Banking group Natwest, supermarket chain Tesco and drinks brand Diageo are UK stocks that represent the sort of value shoppers will be looking for this week in the Black Friday sales, according to fund managers.

The UK equity market is having its own Black Friday sale of sorts, with shares in many companies at significant discounts to their international competitors.

Brexit and the political deadlock ensuing from it has led to a perception of the UK as a permanently lower growth economy, said Alison Savas, investment director at global equity manager Antipodes Partners, who thinks this explains why valuations across the board are so low.

But for investors who are not put off by recession fears and the hangover from Brexit, sorting through the discount aisle could yield opportunities that prove lucrative in the medium-to-long term.

Savas tipped Natwest, Tesco and Diageo as strong companies currently trading at attractive discounts.

Natwest is the cheapest of the trio, priced at just 5x forward earnings. The Commonwealth Bank of Australia, by way of comparison, is priced at 18x forward earnings. Both banks have a similar return on equity at about 18%.

“This low valuation is largely due to macroeconomic recession concerns in the UK as NatWest is a quality bank with strong fundamentals and a well-capitalised position,” Savas said. “It has remained strong in uncertain conditions due to its strong market position in primary banks, low-cost deposits, and a relatively low-duration balance sheet.”

Tesco also looks cheap when compared to peers abroad. It is priced at 11x forward earnings, whereas Walmart in the US and Woolworths in Australia are both priced closer to 25x. Savas said the large discount again reflects negative sentiment about the UK economy.

“Markets are missing that Tesco has proven to be highly resilient and has successfully navigated three key structural shifts: the emergence of discounters, the shift to online shopping and the rise of data usage,” she said.

Tesco has been a winner in the transition to online grocery shopping and has fought off competition from discount grocers such as Aldi and Lidl by price matching products. It has weathered the storm of high inflation without its profitability being impacted, has been disciplined with regards to cutting costs and has passed on price increases.

The supermarket has successfully used data to enhance customer loyalty and to target customers with personalised offers. It has the highest net promoter score (a measure of customer retention) in the market and 80% of all purchases now come through loyalty.

Rob Burgeman, senior investment manager at RBC Brewin Dolphin, also suggested investing in Tesco.

Diageo, meanwhile, is priced at approximately 18x forward earnings, with operating profits growing in the mid-to-high single digits and the spirits company is buying back stock.

Savas said: “Diageo is cheap relative to its business resilience and growth profile because it is listed in the UK. Its valuation is also low compared to other consumer franchises that are less profitable and have lower organic growth profiles.”

Two-thirds of the spirits industry is made up of small-scale, local businesses, but Diageo has a portfolio of dominant brands with strong pricing power, such as Johnny Walker scotch, Casamigos tequila and Tanqueray gin.

Diageo possesses a 10% share of the international spirits market and has been able to dominate in this fragmented industry due to its regulatory licenses, the age of its spirits inventory and its extensive investment in distribution, Savas explained. It also has a strong foothold in emerging markets such as India, China, Latin America and Africa.

DS Smith, a multinational packaging business, is another UK-listed business available at an attractive valuation.

Jo Rands, portfolio manager and research analyst in Martin Currie’s UK equity team, said: “The shares are trading near trough multiples on 8x price to earnings, offering a dividend yield of over 6% and with free cash flow set to inflect higher in April 2025.

“DS Smith has suffered from a period of de-stocking in its end markets, but there are signs this could be coming to an end. If the economic backdrop becomes trickier, DS Smith should remain more resilient, given it has large end market exposure to fast-moving consumer goods.”

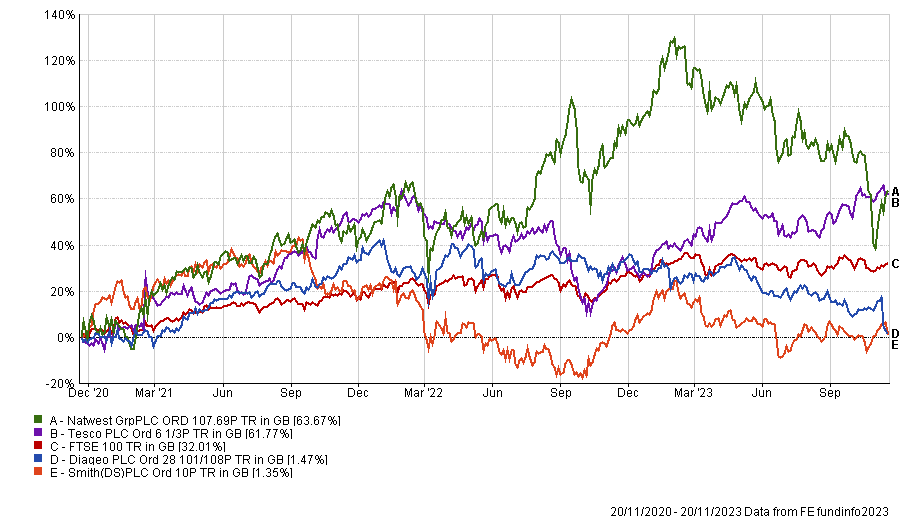

Performance of stocks vs FTSE 100 over 3ys

Source: FE Analytics

If UK large-caps look cheap, then small- and mid-caps are on sale at bargain basement prices.

‘Smid’ (small-to-mid) and small-caps are both trading at a 28% discount to their fair value (as defined by Canaccord Genuity’s Quest equity valuation tool). This is an anomaly given that they traded at a 19% and 41% average premium to fair value between 2002 and 2022.

Last year was the first time that UK small-caps had ever traded at a discount to Quest fair value, said Stuart Widdowson, managing partner of Odyssean Capital.

The overall UK market is trading at a 26% discount to Quest fair value, compared to an average 3% premium for 2002-2022.

As examples of how cheap some small companies have become, energy company XP Power, James Fisher (which provides specialist services to the marine, oil and gas industries) and Ascential, a data and analytics company, are all amongst Odyssean Capital’s top 10 holdings. They are trading at price-to-book ratios of 1.4x, 0.9x and 1.2x, respectively, compared to 10-year averages of 3.9x, 2.3x and 2.9x.

If each company’s price to book ratio reverts to its 10-year average, the implied share price upside would be 183%, 156% and 141%, respectively.

For a quality mid-cap business that is undervalued, Richard Bullas, lead portfolio manager of the FTF Martin Currie UK Mid Cap Fund, selected Genuit.

“As a supplier of building materials into the construction sector, including plastic piping for plumbing jobs, Genuit has seen a slowdown in volume due to the cyclical nature of some if its end markets. That has reduced the share price and depressed the valuation rating,” Bullas explained.

Nonetheless, Genuit should benefit from several structural tailwinds that he believes the market has overlooked.

“Regulatory changes for new homes include greater use of energy efficient heating and ventilation systems, with Genuit one of the UK’s leading supplier of underfloor heating systems. Investment in urban buildings and water infrastructure provides an opportunity for the group’s sustainable water systems, such as a water capture roof systems and water run off management,” Bullas said.

“The group is also going through a period of cost restructuring which has supported profitability through this period and when volumes recover the business will enjoy a higher return on sales and capital than it has historically.”