts.”

Similarly to Lockyer, his recommendation was to focus on smaller companies instead – specifically through the Montanaro UK Smaller Companies trust.

Lockyer too saw no need to consider the Jupiter fund given the “excellent choice of UK multi-cap funds offering exposure to a cheaper set of UK businesses that are not so reliant on the growth style returning to favour”.

Other picks in the sector include VT Downing Unique Opportunities, a multi-cap vehicle with a bias towards small and mid-caps. It was selected by Chelsea Financial Services’ managing director Darius McDermott. Dzmitry Lipski, head of funds research at interactive investor, chose Montanaro Better World, which invests in small and mid-cap companies with an environmental, sustainability and governance (ESG) mandate.