Income investors often want the share price of their holdings to grow over time as well as offer a good payout now but finding stocks that can do both is a challenge.

That’s why many income fund managers boost the overall yield of their portfolio by investing in a set of high yielding stocks and getting their capital return from a separate group of high growth companies with lower dividends, such as Joanne Rands’ Martin Currie UK Equity Income fund.

She explained: “Our fund is very much a total return strategy, so we're not just looking for deep value income from really high yielding companies.

“About a third of the fund is made up of high yielding companies, with two thirds made up by companies with yields around the market level, but with really good total return prospects. That's how we also generate a good overall return in the long term.”

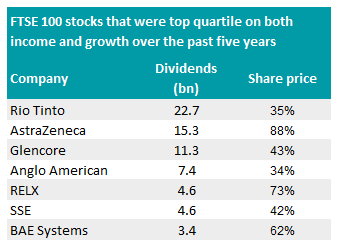

However, there are UK stocks that can deliver on both. There are seven companies in the FTSE 100 that were top quartile for both share price growth and dividends paid out over the past five years, according to data from AJ Bell.

Source: AJ Bell

Shell, British American Tobacco, HSBC and BP were the highest paying companies over the period – jointly paying out more than £109bn in dividends – but none of them were in the top band for share price growth.

Of the few companies that delivered on both, British-Australian metals and mining corporation Rio Tinto paid out the most, delivering £22.7bn to shareholders over the past five years.

Not only was it a top dividend payer, but it was also one of the best performers in the FTSE 100, with shares in the £87.6bn company climbing 35% over the past five years.

The highest growth on the list, however, came from pharmaceutical and biotechnology company AstraZeneca. Shares in the £173.9bn Anglo-Swedish multinational soared 88% over the past five years, but it also managed to dish out £15.3bn in dividends.

Commodities companies Glencore, SSE and Anglo American also gave shareholders the best of both worlds, paying out a collective £23.4bn in dividends whilst also climbing 43%, 42% and 34% respectively.

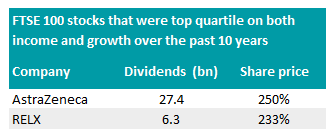

Nevertheless, the chances of getting a UK company that outperformed on both share price and dividends over the long term was even narrower, with just two FTSE 100 companies delivering on both over the past decade.

The nine best performing UK large-cap stocks over that period made high returns, but their negligible dividends meant they did not appeal to investors looking for high levels of income.

Only AstraZeneca and information and analytics company RELX were able to deliver top-quartile share price growth and dividend payouts.

Source: AJ Bell

AstraZeneca did an arguably better job at this, paying out £27.4bn to shareholders whilst also having its stock value soar 250% over the past decade, giving investors the best of growth and income. During that same period, RELX paid £6.3bn in dividends and its share price rose 233%.