Property funds have been nothing short of a disaster for investors, who have been trapped with no way of redeeming their cash several times in the past few years. But the writing could finally be on the wall, after M&G announced it is to close its flagship £565m Property Portfolio.

Real estate has long been an interesting area for investors to gain exposure to an asset class that diversifies away from traditional stocks and bonds portfolios.

Yet property as an asset class has one snag – buildings are hard to trade. It is for this reason that, multiple times now, property funds have had to close their gates to give themselves time to sell assets in order to meet withdrawals.

In the wake of the financial crisis, investors were locked into the funds to give managers time to offload properties. This was followed by a serene few years before Brexit, and then Covid, put them back in the spotlight.

Ryan Hughes, head of investment partnerships at AJ Bell, said: “Offering a daily dealing structure for an asset that can take months to sell was an accident that happened all too often and one that ultimately undermined investor confidence.”

There have been efforts to address this, with the Financial Conduct Authority mulling ideas including the long-term assets fund structure, which would require investors to give a 90-day notice period.

The M&G fund was once among the largest of its peers, with some £2.5bn in assets under management as recently as 2019. It remains the third-biggest in the 13-fund IA UK Direct Property sector, but its closure leaves just a handful of names still operating.

It will take around 18 months to liquidate the portfolio, the asset management firm has suggested, with retail investors making up the majority of the unitholders.

Not all were are convinced that holders will see their cash back so quickly, however. Oli Creasey, equity research analyst at Quilter Cheviot, noted that while Janus Henderson successfully liquidated its fund in short order in 2022, with a single buyer taking the entire portfolio, “others have not been so lucky”.

“Aegon suspended in March 2020, and has been liquidating a relatively small portfolio since summer 2021, a process that is still ongoing,” he said.

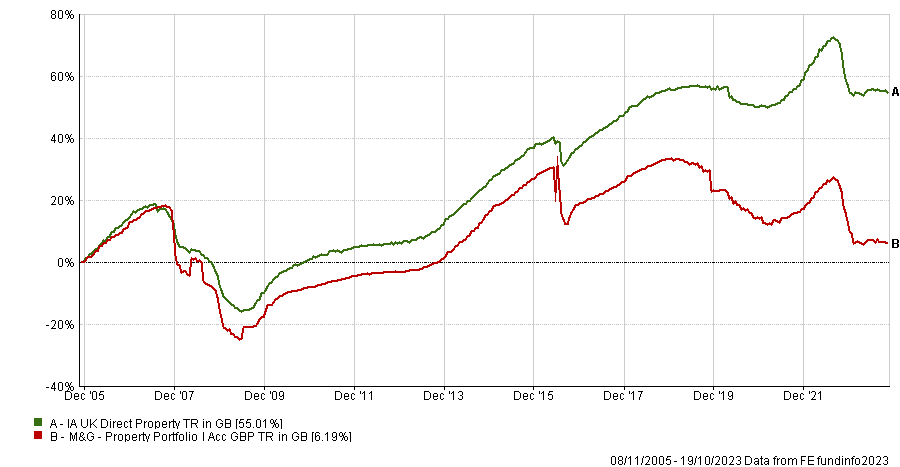

Total return of fund vs sector since launch

Source: FE Analytics

Hughes added that there will be a mix between selling fast and at a reasonable price – something made more difficult now that potential buyers know M&G is looking to offload more than £500m of property assets “into a market that is not exactly buoyant at the moment”.

“As a result, I suspect investors will have to be very patient to see the full realisation of their capital.”

It could be the final nail in the coffin for the sector, which has been under scrutiny for some time. I have gone on record in stating that the LTAF structure could work – providing investors know what they are getting themselves into – as it stops short-term reactionary investing and should aid long-term investors who want the diversification that property promises.

Others say the closed-ended structure is the best way forward for property and other illiquid assets, as investors are free to buy and sell as they choose – providing they can find a willing partner for the other side of the trade. The only issue is they might not like the price that they are getting on the deal, but at least they can get out.

Neither are perfect. And when your own home is the biggest asset you will likely have in your life – with the exception of perhaps a pension for those fortunate enough to save significant amounts – I am not sure if property investing is even worth it. I don’t own any in my own portfolio, and given the recent doom and gloom, I doubt they will be making an appearance anytime soon.