Oakley Capital, Schroder Real Estate and Downing Renewables and Infrastructure lost their places in Winterflood’s recommended list of investment companies for 2025.

Released last week, the list is updated yearly to include those vehicles that Emma Bird, head of investment trust research, and her team believe have the greatest potential to outperform their peers in the next 12 to 24 months.

Yesterday, we covered equity funds; today we focus on alternative investments, where four new entrants counterbalanced three deletions.

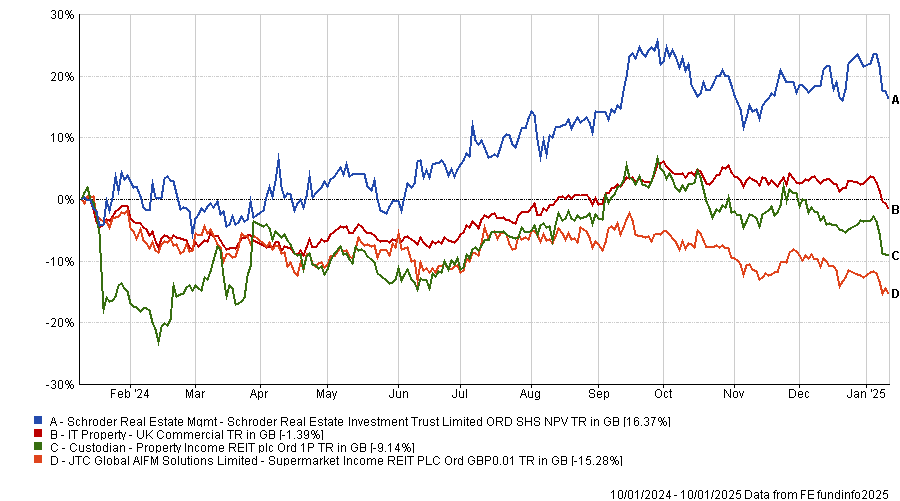

IT Property was the sector with the most changes. The £237m Schroder Real Estate investment trust, co-managed by Duncan Owen and Nick Montgomery, was substituted with the Custodian Property Income real estate investment trust (REIT), run by Richard Shepherd-Cross.

Performance of trusts against sector over 1yr

Source: FE Analytics

The main reasons included its 7.6% dividend yield, which is fully covered and growing, and its 25.5% discount. Comparatively, the Schroder portfolio is yielding 6.9% and trading at a 22.1% discount to net asset value (NAV) after having gone through a “considerable” re-rating in 2024.

Winterflood’s analysts expect performance to continue to be supported by the team’s “clear focus on active asset management, including leasing activity, as well as conducting disposals at a premium to book value, with proceeds used to pay down debt and invest in asset improvements”.

Bird added: “We think that there is scope for a re-rating, given stabilising underlying valuations, with the like-for-like portfolio value up 0.5% over the third quarter of 2024, supported by a more favourable interest rate environment.”

For more specialist exposure, Winterflood added the Supermarket Income REIT, whose sector is demonstrating “supportive fundamentals”, and allowing for “highly attractive yields”, with the trust paying out 8.9%, fully covered by earnings.

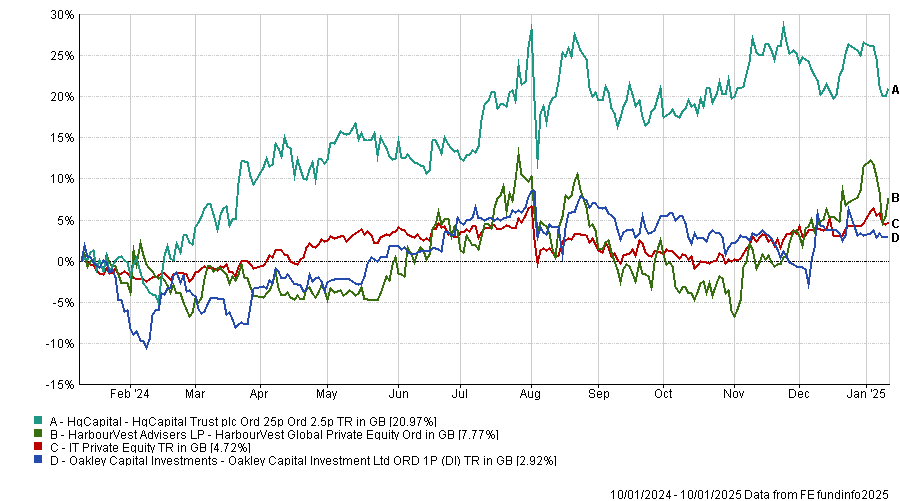

The private equity peer group also went through a substitution: Oakley Capital Investments for HarbourVest Global Private Equity*.

The former offers direct exposure to private equity companies, but the Winterflood analysts preferred adding to the sector through funds-of-funds such as the HarbourVest strategy.

“While we still view the Oakley favourably, the endgame for the North Sails position remains unclear, while disposal activity has been limited in size and not at substantial uplifts,” Bird said.

