Years of poor sentiment towards UK equities have pushed stock prices down to “amazing valuations,” according to Tyndall Real Income manager Simon Murphy, who has been nabbing strong companies for a bargain.

Economic turbulence has dragged share prices down across the board, even those that are reporting healthy results despite the challenging backdrop.

This was confirmed by Duncan Lamont, head of strategic research at Schroders, who said UK assets were at “exceptionally cheap levels” relative to their history.

He noted that “private equity investors are snapping up bargains” while public market investors have been slower to recognise the opportunities at hand.

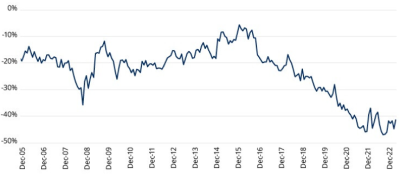

UK forward price/earnings multiple discount to the US and Europe

Source: Schroders

Murphy was one of the investors to snatch cheap stocks early on, having taken over Tyndall Real Income in February 2020, shortly before the pandemic toppled markets.

Since then, the fund’s 20.4% total return is more than double that of the IA UK Equity Income sector, while its three-year return of 55.1% is the fifth highest among its 76 peers.

“Given how crazy the past three years since I took on the fund have been, I’ve had wonderful opportunities present themselves,” Murphy said. “I’m no expert in pandemics and had no idea how long we’d be facing it, but I knew there were amazing valuations.

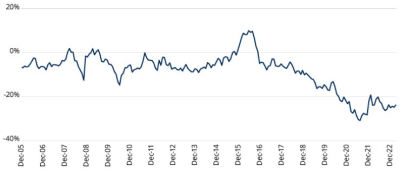

Total return of fund vs sector under Murphy’s management

Source: FE Analytics

After years of falling share prices that began after the Brexit referendum in 2016, disenchanted investors may be wondering when the turning point for UK equities will come. After all, buying extremely mispriced assets is all well and good, but it might not be much use if they never go up in value.

Murphy admitted there have been points in the past where he’s been disgruntled with UK equities, yet the vast gap between share prices and the actual value of companies is so wide it is bound to pay off eventually.

“I’m not always bullish on my asset class – there’s actually been a lot of times when I’m bearish – but right now I’m as much excited than I have been for most of my career,” Murphy explained.

“I'm guilty of thinking for a couple of years now that sentiment is so low it can't get any worse, and then it does. I've given up trying to call when the bottom will be but it's the most depressed today than I’ve ever seen. Whenever you get to that level of pessimism it's normally close to going the other way.”

In this anti-UK environment, Murphy said that he now targets companies that are most reviled by the rest of the market because their share prices are so much more undervalued.

“One particular theme I feel very strongly about is recovering cash flow,” he added. “I love business franchises that are fundamentally really strong, but have gone through a temporary period of difficulty that we are confident will resolve and recover strongly.

“We own several franchises that, if I'm brutally honest, have taken longer to recover than we thought, but we're now starting to see really good recovery as things normalise.”

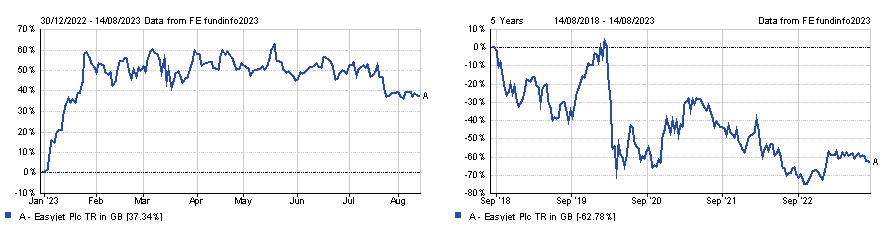

One such area is travel – budget airline Easyjet is a holding in Tyndall Real Income that has dropped 62.8% in share price over the past five years.

Travel restrictions during the pandemic delivered a significant blow to the company in 2020 which it has yet to recover from, but despite poor press around potential strike action this summer, it is reaping some rewards now lockdowns have ended.

“Capacity struggled quite aggressively over the course of the pandemic, and it's not appearing back on the screen very quickly but demand is incredibly strong,” he said.

“We're all desperate to travel now which means the pricing for these companies is really powerful. I tried to book flights recently and they’re eye-wateringly expensive compared to what we're used to.”

Shares in the company are up 37.3% this year now that holidaymakers are back in full flow, yet it has some way to go before catching up with its 2020 losses.

Easyjet share price in 2023 and over the past five years

Source: FE Analytics

Murphy also recently made a couple of purchases in the volatile consumer space, such as price comparison website Moneysupermarket.com.

Its services were in low demand over the past few years as UK consumers scaled back their activity, but the need for insurance should come swinging back according to Murphy, which is already noticeable in its travel coverage part of the business.

Business may have been slow in recent years, but Moneysupermarket.com made good use of its time in improving its services and emerging from the pandemic a lot stronger than it was before.

Murphy said: “If you look at the latest set of figures, the travel insurance business grew by about 23% and car insurance was again around 15%, so it is starting to recover quite nicely and I'm hopeful we'll start to see a lot more of that come through.”

It is not the only consumer company to have upgraded its online offerings – homeware retailer Dunelm is another new holding for Murphy that strengthened over the pandemic.

“I love its position in the home furnishings market, it’s run by a really good management team and it has very good price propositions at every point,” Murphy said.

“It has captured a really good piece of the market and over the next five-or-so years will have a lot more to offer on the internet site. Things like click and collect are a lot better now, so it was another business to focus on IT infrastructure as a route to reach the market more effectively.”