Sustainable funds have topped the market over the past few years, but more challenging economic conditions have cut their wave of outperformance to a halt.

Portfolios that use environmental, social and governance (ESG) factors had been raking in investors’ cash over the past three years, according to data from Calastone, but were hit by a serious bout of outflows in October.

Many ESG funds have a bias towards growth companies, leaving most of them struggling after higher inflation and rising interest rates pivoted markets towards value stocks.

Daniel Babington, fund manager at TAM Asset Management, said that early adopters would have been “rewarded with handsome gains” as “almost any company with an ESG product was the beneficiary of the vast liquidity in capital markets”.

However, investors will have to be much more selective in which ESG fund they buy from now on as few can weather varying economic conditions.

“This sea change in investing has led to a structural shift in the way we must approach the opportunity set,” Babington said. “Investors need to be valuation aware and should be much less willing to pay over the odds for future growth.

“The days of easy money are behind us and investors cannot rely on a good product or sustainable story to solely fuel growth.”

He recommended the Regnan Sustainable Water and Waste fund, which invests in companies tackling water and waste related challenges.

The ESG market is concentrated with funds focused on lowering carbon emissions, leaving sectors such as this lacking investment, according to Babington.

“You must invest to make unsustainable sectors sustainable,” he said. “Sustainable waste management and efficiency of water resources are undervalued by the market in their importance.

“Regnan Sustainable Water & Waste provides exposure to both these long-term themes with a tried and tested process, blending and managing the two opportunity sets to achieve a resilient and diversified strategy.”

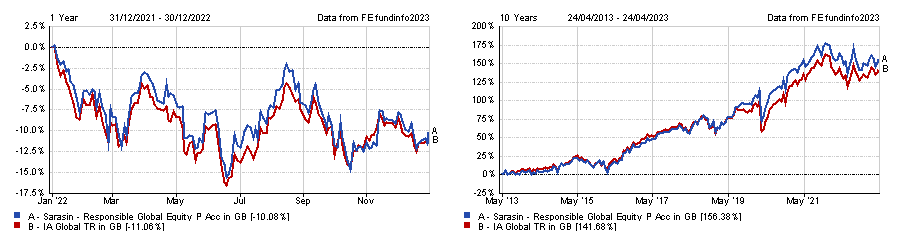

This fund was launched in September 2021 and it has avoided losses (unlike its peers in the IA Global sector) with a 0.1% return over the period by investing in this overlooked area.

Total return of fund vs benchmark and sector since launch

Source: FE Analytics

Amelia Overd, associate at Castlefield, noted that much of the underperformance from sustainable funds was driven by their lack of exposure to 2022’s big winners in the oil and gas sector.

Nevertheless, the slowdown of ESG funds has bought them back to pace with the rest of the market, which it has been beating for several years.

Overd said: “It's not been surprising to see growth companies and sustainability funds struggling a bit more against conventional peers that have some of those big industry stalwarts that have done relatively well recently.

“Those funds are coming off a very strong and long period of outperformance, so it's really putting those performance figures back in-line with the market.”

Investors who want exposure to an ESG fund that isn’t dominated by growth stocks may want to consider Sarasin Responsible Global Equity, according to Overd.

She said: “The process has led to a slightly more blended portfolio in terms of investment styles, so it has outperformed in periods where more growth-orientated funds were struggling. That is one that’s a bit more durable.”

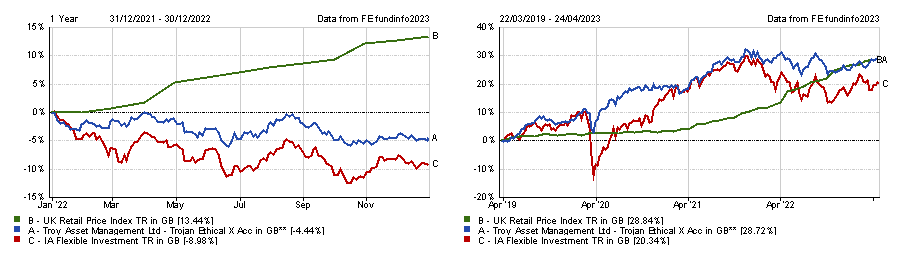

The £383m portfolio beat the rest of the IA Global sector by 14.7 percentage points over the past decade, raking in a total return of 156.4% over the period.

Its value tilt was not enough to shield it from the volatility of last year, but its 10.1% decline was slightly shallower than the rest of the peer group.

Total return of fund vs sector in 2022 and over the past decade

Source: FE Analytics

Even so, Overd said that Sarasin Responsible Global Equity might be of interest to those seeking a more diversified ESG portfolio.

“It is not explicitly seeking growth companies and is not averse to looking at things that might be considered value if it's got decent sustainability criteria,” she added.

“The managers are not pinning their flag to a particular investment style in that sense, so they have a bit more flexibility to rotate between different opportunities.”

Investors seeking ESG exposure that stands out from the crowd may also want to consider Janus Henderson UK Responsible Income, as recommended by Juliet Schooling Latter, research director at FundCalibre.

It has a 55.1% weighting to mid- and small-cap companies, separating it from other sustainable funds that chase large-cap growth names.

The £518m fund leapt to the top quartile over the past decade, climbing 27.6 percentage points ahead of the IA UK Equity Income sector with a total return of 102.5%.