For investors who still prefer direct access to private equity, the only recommendation is now HgCapital Trust**, favoured for its defensive characteristics.

Performance of trusts against sector over 1yr

Source: FE Analytics

“We do not view the tight discount as an obstacle to investment, particularly as the trust is one of the few pure-play methods to gain exposure to a high-growth European technology portfolio,” Bird said.

“The ‘boring’ but critical software companies in its portfolio have demonstrated considerable operational resilience and lead us to continue to recommend it for 2025.”

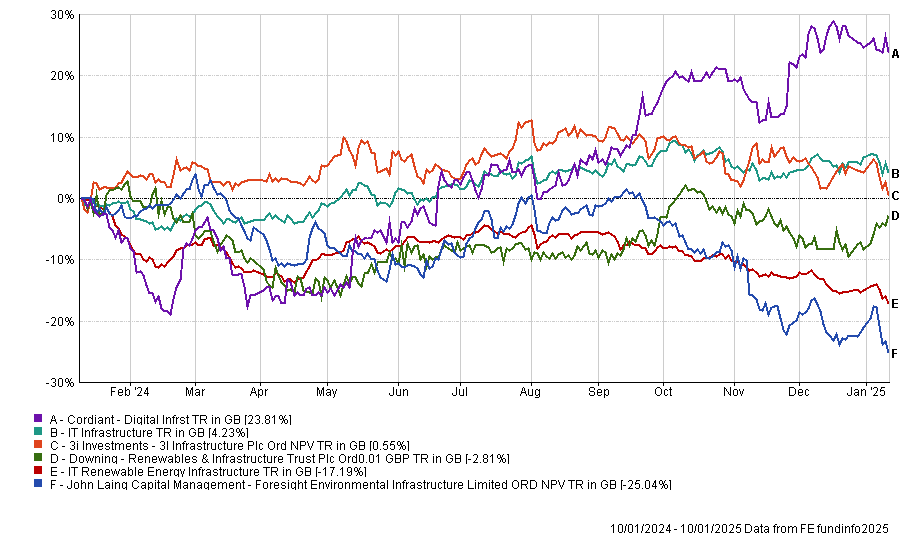

Finally, in the infrastructure sector, the £137m Downing Renewables and Infrastructure* was dropped after only one year of inclusion.

Over 2024 its NAV total return was up 5% versus -1% for the peer group average, but this wasn’t enough to convince the Winterflood analysts to retain it.

“We continue to think that the fund offers an attractive, diversified and fully operational portfolio, including access to hydro,” Bird said.

“However, its small size continues to constrain institutional demand for the fund. Should sentiment towards infrastructure assets improve, we expect demand to be concentrated in larger, more liquid vehicles that have established a longer-term track record of performance.”

The still-recommended alternative is Foresight Environmental Infrastructure*.

While the renewable energy infrastructure area suffered a loss, financials and digital gained the 3i Infrastructure trust, which is now recommended alongside Cordiant Digital Infrastructure.

Performance of trusts against sectors over 1yr

Source: FE Analytics

The 3i portfolio is “large, liquid and attractive, with upside potential from accretive capital expenditure opportunities”.

Bird said capital growth will be an important component of total returns in a ‘higher for even longer’ environment, and 3i Infrastructure has “a strong track record of execution” in this regard.

Additionally, the fund’s share price discount has widened substantially over 2024 to today’s 15.8%, offering an attractive entry point.

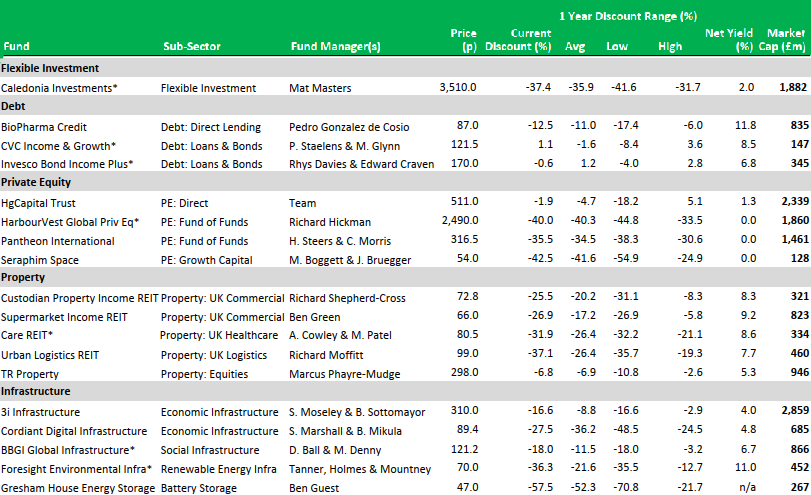

Winterflood alternative trust recommendations for 2025

Source: Winterflood Securities

* Denotates a corporate client of Winterflood Securities

** HgCapital is an investor in FE fundinfo