China has been a polarising place to invest this year, but it might be worth considering if the managers of the best performing investment trust of the past decade have got their timing right.

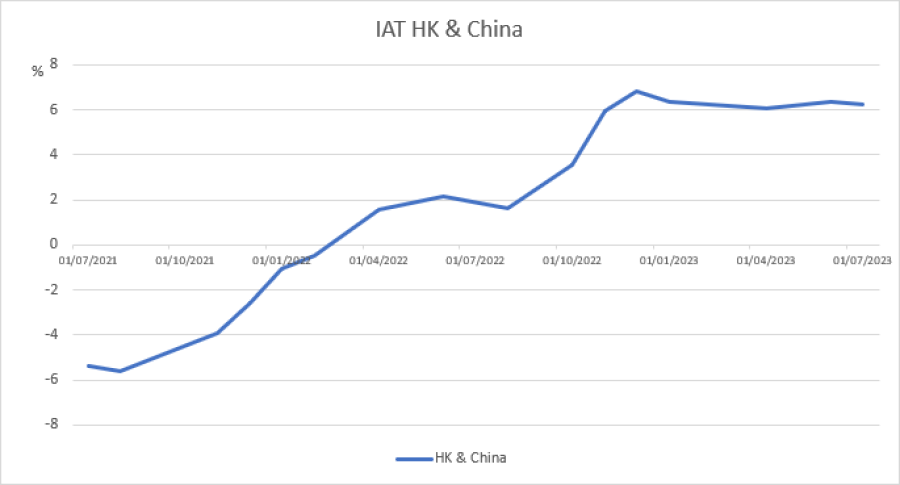

The Invesco Asia Trust has moved to back Chinese and Hong Kong equities over the past two years from an underweight 5.4 percentage points below its benchmark’s weighting 24 months ago, 6.2 percentage points above it.

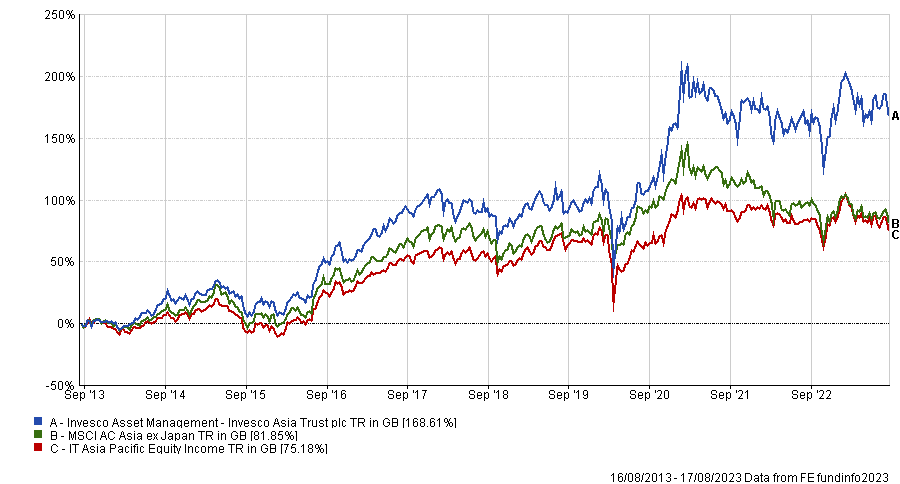

It has made the decade’s best return in the IT Asia Pacific Equity Income sector, 168.6% over 10 years, and has come out on top over one, three and five years as well – suggesting the managers rarely get these big decisions wrong.

Performance of trust over 10yrs vs sector and benchmark

Source: FE Analytics

Although the reopening of the Chinese economy at the end of last year has not met investors’ expectations with the local equities struggling, the trust co-manager, Fiona Yang, still thinks China is in a much better place than it was two years ago.

She said: “We do think the current soft patch is more cyclical in nature and less of a structural issue. If you compare to October 2022 when there was little visibility on what the government policy would be, we now have more clarity on the supportive stance coming out from the central government.

“China does face cyclical downturns, but policymakers have a lot of tools to address those issues and I think they will be under pressure to stimulate the economy before the end of this year.”

Exposure of trust to Chinese and HK equities

Source: Invesco

Recent economic data from China has shown that the July’s consumer prices index fell by 0.3% year-on-year and producer prices index by 4.4%, suggesting the world’s second-largest economy could soon slip into deflation. As a result, several banks such as JP Morgan, Morgan Stanley and Citigroup have cut their Chinese growth forecast for 2023.

