Investors should be cautious about trying to keep up with the bull market that has taken hold in many parts of the globe, multi-asset managers have warned, as the potential for disappointment is elevated.

Although the first three quarters of 2022 were dominated by a broad-based sell-off, the past 10 months have witnessed a sharp rally in stocks. Indeed, as the chart below shows, many regions appear to have entered a new bull market.

Performance of indices in local currencies since 1 Oct 2022

Source: FE Analytics

Tom Nelson, head of asset allocation portfolio management at Franklin Templeton Investment Solutions, noted that a market previously obsessed with recession caused by interest rate hikes “seems to have quickly moved on”, with sentiment being bolstered and volatility falling.

However, he added: “We believe there is risk in trying to run with the current bull markets.

“Asset prices are suggesting cyclical growth will not only remain positive, but will accelerate above-trend in the coming months. We think this is unlikely as central banks remain restrictive and cyclical growth momentum, outside of asset prices, remains subdued.”

But Nelson conceded that markets have been able to tolerate restrictive monetary policy and weak growth momentum for much of the recent past, which may cause some to question what the catalyst for an equity market correction could be.

On this, he argued that the upcoming earnings season will be “pivotal”. For one, weaker earnings growth would hit investor sentiment hard, as markets are currently pricing in a rosy picture for companies. Secondly, weak profitability may lead to weaker labour markets – which increases the risk of a recession.

Given this, Nelson reiterated the need for a cautious stance amid the ongoing bull run, warning that “equity markets are over-extended and due for a pullback”.

“Overall, our tactical view is to position multi-asset portfolios defensively; we currently prefer fixed income over equities. While our macro outlook supports this positioning, we also think relative valuations support fixed income,” he explained.

“Equity risk premium, which measures the relative attractiveness of equities to interest rates, is currently more supportive of government bonds. Cash is another attractive option over equities, in our view. Many cash rates are near cyclical highs and now offer positive real returns – a rarity over the last decade.”

Rathbones’ David Coombs is another multi-asset manager who is viewing the ongoing bull market with a degree of caution and said investors should be wary of ‘fear of missing out’ (FOMO).

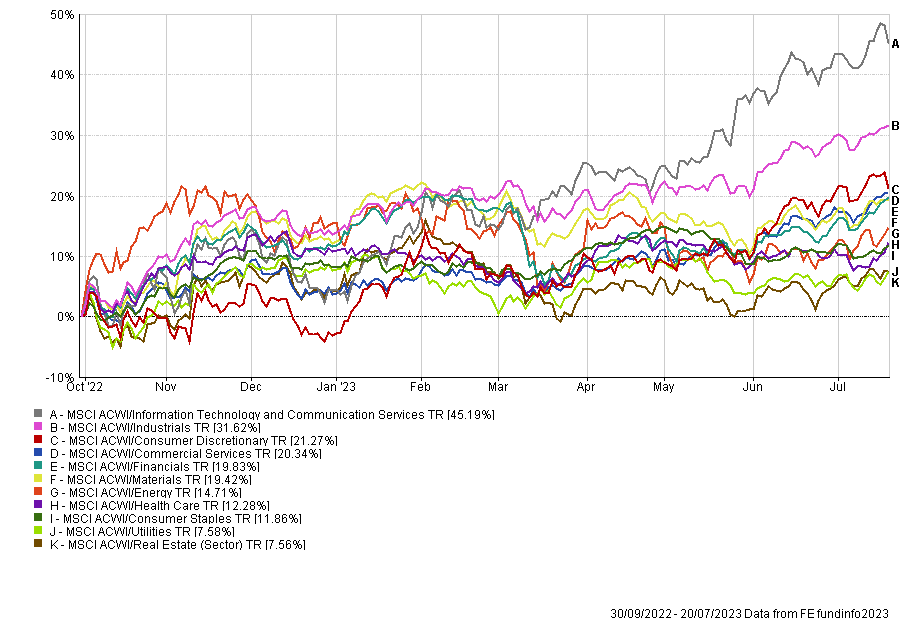

Performance of industries in local currencies since 1 Oct 2022

Source: FE Analytics

An example is tech stocks, which tanked in 2022 but have led the ongoing bull market by a significant margin. Many investors went into 2023 expecting recession, with bonds and defensive equities being tipped as the safest way to navigate this.

Coombs had little in defensive equities sectors such as consumer staples, utilities and pharma stocks or in gilts and had been adding to tech on weakness. However, the fact that this bull market has been led by a narrow band of tech stocks and investors are back to piling into them acted as a red flag for the manager.

“Big tech stocks are now looking very expensive again. But lots of investors missed out on them in Q2 and they’re in full-on FOMO mode. The momentum in tech is very strong, shorts are being closed rapidly and almost everyone seems to be expecting Goldilocks soft landings,” he said.

“Trimming big tech feels right. I hear mutterings about running your winners, but in multi-asset land, you take the profits when you can and come back to fight another day. Experience tells me discipline is needed when it’s the performance chasers that are in the ascendancy.”

In his portfolios, Coombs has built up exposure to 10 and 30-year gilts as well as 10-year US treasuries to offer some protection if “over-zealous central bankers” fail to achieve a soft landing and push the economy into recession.

He has also been buying S&P put options: “We get nervous when volatility is low and the consensus believes recession will be avoided. If that consensus turns out to be wrong… then markets could be in for an unpleasant disappointment.”