What investors choose to put in their pension is an important decision as it can have a significant influence on their overall quality of life when they enter retirement.

It is very important to start early so that a large pot can be accrued, but as we get nearer to retirement, having a portfolio of resilient trusts that offer both capital preservation and growth can be a winning strategy.

Trustnet asked experts for the best trusts investors can hold at the core of their pension to pave the way to a comfortable retirement.

Ruffer Investment Company

The Ruffer Investment Company’s low volatility may have satisfied low-risk investors who wanted steady performance, but its cautious approach didn’t sacrifice on total return.

This £1bn portfolio suggested by Kepler investment trust research manager Thomas McMahon, followed narrowly behind the IT Flexible Investment sector with a total return of 37.3% over the past decade.

McMahon pointed out that not only does it deliver a similar return to its higher risk peers, but it is far more resilient when the rest of the market is struggling.

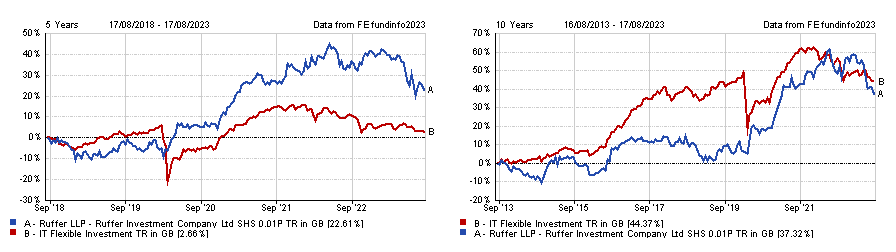

Over the past five years for example, Ruffer soared 22.6% in the face of challenging economic conditions whilst its peer group made a modest 2.7%.

Total return of trust vs sector over the past five and 10 years

Source: FE Analytics

“It has a strong track record of delivering equity-like returns with much lower volatility and has also tended to perform very well when stock markets are weak,” McMahon said. “For these reasons it could be a decent core holding in a long-term pension portfolio.”

Its resilience is mostly thanks to its unconstrained investment universe which allows managers Duncan MacInnes and Jasmine Yeo to spread allocations across a broad spectrum of assets.

Although it can invest broadly, the portfolio is mostly comprised of fixed income assets (77.5%) with equities accounting for around a fifth (22.3%) of all holdings.

Ruffer could appeal to all savings-conscious investors, but those approaching retirement age may want to pay closer attention, according to McMahon.

McMahon said: “Long-term investors can afford to take risks, but having core holdings that are more dependable can be valuable psychologically as well as protecting against unexpected demands on capital.

“Potentially more could be added to these holdings as retirement nears, reducing sequencing risk and the variability of the sum available at retirement.”

At a current discount of 3.5%, McMahon added that now would be a strategic time to buy the trust below its net asset value (NAV).

City of London Investment Trust

Juliet Schooling Latter, research director at Chelsea Financial Services, also understood investors’ desire for both capital preservation and growth without the unpredictable returns.

A portfolio that offers this at a steady rate is City of London Investment Trust, but it has an extra perk – as an income-dedicated portfolio, City of London’s yield of 5.2% is substantially higher than that of Ruffer’s 1%, offering investors a much-needed source of revenue in their retirement years.

Schooling Latter said: “In retirement, most people will want an element of growth (to make sure they don’t run out of money) but they also won’t want to be taking excessive risk.

“Many retirees will also be looking for a reliable income so, to me, the obvious choice here is the City of London Investment Trust. It’s a great core holding for almost any portfolio.”

Shareholders can safely rely on the level of income growing annually, with the trust having increased its dividend for the past 56 consecutive years.

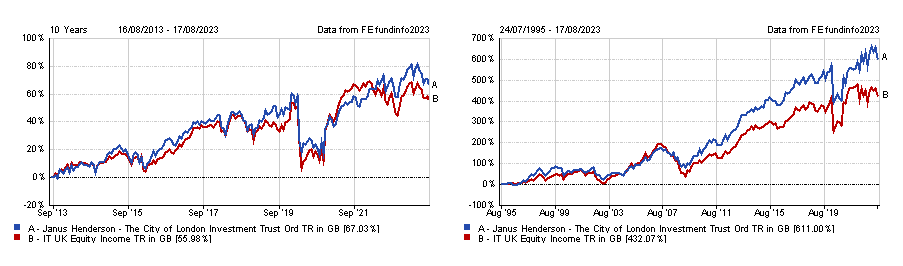

Dividend growth over the long term may have been strong, but so have its returns – it soared 67% over the past decade, beating the average IT UK Equity Income fund by 11.1 percentage points.

Schooling Latter said that the £1.9bn trust is in safe hands with Job Curtis, who has bolstered returns 611% since taking charge in 1991.

