The UK is a nation of cash lovers, with people preferring Cash ISAs to investing. That is despite figures from FCA’s Financial Lives report highlighting that Britons have far more in cash than they need.

While the amount invested in cash goes down as the money available increases, two in five of those with £100,000 to £250,000 on hand still hold all or most of it in cash. For less wealthy savers, that goes up to three in five for those with £50,000 to £100,000 in investible assets, and to 79% for those with £10,000 to £20,000.

While some may have legitimate reasons for sticking to cash, many will be harming their long-term wealth by not investing, said Laura Suter, head of personal finance at AJ Bell.

“A sixth of people think that cash ISAs delivered the same return as stocks and shares ISAs over the past 10 years and a third don’t realise that inflation can strip away the spending power of cash,” she said.

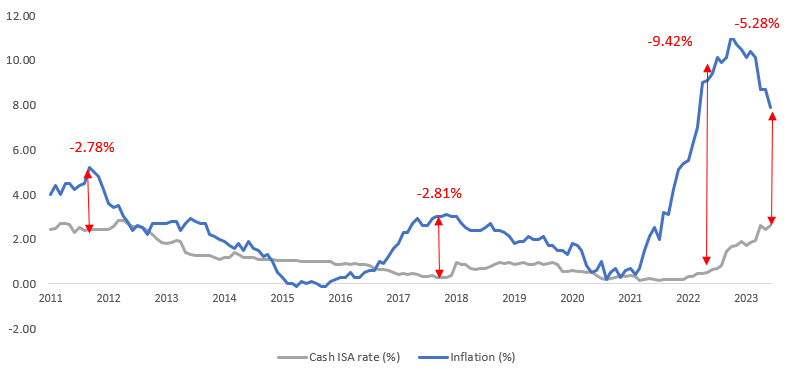

According to analysis from Quilter, cash ISA savers are realising a more than 5% loss on their savings over the past 12 years due to the gap between savings rates and inflation.

At the end of last year, they were suffering near double-digit losses, with July 2022 marking the highest loss in over a decade when savers faced a decline of 9.4%.

Real cash ISA returns

Source: ONS, Bank of England, Quilter

Someone who invested £10,000 in a cash ISA in January 2011 would currently have £11,472.09. Adjusted for inflation, this has a purchasing power of £8,041 today. In contrast, a £10,000 investment in a stocks and shares ISA, held in the IA Global Equity index over the same period would be worth £26,956 or has the purchasing power of around £18,901 after inflation and without accounting for charges, explained Rachael Griffin, tax and financial planning expert from Quilter.

“Although the picture has improved in certain corners of the market, even savers on the very best rates will still get ravaged by the impact of inflation and be realising a real terms 3% loss,” she said.

“A good rule of thumb is to save three to six months of your salary in cash and then invest in a spread of different assets that can deliver a long-term return.”

While the average cash ISA rate is now 2.62% according to the Bank of England, there are much more competitive rates on the market, with the best currently coming in at 5.9%, according to Moneyfacts. Both NatWest and the Royal Bank of Scotland offer this rate on their two-year fixed-rate accounts.

If you want to lock your money for only one year, both issuers will give you 5.7% – narrowly beaten by Shawbrook Bank’s and Virgin Money’s 5.71%, which is the best you can get for this time frame.

The best easy-access ISA is again Shawbrook Bank’s, at 4.33%.

Stepping outside of the ISA wrapper will get you better rates, with different providers offering up to 6.05% over different time horizons.

To get this rate over one year savers could turn to Atom Bank, where they can open their one-year fixed saver from a mobile. Committing for a few month more opens up more possibilities to get this rate. United Trust Bank matches it in its 15-month fixed account, while Ford Money and OakNorth Bank will pay it after 18 months.

If you believe interest rates will come down soon and are happy to lock your money for two years, you can get this rate from Ford Money, Hampshire Trust Bank, Atom Bank, Ikano Bank and United Trust Bank – all of which can be opened online.

If you need unrestricted access to your money, Shawbrook Bank has the highest easy-access rate of 4.63%.

To get even more from your savings, you could save smaller amounts regularly. This will bump up your rate up to 7%, paid by First Direct for a year on monthly contributions of £25-£300.