Smaller companies have been shunned by investors around the globe, but an increasing number of managers have been upping their allocations to this area across geographies.

In the UK, James Henderson and Laura Foll at the Lowland Investment Company are such managers.

It is largely known that UK equities are trading at a big discount to their overseas peers, but what's less well understood, according to Foll, is that UK small and medium-sized companies have had even weaker sentiment – which might be on the verge of turning.

“Small-caps have underperformed the FTSE 100 very materially over the past couple of years because they are more domestic and if there's a question mark about the UK economy, this is more likely to be reflected at the smaller and medium-sized end than the very large international businesses that we see in the FTSE 100,” she said.

“So if the UK economy seems to be doing a little bit better, and we're not in recession this year as everyone expected 12 months ago, it's yet to be reflected in those UK small or medium-sized companies, where sentiment remains very weak and valuations very low. This is the opportunity, and Lowland has been moving to that area by reducing the FTSE 100 holdings in order to add a number of new small-cap positions.”

Performance of indices over 2 years

Source: FE Analytics

Lowland has introduced third-party logistics company Wincanton, which serves the likes of Kingfisher and Sainsbury's, as well as power solutions supplier XP Power and Videndum, which makes production equipment that's used in the US film industry.

The trust announced its results last week, which were largely driven by foreign takeovers of UK small caps.

In Europe, Matthias Born, manager of the Berenberg European Focus fund, is making a similar move, thinking that a lot of bad news is already priced in into small-caps’ prices, despite them being “very solid businesses with little leverage”.

“In our all-cap fund, we have increased the small-cap part of the portfolio because we think that’s where the best opportunities have certainly been at the end of October, which was the low point in the market, but also where they still are today.”

One example here was Norwegian logistics technology company Autostore and Dutch semiconductor manufacturer Besi, but Born also added in other sectors such as medical technology and industrials.

“Some of these names were performing quite badly recently. Some of the stocks were down by 30% to 40% year to date, which we used as a good opportunity to increase or buy new positions in these in these stocks,” he said.

To do that, he cut other larger-cap positions such as Novo Nordisk, the multinational pharmaceutical company known for its diabetes treatment. The stock is in the top-10 holdings of the Berenberg portfolio, as its long-term case still stands, according to the manager, but was cut form 8% to 5% over the past eight weeks because of valuation and estimates which were “getting quite optimistic”.

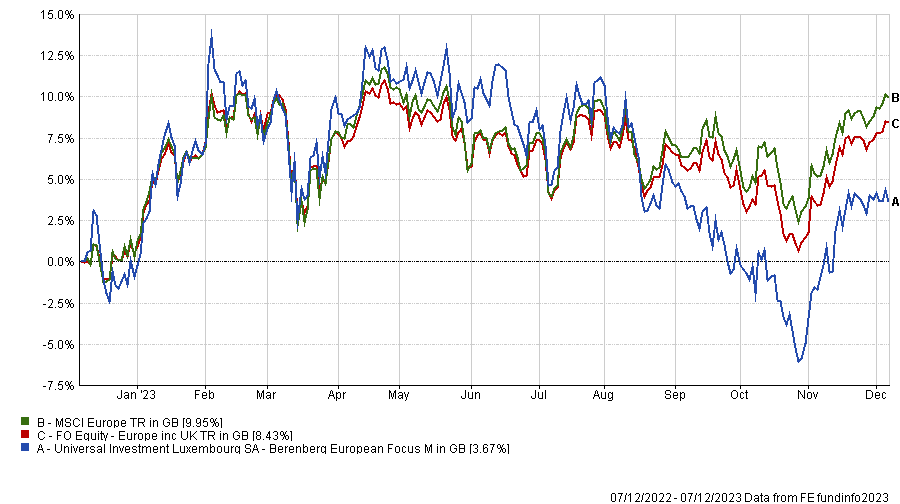

Performance of fund vs sector and index over 1yr

Source: FE Analytics

US equity experts are also starting to hold similar views. Head of US equities at Federated Hermes Mark Sherlock pointed out that US small and mid-caps usually do well in the year ahead of elections, but are also a good investment case in the longer period.

“Since president Hoover’s last year in office in 1932, the S&P 500 has gained an average of 6.5% in an election year. The Russell 2500 Index doesn’t have data as far back as the Hoover administration, but since its inception, it has outperformed the S&P 500 in three of the past four first years post-election,” he said.

“We don’t claim to have a crystal ball that can predict the outcome of the 2024 election, but the strong tailwinds that are supportive of US SMID [small- and mid-cap] companies for the next five-10 years will still be in situ regardless of who is sitting in the White House.”

This is due to the Inflation Reduction Act and infrastructure spending, which have largely been authorised and will boost new investments, together with tailwinds from the ongoing onshoring trend.

Finally, from an asset allocation perspective, it makes sense for well diversified portfolios to introduce some exposure to take advantage of depressed valuations, according to Fahad Hassan, chief investment officer at Albemarle Street Partners.

“Migrating to the safety of large-cap benchmarks is an all too common behaviour heading in to an economic slowdown and it is important to recognise the opportunity this creates. Having peaked in the autumn of 2021, smaller company indices in the US, Europe and UK have fallen by 30% to 45%,” he said.

“Depressed valuations are often a precursor to better future returns and our current work suggest that UK, European and US smaller companies should generate 3-4% better returns than their large cap equivalents over the next five years.”