Equities will always be a better bet for long-term investors than cash, even if interest rates continue to rise from here.

This is according to Duncan Lamont, head of strategic research at Schroders.

Savings rates have trebled in 12 months, with figures of 5% available on one-year deposits. News released today showing that inflation remained at 8.7% in May, compared with an expected fall to 8.4%, has increased the likelihood of further interest rate hikes. Unsurprisingly, savers are now committing more money to cash ISAs than at any point in the past five years, while advisers have reported a surge in interest in the most liquid of asset classes, even among long-term investors.

Lamont admitted that all savers’ circumstances are different, and some may have excellent reasons to be holding cash. However, he warned that while rates available on cash have rocketed in nominal terms, the real return after inflation is taken into account is still negative.

“Negative returns mean losses,” he explained. “And the jump in inflation since early 2022 means that the value of cash is now eroding at a faster pace than for most of the previous decade, even if the cash earns today’s top available rates.”

The head of strategic research pointed out the main benefit of cash over equities is the certainty that it will retain its value – but this is only true in nominal terms. While £100 today will still be £100 in future years, there is no certainty its spending power will hold up, and although low inflation will see the money retain its spending power to some degree, high inflation will erode it quickly.

“Time is the critical factor,” added Lamont. “Over short periods, cash is likely to fare better against inflation. Over long periods, cash fares worse, even where inflation is relatively low.”

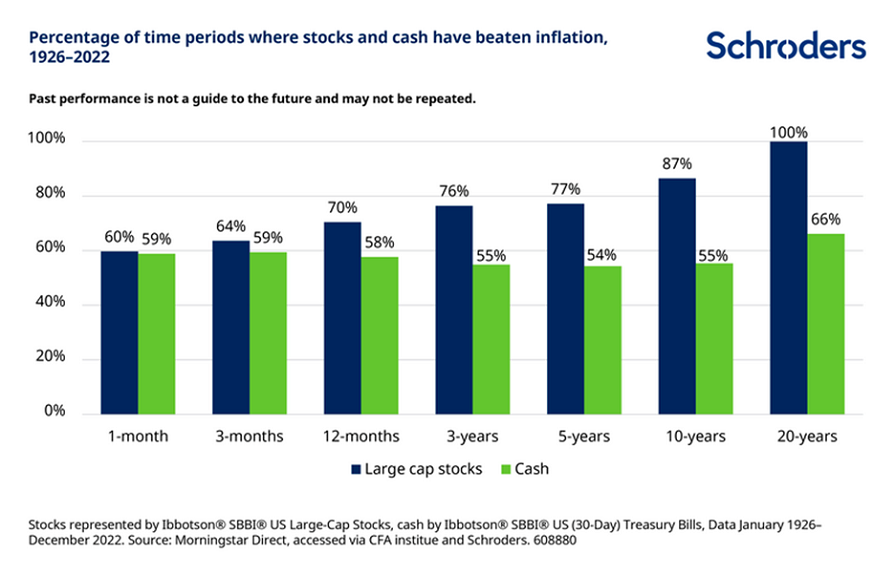

Lamont looked at returns on cash and equity investments over a range of timeframes over the past 96 years, then compared them with inflation.

The results showed that over very short periods – three months or less – there has been little difference in the likelihood of cash or equities beating inflation. But for longer periods, the gap widens conclusively – and when it reaches 20 years, the likelihood of equities beating inflation hits 100%.

“While stock market investments may be risky in the short run, they have offered far more certainty in the long run when viewed against inflation,” said Lamont, adding that “equities have delivered strong long-term returns through a variety of different conditions”.

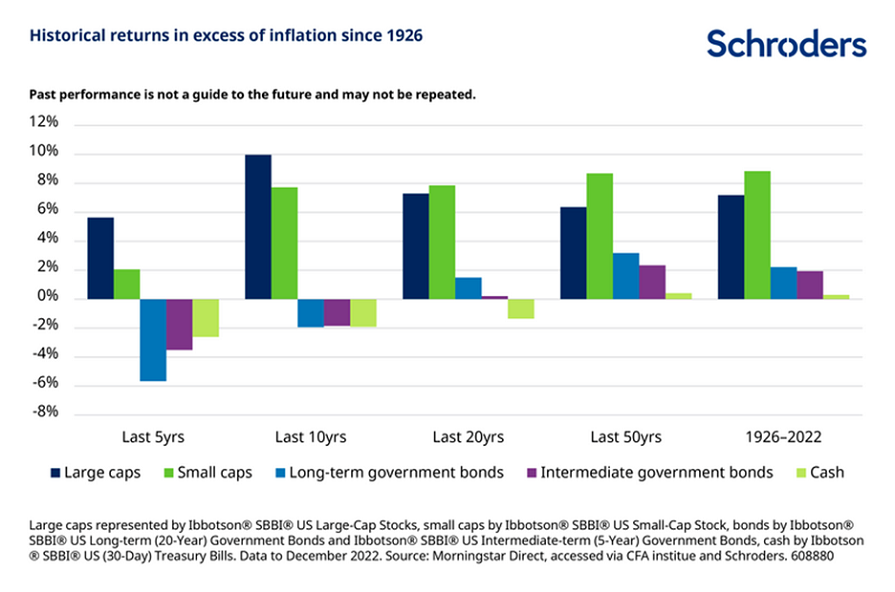

Further research showed that any cash left in a deposit account since 1926 – during which time inflation and interest rates have gone through both highs and lows – retained its spending power over this time, but only just.

However, the recent era of ultra-low interest rates has meant that cash has been unattractive for investors, even with low inflation. In the past five, 10 and 20 years, cash savings have failed to keep up with price rises and so depositors would have been worse off.

By contrast, stock market investments have delivered inflation-beating returns over the past five, 10, 20 and 50 years, as well as since 1926.

However, Lamont said that while equities are always a better bet than cash over the long term from a mathematical point of view, the problem is that real life often gets in the way for the people holding these assets, and individual timeframes will differ.

“While long-term historic data strongly suggests stock market investments stand a better chance of beating inflation than other investments, they are also volatile,” he continued.

“In conclusion, different risks attach to both cash and equities. Cash is far from a risk-free asset: even at today’s best available savings rates, deposits are likely to lose real value. And, as our data shows, cash can deliver real losses over longer periods too, including the past two decades.

“But shares also carry risk, especially when held for shorter periods. Investors who opt for stock markets over cash need to be prepared for a bumpy ride.”