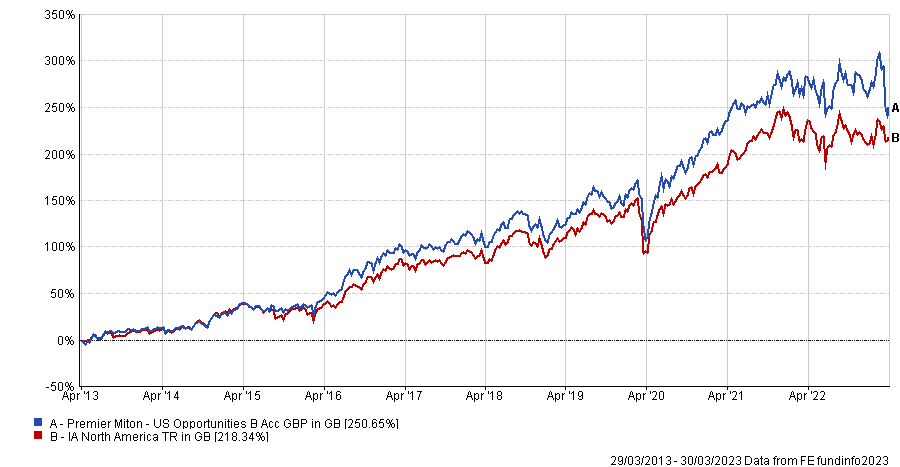

Many US funds are highly concentrated towards large-cap giants, but Premier Miton US Opportunities beat the IA North America sector over the past decade by also allocating to mid- and small-cap companies.

The portfolio was up 250.6% over the past 10 years whilst its peers trailed 32.3 percentage points behind.

Exposure to large-caps compared to mid- and small-caps are currently half and half in the portfolio, but manager Hugh Grieves expects the previous market leaders to struggle moving forward.

Here, he tells Trustnet why investors shouldn’t focus on the top half of the US market and how big technology companies will slow the S&P 500 down over the next decade.

Total return of fund vs sector over the past decade

Source: FE Analytics

What is your investment strategy?

We’re a multi-cap fund, so we invest throughout the whole of the US market. We’re also style agnostic, which means we can be growth or we can be value. We had a mild growth bias pre-pandemic and we’re now more value biased.

We've got a focus on capital preservation, so we're not trying to shoot the lights out in any particular month or quarter – the aim is to steadily compound returns over time.

There's no formal benchmark, but the ambition is to beat the S&P 500 because that's the gold standard.

What sets you apart from your peers?

We look nothing like the S&P 500 and we make money in a very different part of the market to most other US funds and certainly index funds.

I think we're the only multi-cap fund in a large-cap universe, so we're always going to have more mid- and small-caps than the S&P 500 and the peer group.

That can be good when mid- and small-caps do well and we have a fantastic tailwind, but if they do badly, then the opposite applies. Since we've launched the fund, mid- and small-caps have actually had a really tough time.

Since we launched the fund 10 years ago we’ve had mid- and small-caps underperforming and the FAANGs going to the moon, which we haven't participated in at all.

Despite all that the fund has done well and it’s demonstrated that the process works even when we have all these headwinds to deal with.

If they’ve underperformed, what is beneficial to you in holding mid and small caps?

The US market is peculiar compared with other markets in that it's very top heavy. Microsoft and Apple combined are larger than the bottom half of the index, so you have a world where managers only focus on the top 200 companies in America because that's 85% of the index.

There's literally thousands of other companies that would be FTSE 100 companies in the UK but get ignored because they're small relative to Apple and Microsoft.

We thought it was crazy. These are great businesses, so why not have a vehicle that can invest in those companies and the largest ones as well to capture that spectrum?

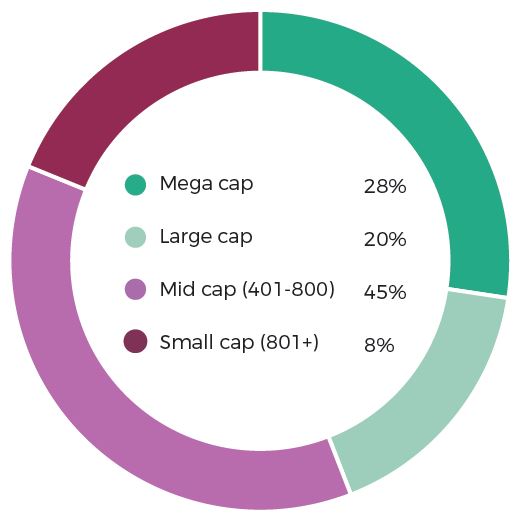

We have roughly 28% in the top of the market, about 20% at the bottom of the S&P 500 and then the rest in mid- and small-caps, so you can really see that difference.

Market cap of fund assets

Source: Premier Miton Investors

Have mid- and small-caps always made up the majority of your portfolio?

We were 70% mid and small when we launched the fund but that was completely the opposite at the end of 2019 when we were only 30%, so it really does move back and forward depending on where we’re finding the best ideas and where we are in the economic cycle.

