Investors are fearful of a potential recession but it could actually be a good thing for the UK, according to Neil Birrell, CIO of Premier Miton and manager of its Diversified Fund range.

He explained that asset prices became over-inflated after the flash flood of stimulus during the pandemic, so a recession could be what is needed to bring valuations down to reasonable levels.

“Recessions aren’t necessarily bad things,” Birrell said. “Normally, recessions come about because you get excesses built up in economies and bubbles built up in asset prices (house prices are a very good example of that), so you can think of them as the air coming out of the balloon or a bloodletting before you can rebase.”

While a recession would be painful for many, the UK economy could come out of it much stronger because it would flush out most of the poor quality businesses.

“During high growth periods, relatively bad companies can do well because there’s huge demand for everything,” Birrell added.

“When you go into recession, those bad companies go bust. That has the unfortunate effect of people losing their jobs but at the same time you’ve then got lower interest rates, everything is rebasing, new companies form, employment starts and you’ve got good companies rising up as a result, so you shouldn’t be scared of it.

“Now that’s quite easy to say if you’re not one of those people who’s been laid off during that period but, at an overall economy level, it’s not necessarily a problem.”

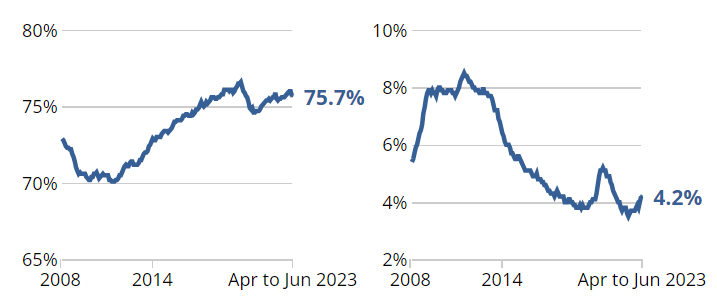

Indeed, low unemployment in the UK is one of the main drivers of inflation and a key reason why the Bank of England (BoE) is under pressure to keep interest rates high.

Birrell said the tight labour market in the UK and resulting wage-push inflation is making high prices much stickier than other economies, and a recession could help fix that.

UK employment vs unemployment rates since 2008

Source: Office for National Statistics

Nevertheless, Birrell said the UK has been “surprisingly robust” against rising interest rates, moving the overall consensus away from a recession.

Whether the UK enters a ‘technical’ recession or not is irrelevant as markets have priced in the resilience of UK stocks and made investing in equities much more appealing than at the start of the year, according to Birrell.

“Markets look to the future,” he said. “They value what they think will be happening going forwards and, at the moment, there is no great expectation of recession, so I don’t think it’s the end of the world for markets.”

Birrell entered the year cautiously with fixed income allocations in the Premier Miton Diversified Fund range at an all-time high, but he has become more confident in recent months.

Equities now account for just over half (53.3%) of his largest portfolio – Premier Miton Diversified Growth – with bonds at 18.9% and an additional 21.7% in alternatives and property.

Birrell said: “We were low risk in the fact that we had more exposure to bonds – which have more predictable returns – and lower exposure to stock markets than we’d ever had in our 10-year history.

“We’ve been surprised by how strong markets have been, and I’ve got to the stage now where it looks like the economy is going to bumble its way through. If we can do that, then the outlook for markets is relatively good, although I think volatility will remain.”