Alliance Trust turned over more than half (56.7%) of its holdings last year but there are good reasons why the portfolio chopped and changed, according to Craig Baker, global chief investment officer at the investment trust’s management firm Willis Towers Watson.

For starters, the running of the £2.8bn portfolio is split between nine management groups, all of which were trading more than normal.

Baker described the turnover figures as “much higher than we would normally see”, noting that the average amount of changes in the underlying managers’ portfolios was between 40% to 50%, compared with a more typical year, when this figure would sit at 20%.

“A lot of that is because when you have big changes in markets, managers find opportunities to sell things that have reached their price targets and buy new ideas that look more attractive,” he said.

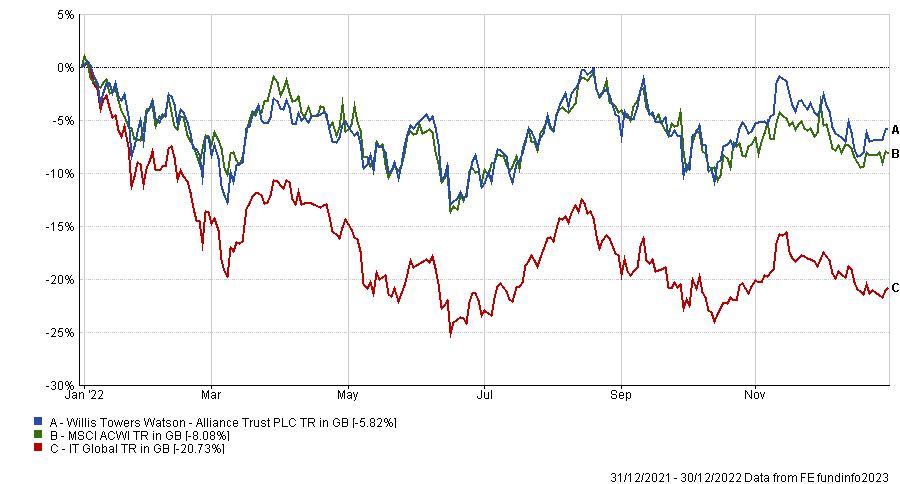

Returns for the trust were down 5.8% last year, although its 14.9 percentage point lead on the IT Global sector made it the second-best performer in its peer group behind the F&C Investment Trust.

Total return of trust vs benchmark and sector

Source: FE Analytics

Its 56.7% turnover may have been higher than normal, but Baker said that was not unusual given the volatility caused by Russia’s invasion of Ukraine, soaring interest rates and rising inflation.

“A turnover of more than 40% doesn't worry me in a year where lots of big things are happening in the portfolio,” he added.

It has been a tough time for investors, who have been forced to navigate markets ever since the Covid-19 pandemic. While 2020 was the year of growth technology, 2021 was a balance of re-opening optimism and lockdown realism, before 2022 derailed markets altogether.

“You don't normally get that many big macro factors happening all in the space of three years so it's not surprising that managers have had more turnover in that kind of environment,” said Baker.

The high level of turnover wasn’t driven purely by managers exiting positions for new holdings – much of the changes came from shifting exposures to existing holdings.

Baker said: “That 50% turnover might not be so high in some of the managers’ portfolios because they were moving around their weightings based on where valuations had got to,” he said, although Baker added that there “were definitely stocks sold because of opportunities elsewhere”.

Indeed, the high volume of changes did not alter the sectoral positioning of the trust significantly because managers typically replaced the stocks they sold with companies in the same sector, according to Baker.

For example, Alliance Trust dropped its investment in Danish pharmaceutical company Novo Nordisk in favour of Irish clinical research business ICON.

Likewise, US communications tool manufacturer Twilio was replaced by Japanese automation equipment producer Keyence.

Share price of companies over the past year

Source: Google Finance

Rebalancing across the trusts did not therefore lead to many significant changes with one exception: GQG Partners.

He said: “We're more interested in challenging the managers on why they think the stocks they're buying are attractive on a three-year or longer time horizon. The one manager that tends to change the portfolio a bit more and probably has a little bit higher turnover than the others is GQG.”

GQG Partners is the biggest management group on the trust and is responsible for running 19% of the portfolio. Rajiv Jain, Brian Kersmanc and Sudarshan Murthy sold out of many of their technology holdings in favour of energy stocks at the end of 2021, which caused a “major shift” in the trust’s exposures, according to Baker.

“That hurt them at the time, but they significantly outperformed in 2022 when markets shifted out of technology and into energy,” he said.

However, it has once again proven a hinderance in 2023 so far, as the sleeve of the portfolio managed by GQG Partners has underperformed year-to-date. Alliance Trust’s overall energy exposure currently stands at 5.9%.

The departure of River and Mercantile as managers of the trust also led to above-average turnover, according to Baker.

He said that its 6% portion of the portfolio was given to Jupiter and Black Creek to create “a nicer balance to the portfolio”.

Bill Kanko and Heather Peirce at Black Creek and Ben Whitmore at Jupiter now run 14% and 11% of Alliance Trust respectively.

The removal of River and Mercantile was partially driven by the desire to spread parts of the smallest manager out, but Baker said that it was also due to concerns around AssetCo’s takeover of the firm.

“We’re still positive on the manager, but we were just concerned that that was going to lead to a bit of a cultural change at the organisation over time,” he added.

Alliance Trust’s performance over the past five years has been steady, but returns have clung closely to that of the MSCI ACWI benchmark, something that Baker is not satisfied with.

He said: “From April 2017 to the end of December 2022, we were exactly in line with passives, which is not where we'd like to be over the long-term. We think we can do far better than that.”

It was up 54.7% between April 2017 to December last year – compared to the index’s 55.5% return –but Baker added that he is confident that the changes made to the portfolio last year will boost future performance.

“In just the past three months, what you started to see is fundamentals driving share prices a bit more, which has not been the case for quite some time,” he said.

“Companies have been delivering but that hasn't necessarily made its way to share prices. That seems to be happening a bit more in recent times so we're quite confident about the future.”