The emergence of low-cost passive funds have made active strategies’ higher fees hard to justify. With only 18% of the funds in the IA Global sector having beaten the FTSE All World and 23% the MSCI World in the past 10 years, there is not many incentives to pay for an active manager.

There are, however, some that have delivered exceptional returns in the past decade and justified their higher costs as a result.

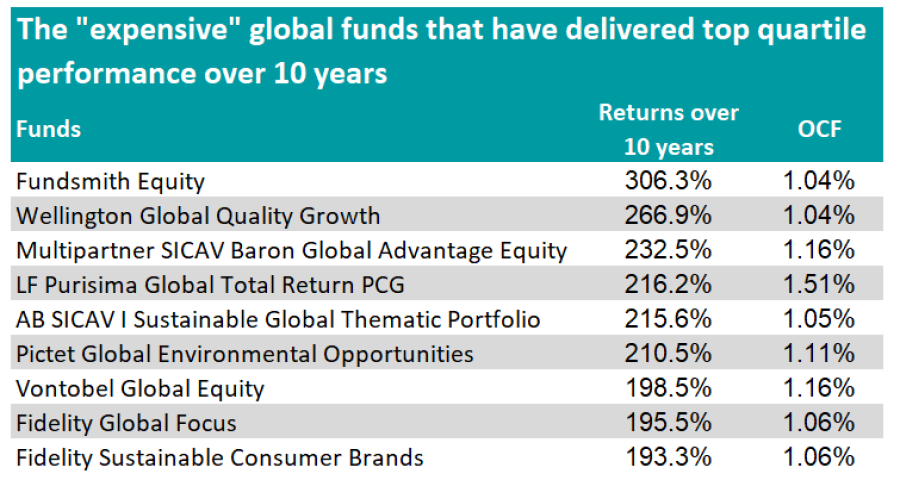

Trustnet has looked at the funds with an ongoing charge figure (OCF) of more than 1% that have made top-quartile returns over 10 years in the IA Global sector. All OCFs are based on the fund’s main share class as determined by FE Analytics.

The expensive global funds that have delivered top-quartile returns over 10yrs

Source: FE Analytics

Starting with the best performer, which also happens to be the largest active global fund in the UK, Fundsmith Equity has returned 306.3% over 10 years and has an OCF of 1.04%.

FE fundinfo Alpha Manager Terry Smith’s flagship portfolio has a quality-growth style bias, investing in well-established companies with a high return on equity and operating in industries with high barriers of entries.

Performance of fund vs sector and indices over 10yrs

Source: FE Analytics

Jason Hollands, managing director of Bestinvest, said: “Fundsmith periodically comes under criticism for above-average fees but most investors in the fund will be sanguine about paying a little extra for a product that has more than justified its costs in terms of generating significant excess returns over the index.

“The managers have a clear and well-articulated approach and have stuck to their guns. There is no reason to believe that the fund won’t continue to prove a sound investment.”

Smith has fiercely defended the fund’s charges in the past, noting that it is actually below average once transaction costs (which are calculated outside of the OCF) are taken into account, as his buy-and-hold strategy typically has minimal turnover.

Another quality-growth fund on the list is Wellington Global Quality Growth, managed by Alpha Manager John Boselli. The fund, which has returned 267.6% over 10 years, also has a 1.04% OCF.

Boselli looks at growth, valuation, capital return and quality criteria in his stock selection, with the fund’s largest weightings in the financials and information technology sectors.

Performance of fund vs sector and indices over 10yrs

Source: FE Analytics

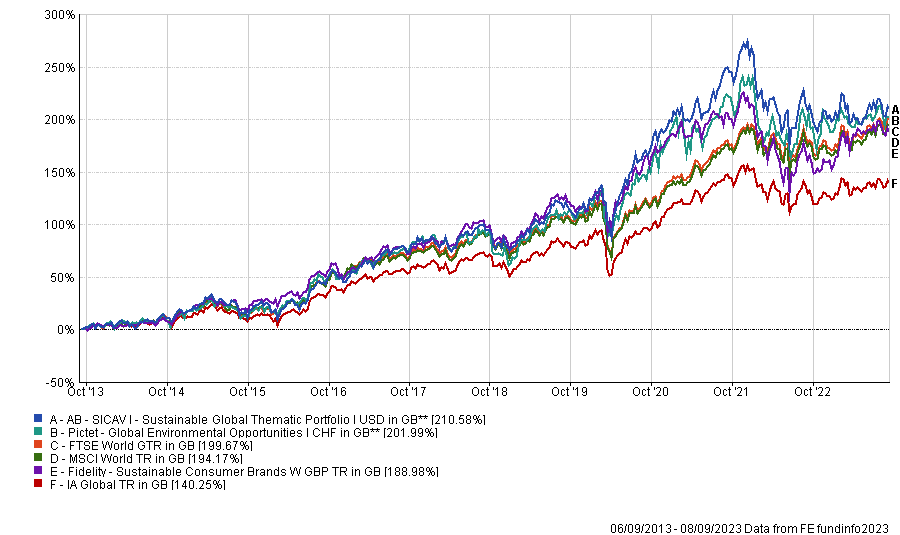

There are also three sustainable funds in this list, reflecting the rise of environmental, social and governance metrics (ESG) in the past 10 years.

Fidelity Sustainable Consumer Brands, which charges 1.06%, combines quality growth with sustainability. The manager focuses on strong brands with superior pricing power, intellectual property and innovation, while applying an ESG filter in the process.

With roughly £6.4bn of assets under management, Pictet Global Environmental Opportunities is the largest of those sustainable funds. It looks to tackle environmental challenges through investments in energy efficiency, waste management & recycling or pollution control. It is also the most expensive of the three sustainable funds, with an OCF of 1.11%.

Performance of funds vs sector and indices over 10yrs

Source: FE Analytics

The best performing sustainable portfolio on the list is AB SICAV I Sustainable Global Thematic Portfolio, which has an OCF of 1.05%. It invests in companies that are aligned with the United Nations Sustainable Development Goals, such as tackling climate change, improving health or enabling sustainable consumption, and has made 210.6% over the past decade.

Finally, the most expensive fund on the list is LF Purisima Global Total Return PCG, which has an OCF of 1.51% and has returned 215.6% over 10 years. The fund has a strong bias towards US technology which makes up nearly 32% of the portfolio.

Other funds on the list include Multipartner SICAV Baron Global Advantage Equity, Vontobel Global Equity and Fidelity Global Focus. The latter fund was managed by Amit Lodha until June 2021 before he was replaced by Ashish Kochar. As a result, Hollands said that the fund’s longer-term record might arguably not be that relevant.