We were getting a lot of pushback from clients in 2019 saying, ‘come on guys, you’ve told us about all these great mid- and small-cap companies but you look a lot like most other US funds’.

Back then we said that at the next recession we’ll turn the dial the other way and buy lots of small-caps because that's when they just get ridiculously cheap, so that's exactly what you saw us do in 2020 when the pandemic hit.

Have you missed out on large cap growth because of that bias?

It’s definitely been a headwind to performance. We have owned Microsoft and Amazon occasionally, but it has never made a significant contribution to performance at all.

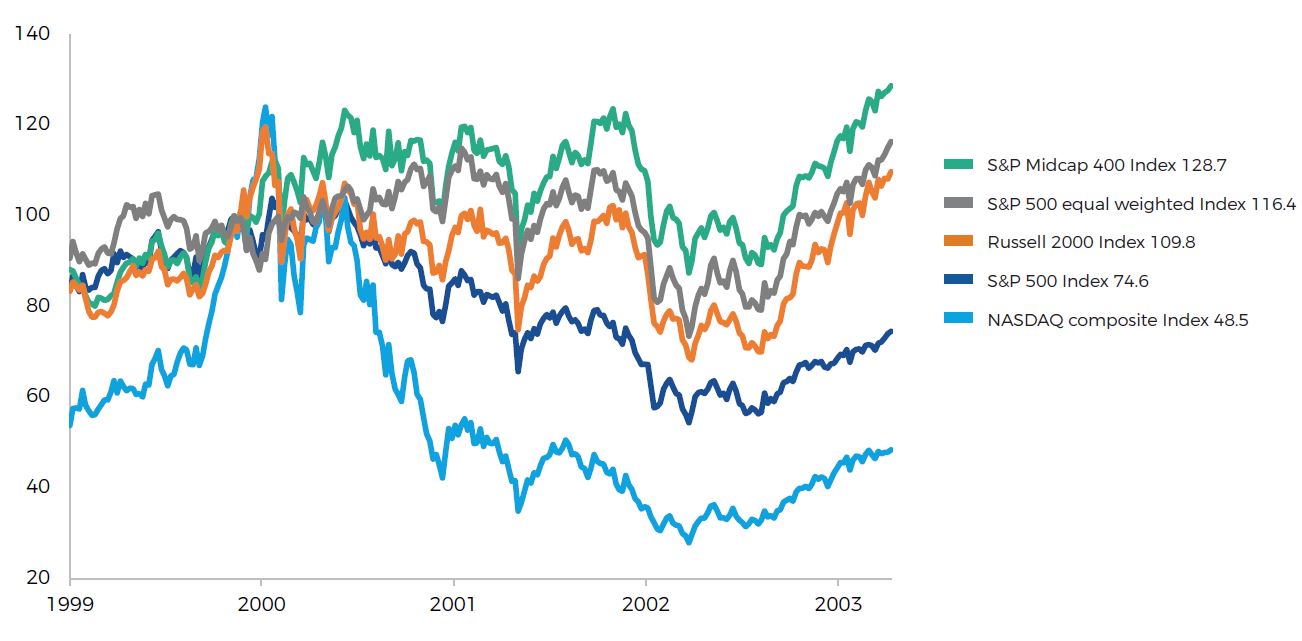

What’s interesting now is we’re at peak 2000 levels. What happened after 2000 was you had 10 years of decent economic growth whilst the S&P went nowhere.

Part of the reason for that was because all these large-cap tech stocks that dominated the index ended up being a drag on performance for the next decade.

I think that’s going to happen again over the next couple of years. The US economy is going to be in reasonable shape, but the index is just going to do nothing because of these large-cap tech stocks, so investors have to do something different to what's happened in the past.

The S&P has been really easy to own because it’s nice and cheap, but if we’re facing a decade of it going nowhere then you're not going to make much money.

US equity index returns before and after 2000

Source: Premier Miton Investors

What has been your best performing asset over the past year?

Schlumberger was our top performer over the past 12 months. It contributed about 1.5% to the fund’s performance.

We bought it during the pandemic when it just got ridiculously cheap and people thought the world was going to end but it’s obviously bounced back.

Graphic Packaging, which is the largest producer of printed cardboard, also contributed around 0.5% to performance.

It's an industry that had no volume growth for years and was going nowhere, but because of the move from plastic to fibre-based packaging for sustainability issues, you're now starting to see volume growth in a very consolidated market.

What was your worst performer?

Banks have been in the news of late and Western Alliance has been one of them. It detracted 1.5% from the fund’s performance over the last year.

Within Western alliance, there is a small business that looks very much like Silicon Valley Bank and that’s obviously put it in the gunsight of short sellers.

The business is solid but it will have scars from what's happened over the past 10 days for sure. I’m still positive on it though.

Share price of best and worst performer over the past year

Source: Google Finance

What are you interests outside of fund management?

I enjoy running and cycling – I try to go cycling a couple of times a week and like taking my dog for a walk.