Furthermore, Country Garden, one of China's largest property developers, has recently fallen behind on its bond payments and spooked the market, with fears of a repetition of the collapse of Evergrande in 2021.

Yet, those bad news have not changed the manager’s views on Chinese equities.

She said: “The Chinese PPI has been under deflationary pressure for some time and the recent weak inflationary data gives even more room for the government to ease fiscal and monetary policies.”

So far, China has given some signals that policy support might be coming. For instance, the People’s Bank of China has cut policy rates twice in three months and injected 204bn yuan (£21.9bn) through seven-day reverse repurchase agreements. It has also cut borrowing costs and the country is expected to introduce a plan to address local government debt risks on top of this.

Kristina Hooper, chief global market strategist at Invesco, said: “While the economic re-opening has been bumpy, there is the potential for a boost to Chinese equities in the near term given policy stimulus in the offing.”

South Korea is another market the Invesco Asia Trust is currently overweight.

Yang said: “It is cheap and unloved, which is a good starting point for contrarian investors like us. Historically, Korea has been trading at a huge discount compared to its Asian peers, because it had generally poorer corporate governance and weaker shareholder return policies.

“We have seen quite a big shift in our shareholder return. If you look at the dividend per share paid by Korean companies, it has grown by over 300% over the past decade, outpacing the Asian country average.”

The Korean stock market has launched a range of reforms to put an end to the “Korea discount” in an effort to gain developed market status. The Korea discount refers to South Korean stocks’ tendency to trade at lower valuations than their Asian peers.

Yang added: “I do think this discount based on corporate governance or low shareholder return should narrow over time and this is what we have seen this year in Korea. It’s been one of the best performing markets in Asia.”

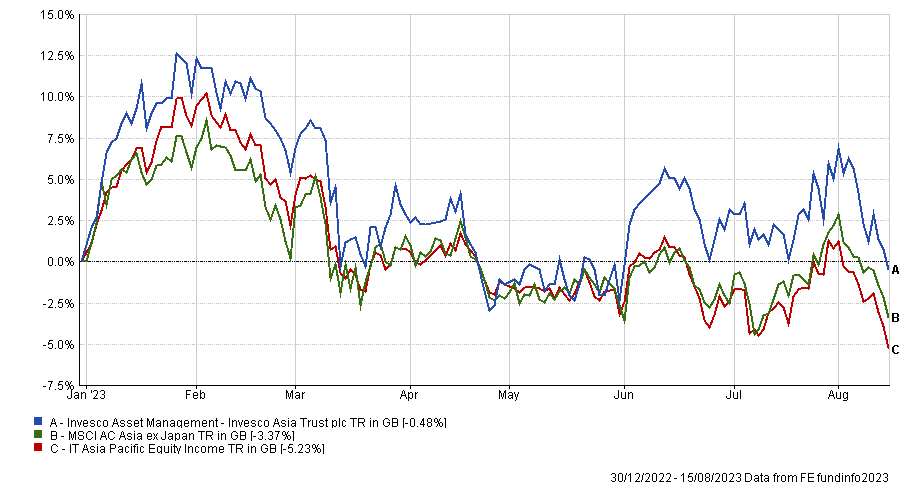

Performance of trust YTD vs sector and benchmark

Source: FE Analytics

Another country where the trust has moved to an overweight position recently is Vietnam with the introduction of two new stocks in the portfolio this year.

Yang said that the country is a key beneficiary of the China Plus One strategy, with demographic advantages.

Similar to China, the Southeast Asian market has been sold off in recent years following crackdowns in the real estate sector and an anti-corruption campaign.

Yang added: “The government has stepped in quickly to help the real estate sector. That's quite different from what happened in China. As for the anti-corruption campaign, it was, in my opinion, more of a political infighting rather than a dramatic change in the underlying economic policies carried out by the government.

“All of those cyclical headwinds provided a good opportunity for us to buy stocks in a country that offers structural growth.”

Conversely, the trust is underweight India and Taiwan. Yang said, although both countries have performed well over recent quarters, valuations in those market have reached the investment team’s estimates.

As a result, the trust sold its position to one of its Indian holdings, automotive company Mahindra & Mahindra, in the second quarter of this year.