Total return of fund vs sector over the past 10 years and since Curtis became manager

Source: FE Analytics

Although the portfolio is predominately concentrated in British companies (82.9%), Schooling Latter pointed out that it is not reliant on the UK economy.

Most of its holdings – such as top positions in Shell, BAE Systems and HSBC, which account for 10.8% of all assets – are international companies that source their revenues from around the globe.

City of London is also one of the very few investment companies selling at a premium. The majority of portfolios are selling at an average discount of 13.1%, while City of London’s share price is 1.2% above its NAV.

This may not make it the most appealing entry point – Trustnet previously looked at the most attractively valued trusts – but it does give investors some confidence in its performance.

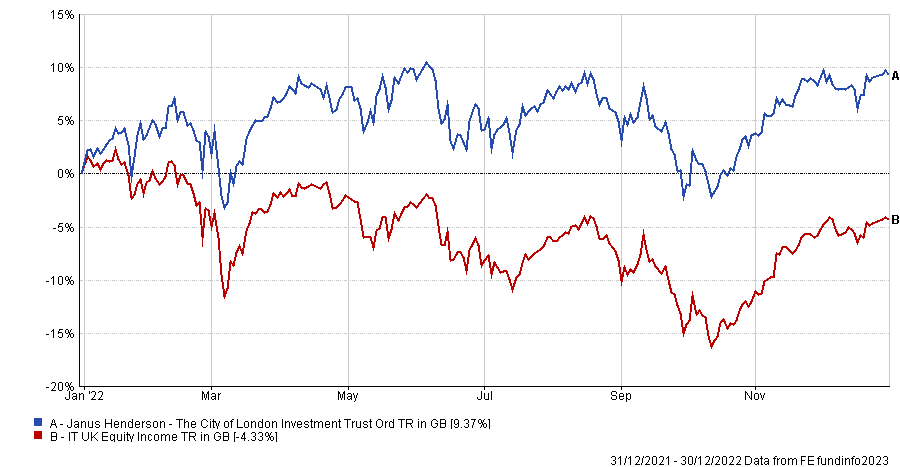

Most trusts are selling at a discount because their performance last year was poor, but City of London pulled through and delivered a 9.4% return whilst all others made a loss.

Total return of trust vs sector in 2022

Source: FE Analytics

The initial price may be somewhat high, but Schooling Latter said the ongoing charge of 0.33% per annum of net assets under management is “very good value”.

Alliance Trust

Although timing when to buy trusts at a discount can be “counterproductive”, QuotedData’s head of investment company research James Carthew said investors “should welcome weak markets as they provide an opportunity to build larger positions”.

This is precisely the case with Alliance Trust – a perfect addition to any pension that is selling at a 6.7% discount to its NAV.

Carthew said he liked the fact its all-out equity exposure could deliver high returns whilst its management team of 10 external management teams keeps allocation diversified and adds defensiveness in down markets.

“I suggest that the best core pension investments would be globally-diversified, equity-heavy funds that you can trust will be around until you feel ready to retire,” Carthew added.

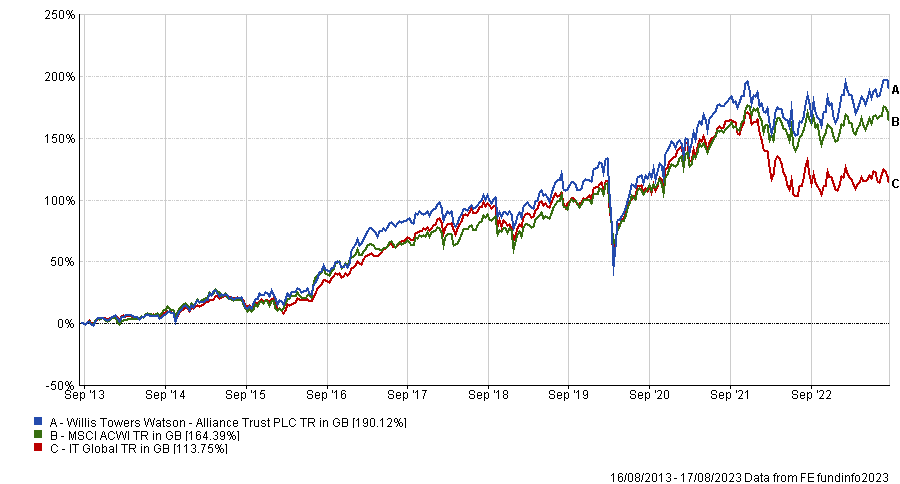

Although Alliance Trust’s large management team spread allocation across a varying range of sectors and investment styles to create diversification and defensiveness, the £2.9bn portfolio still generated a 190.1% return over the past decade that beat the IT Global sector by 76.4 percentage points.

Total return of trust vs sector over the past decade

Source: FE Analytics

Carthew added: “It is helped by having a mix of ‘value’ and ‘growth’ style managers and so has not suffered as investor sentiment has swung from one to the other in recent years.”