Schooling Latter said: “Because this is an equity income fund, growth is less of a factor, so performance tends to be more consistent.

“It may lag in a rapidly rising market, but the strong valuation discipline means it protects more in down markets too, making cumulative performance attractive.”

Total return of fund vs benchmark and sector over the past 10 years

Source: FE Analytics

The current yield of 4.5% could also make it a good option for those seeking income in a financially challenging environment, according to Schooling Latter.

She said: “In a world of lower growth, dividends are likely to become a more important part of total returns, so this fund is well-placed to achieve stronger, consistent returns for investors going forward.”

Alternatively, Emma Bird, head of investment trust research at Winterflood, said that the Schroder BSC Social Impact Trust offers unique exposure to ESG themes through private markets.

The trust invests in private companies creating a positive social impact, with very different holdings compared to most open-ended sustainable funds.

However, Bird noted that 40% of holdings are not covered by inflation-linked revenue contracts, which has left it somewhat vulnerable in market where prices are rising so rapidly.

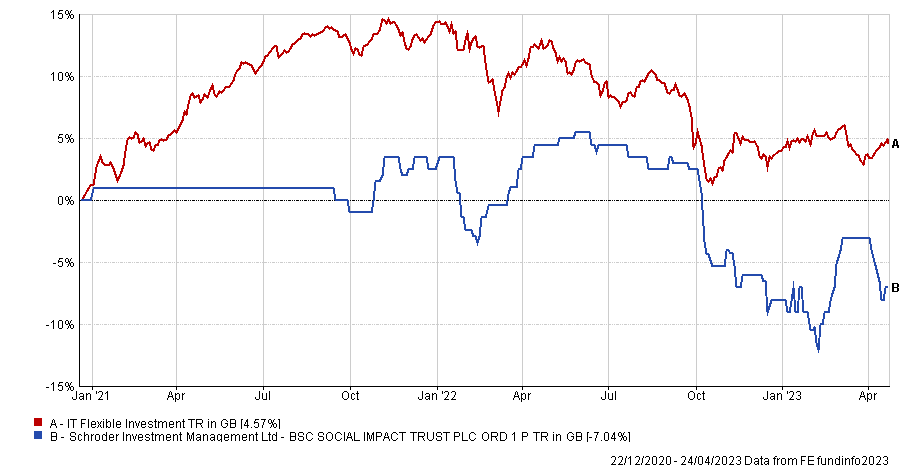

Returns dropped 7% since it launched in late 2020 while the IT Flexible Investment sector rose 4.6%, but Bird is satisfied by the trust’s collection of holdings.

Bird said: “We expect the fund’s impact-driven and diversified strategy to offer some resilience in a downturn, with the organisations in which it invests having long track records that demonstrate their ability to successfully navigate challenging markets.

“The lack of leverage at either the investment trust or underlying fund level means that there is no exposure to increasing finance costs as a result of rising interest rates, while it also supports the fund’s defensive offering.”

Total return of trust vs sector since launch

Source: FE Analytics

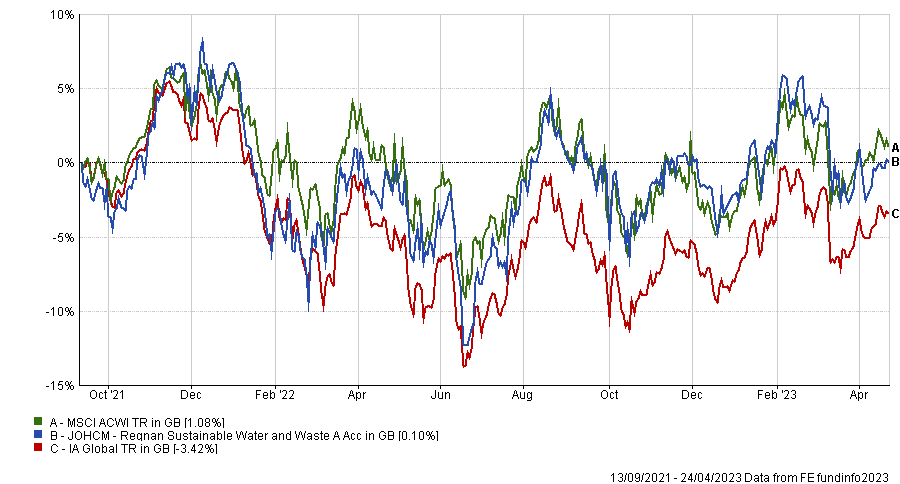

Back on the open-ended side, the Trojan Ethical fund offers some attractive defensiveness in volatile markets, according to Rob Morgan, chief investment analyst at Charles Stanley.

The five FE fundinfo Crown rated fund was up 28.7% since launching in early 2019, giving it an 8.4 percentage points lead on the IA Flexible Investment sector.

Even in the down markets of 2022, the £802m fund’s 4.4% decline throughout the year was above the peer group’s 9% loss.

Total return of fund vs benchmark and sector in 2022 and since launch

Source: FE Analytics

Morgan said: “It represents a sensible defensive option for investors wishing to invest in a responsible manner, and the cautious approach adopted chimes with the objectives of many private investors seeking to preserve wealth through economic thick and thin.”