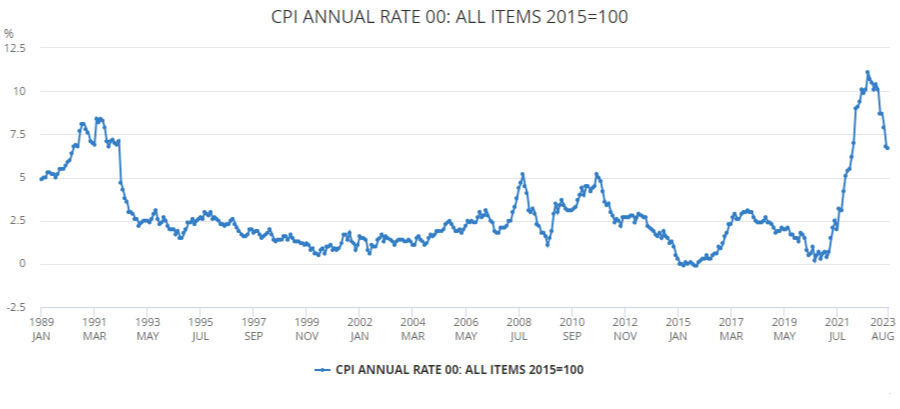

UK inflation fell in August, a surprise move to many, ahead of the Bank of England’s interest rate decision tomorrow. The latest figures imply we are near the end of the hiking cycle, according to experts, although a further increase to the base rate remains the most likely outcome from the monetary policy committee (MPC) meeting.

The consumer prices index (CPI) rose by 6.7% in August, down from 6.8% in July. Within this, core CPI was down to 6.2% from 6.9%, while services inflation dropped from 7.4% to 6.8%. These figures were lower than expectations, which were for prices to tick higher to 7%.

All eyes will turn to the policymakers, who meet tomorrow to decide whether inflation is cooling quickly enough to halt its interest rate hiking cycle.

Source: Office for National Statistics

Daniele Antonucci, chief investment officer at Quintet Private Bank, said the latest figures “support our view that the Bank of England is not too far from pausing its rate hiking cycle”.

“There is evidence that higher interest rates are having their intended impact: inflation is falling and activity is slowing. Now the messaging from central bankers is beginning to point to a peak in rates.”

Indeed, AJ Bell head of financial analysis Danni Hewson noted after the figures that the odds of a rate rise tomorrow have been slashed from around 80% to just 50%.

“Just like that what had seemed like a sure thing is cast into doubt. Moments after the shock inflation number was released, the market expectation of a Bank of England rate rise began to plummet,” she said.

“After a slew of profit warnings from UK PLC yesterday and a GDP figure that sat badly for the UK economy, the news that inflation has continued to cool is likely give policy makers enough wiggle room to adopt a wait and see strategy.”

Tomasz Wieladek, chief European economist at T. Rowe Price, erred on the side of expecting another rate hike tomorrow, but noted that inflation will not be the only key factor that the Bank is looking at.

Wage growth last week, for example, will also be a factor. Average salaries including bonuses rose 8.5%, higher than the rate of inflation, which can be problematic as companies will need to cover their costs and could do so by raising prices.

Meanwhile, the unemployment rate has started to rise above expectations, while there are real risks that the economy could be about to slide into recession.

“The BoE will have to trade off these data surprises. I expect the debate at tomorrow’s meeting to be particularly heated. Although near-term inflation dynamics are looking better, and the weakness in demand demonstrates the monetary policy transmission mechanism is working, the medium-term inflation outlook likely worsened since August due to higher pay growth surprises,” he said.

“Given this news, I expect the Bank of England to reach a compromise. It will hike by 25bps but also indicate this is probably the last rate rise in the cycle. There are risks the Bank remains on hold. However, whatever happens tomorrow with the policy rate, I believe the Bank will accelerate its quantitative tightening programme.”

James McManus, chief investment officer at Nutmeg, added that the complex data backdrop also includes UK GDP shrinking 0.5% in July.

Richard Carter, head of fixed interest research at Quilter Cheviot, agreed. “While this dip in inflation eases the pressure somewhat on the Bank of England to raise rates once more, it likely remains poised to pull the trigger on another 25bps interest rate hike tomorrow. If this proves to be the case, many will be asking when enough is enough,” he said.

“The Bank has had a tough task in navigating its fight against inflation, and this morning’s figures suggest it may finally be having a real impact.”

Households remain under pressure from inflation, with higher bills including mortgages, groceries and fuel, culminating in the current cost-of-living crisis.

McManus said that the inflation figures today will “offer some relief after expectations of a rise in August” but warned that inflation remains three times the Bank of England’s 2% target and has some way to go if the Bank is to achieve its expectation.

“With the prospect of rising crude oil prices reducing the long promised disinflationary impact on energy inflation over the coming months, we’re not out of the woods yet,” he said.