In 2023, assets in pension funds have fallen by £626bn, dropping from more than £2tn at the start of 2022 to less than £1.4tn by the end of March, according to the latest Office for National Statistics data.

On top of that, with annual returns at just 9.5% as of 2021 according to Moneyfacts, Britain’s pension sector has historically underperformed the Canadian (20.4%) and Australian (22.3%) systems, as highlighted on a note by Senior Capital.

These are just some of the reasons why UK pension savers should keep an eye on their pension funds and make sure they’re achieving an adequate level of returns.

In this Trustnet series, we are looking at the best-performing pension funds since 2013 sorted by provider. Today it’s Legal and General’s turn and we start with the ABI Mixed Investment 0-35% Shares sector, which contains defensive funds with up to 35% of exposure to equities.

The only L&G fund in this sector has lagged its average peer by 1.6 percentage points, as shown in the table below.

Source: FE Analytics

Managed by Jupiter, more than half of the L&G Jupiter Distribution portfolio is invested internationally, while 31.8% is held in the UK. Its top holdings include gilts, positions in numerous income funds and a gold exchange-traded fund (ETF).

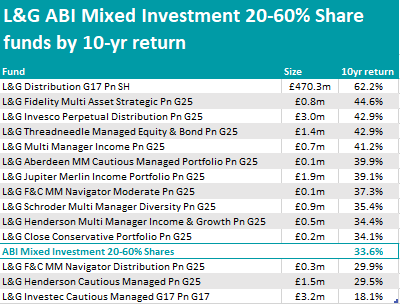

It’s a different story for ABI Mixed Investment 20-60% Share funds, which can contain more risk. The average return from portfolios in this peer group since 2013 is 33.6%. Here, only three funds have failed to beat this benchmark, while the top-performer has almost doubled it.

L&G Distribution, managed by LGIM’s Nicola Morgan-Brownsell, is a large-cap value fund with 41.9% invested in equities and 37.9% in fixed income with a home bias (44.6% is invested in the UK) followed by a focus on the US (16.2%) and the Eurozone (12.7%).

It’s the largest vehicle offered by Legal and General in this risk bracket, dwarfing all other funds in the list.

Source: FE Analytics

Almost 20 percentage point behind, the second-best performer was L&G Fidelity Multi Asset Strategic, a composition of other strategies by Fidelity, including its top holding, Fidelity Global Aggregate Bond (26.2%).

Co-managed by Ciaran Mallon and Edward Craven with a more international approach, L&G Invesco Perpetual Distribution came in third. It allocates 42.5% of its portfolio in global bonds, followed by UK bonds (24.5%) and UK equities (20.6%).

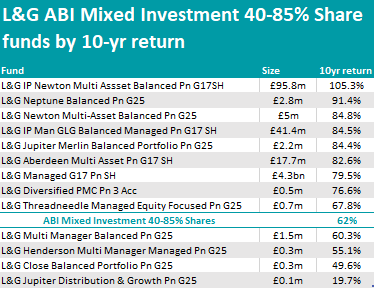

In the next risk bracket, all L&G strategies have beaten the ABI Mixed Investment 40-85% sector, with the best return achieved by L&G IP Newton Multi Assset Balanced Pn.

The five FE fundinfo Crown-rated fund is co-managed by FE fundinfo Alpha Manager Bhavin Shah, Simon Nichols and Paul Flood, who, with an almost equal split between UK and US equities (26.5% and 24.5%, respectively), achieved a 105.3% return over the past 10 years against the sector average of 62%.

The rest of the portfolio includes UK fixed interest (15.4%), European equities (12.5%) and cash (8.7%).

Source: FE Analytics

In second position, Liontrust’s Tom Record made 91.4% since 2013 with the L&G Neptune Balanced portfolio, which is skewed towards North American equities (50.9%) and prefers UK debt (13.3%) over domestic equities (3.3%).

The largest vehicle in the list is L&G’s own Managed portfolio – a blend of value and growth stocks (61.8%), bonds (20.5%) and cash (12%), solidly anchored in the middle of the ranking.

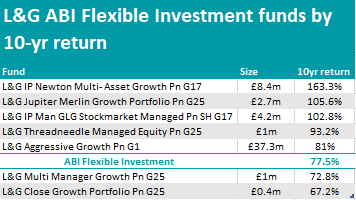

Finally, the ABI Flexible Investment contains funds with no allocation constrictions – for L&G, these are mostly small vehicles in assets-under-management (AUM) terms.

The top performer was again a fund managed by the team at Newton, FE fundinfo five-crowed L&G IP Newton Multi- Asset Growth, which made 163.3% in the period in analysis.

Source: FE Analytics

The only L&G-managed portfolio to just about make it above the 77.5% dividing line was the five-crown strategy L&G Aggressive Growth Pn, while L&G Multi Manager Growth Pn did not hit the mark.

L&G Close Growth Portfolio Pn also disappointed and closed the list with a 10 percentage-point lag below the average.

This article is part of an ongoing series on best-performing pension funds by provider. In the previous instalments, we looked at Standard Life, Aegon/Scottish Equitable, Scottish Widows, Aviva and Royal London funds.