There is always a rush for investors to use up their ISA allowance before the end of the tax year, but this time around there is likely to be an even greater sense of urgency.

Alice Haine, personal finance analyst at Bestinvest, pointed out that the thresholds for the basic 20% and higher 40% rates of income tax will be frozen until April 2028 at £12,570 and £50,271 respectively, and the highest 45% income tax band will reduce from £150,000 to £125,140 on 6 April. This means more people will either be pulled into the tax system for the first time, or into higher tax bands as nominal wages increase.

“Add in the fact that the annual Capital Gains Tax (CGT) exemption will halve from 6 April (from £12,300 to £6,000) and halve again in April 2024 to £3,000 – and the annual tax-free dividend allowance will halve to £1,000 from £2,000, then reduce again to a mere £500 in 2024 – and it’s clear your investments might need a more tax-efficient storage space before allowances dwindle,” she said.

Investment trusts represent a sensible use of the ISA allowance, but with more than 300 to choose from, many people don’t know where to start.

As a result, the Association of Investment Companies (AIC) asked financial advisers to name the trusts they would recommend for young, middle aged and retired investors. Here, we look at the ones they are backing for the first of these groups.

Paul Chilver of Birkett Long – Fidelity Asian Values and Odyssean

Younger investors tend to have a longer-term investment horizon and can therefore afford to take more risk, according to Paul Chilver, associate and financial planning manager at Birkett Long.

As a result, his first suggestion is an Asian smaller companies investment trust – Fidelity Asian Values.

“This has an excellent long-term track record and is well diversified with its highest weightings to Chinese, Indian and Indonesian equities,” he said.

Chilver’s second suggestion is closer to home. Based on the assumption that we are starting to see signs of improved performance by the UK market after a torrid 2022, he said it might be a good idea to increase exposure to an area that tends to do well in the early stages of a recovery: UK smaller companies.

He recommended a relatively new trust in this area – Odyssean – which is approaching its fifth anniversary.

“Despite some of the losses experienced by many UK smaller companies investment trusts, this one is showing an excellent track record,” he said.

Jim Harrison of Master Adviser – F&C and Impax Environmental Markets

Jim Harrison, director at Master Adviser, agreed with Chilver about younger investors’ ability to take on greater risk. However, he said they should also look for a diverse spread of underlying assets, which is why he recommended the F&C Investment Trust.

“F&C Investment Trust knows all about longevity,” he said. “It is a global trust with more than 350 underlying stocks and gives exposure to unlisted securities and private equity.”

For young investors who prioritise being a force for good over chasing returns, he would recommend Impax Environmental Markets, which he said is “active in improving lives through cleaner and more efficient delivery of energy, water and waste”.

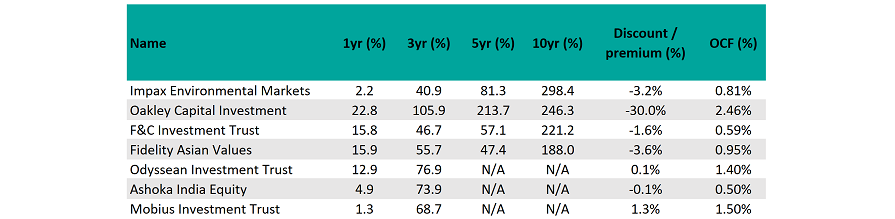

Source: FE Analytics

Genevra Banszky von Ambroz of Evelyn Partners – Ashoka India Equity and Mobius IT

A longer time horizon allows younger investors to take a punt on an individual region with a powerful tailwind behind it, even though it may take many years for the thesis to play out.

Genevra Banszky von Ambroz, investment management partner at Evelyn Partners, said India looks compelling and tipped Ashoka India Equity for access to this region.

“It was launched in 2018 and has already built an extremely impressive absolute and relative track record for multi-cap investing in the Indian market,” she explained.

“It’s also worth noting that the managers are strongly aligned with shareholders due to a fee structure with no management fee and performance fees earned by outperforming the benchmark index and paid in shares.”

For investors seeking a more geographically diversified option, she tipped the Mobius Investment Trust, which takes a high-conviction approach to investing in small and medium-sized companies in emerging and frontier markets. Its managers also like to engage with companies to improve environmental, social and governance (ESG).

“We are seeing that clients, especially younger ones, are as motivated by driving positive change in the world as they are by financial returns,” she added.

Daniel Lockyer of Hawksmoor Fund Managers – Oakley Capital

Private equity is another sector that lends itself well to investors with a long-term horizon, according to Daniel Lockyer, senior fund manager at Hawksmoor Fund Managers.

He pointed out it has historically outperformed public markets over the long term and there is no reason why that can’t continue.

“We regard Oakley Capital as one of the best private equity managers. It focuses on just three sectors: education, technology and consumer, which offer investors exposure to structural growth themes.

“The portfolio is conservatively valued and can be accessed at a 30% discount, which represents a very attractive entry point for investors.”