More than half of the money in the IA Commodity/Natural Resources and IA Mixed Investment 40-85% Shares sectors is invested in funds that have made a top-quartile return in 2023 so far, research by Trustnet suggests.

Quartiles are one of the most common methods of determining a fund’s performance relative to its peers. Under this approach, funds are sorted into four equal buckets to show, loosely, those that have outperformed strongly, outperformed slightly, underperformed slightly and underperformed strongly.

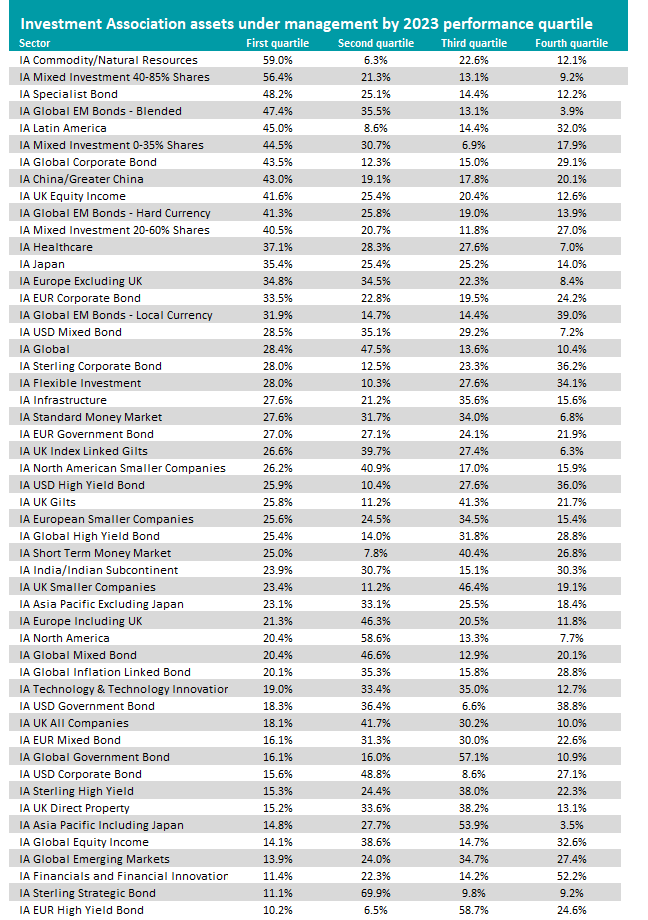

But in this research we have taken those quartile buckets and weighted them by their total assets under management to show in which sectors the most amount of money is being run by funds enjoying a first-quartile 2023.

This makes a subtle difference, as it aligns more closely (but not perfectly) with the experience of the average investor in a sector, rather than focusing on the outcome of the average fund.

If we look at the entire Investment Association universe, 26.8% of investors’ money is currently in funds that are top quartile this year, while 37.4% is in the second quartile. Some 19.8% of assets are in the third quartile and just 16% is in bottom-quartile funds.

When it comes to sectors, IA Commodity/Natural Resources is in first place, where 59% of its money in funds that are in the top quartile this year. Only 12.1% of the peer group’s assets are in fourth-quartile funds.

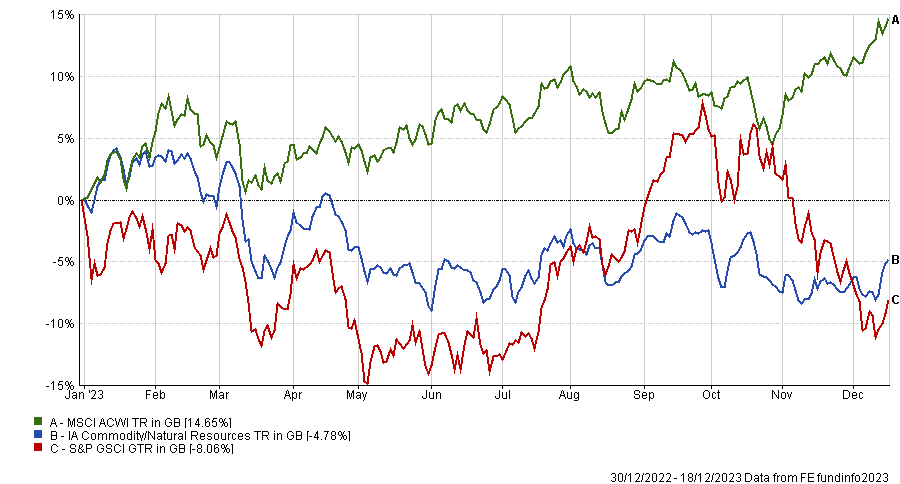

Performance of commodity funds, commodity prices and global equities over 2023

Source: FE Analytics

On the face of it, the sector has had a tough 2023. The average fund has lost 5.2% for the year to date after commodity prices fell; the S&P GSCI broad commodity index is down 8% this year.

However, this article is about looking beyond the performance of the average fund. Among the eight IA Commodity/Natural Resources funds in the top quartile for 2023 so far are some of the sector’s biggest members and six have made a positive return.

The £4bn Pictet Clean Energy Transition fund, for example, is the peer group’s best fund this year with a total return of 19.9% while accounting for 13.6% of the sector’s assets. The £7bn Pictet Water fund is in second place after making 8.6%; it runs 23.9% of the sector’s money.

Pictet Timber, iShares Global Water UCITS ETF, iShares Global Timber & Forestry UCITS ETF and Xtrackers MSCI World Materials UCITS ETF are also in the IA Commodity/Natural Resources sector’s top quartile and have made a positive return.

BlackRock BGF World Energy and Xtrackers MSCI World Energy UCITS ETF, however, have made a loss this year but ones that are small enough to keep them in the first quartile.

All of the Investment Association’s fund sectors can be found in the table below, along with the percentage of each’s assets broken down by quartile for the year to date.

Source: FE Analytics

IA Mixed Investment 40-85% Shares comes in second place with 56.4% of its assets being managed by top-quartile funds.

The average fund has made 6.7% this year, but its top quartile includes the likes of the £14bn Vanguard LifeStrategy 60% Equity fund (running 14.4% of the sector’s assets and returning 8.8% this year) and £10bn Vanguard LifeStrategy 80% Equity fund (running 10.1% of assets with a 10.3% total return).

Other large funds in the first quartile include Royal London Sustainable World Trust, BlackRock Consensus 85, Liontrust Sustainable Future Managed and HL Multi Manager Balanced Managed.

In the IA Global sector – the largest Investment Association sector – things are a bit closer to the line with 28.4% of its assets in funds generating a first-quartile return this year.

These include the £12.9bn Vanguard Global Stock Index fund, the £9.9bn Xtrackers MSCI World UCITS ETF, the £3.8bn Royal London Global Equity Diversified fund and the £3.6bn Rathbone Global Opportunities fund.

Investors in the IA Technology & Technology Innovation sector – which is leading the performance tables this year – have been less lucky, however, as just 19% of the peer group’s money is in top-quartile funds.

These include L&G Global Technology Index Trust, T. Rowe Price Global Technology Equity and iShares S&P 500 Information Technology Sector UCITS ETF.

The bulk of the sector’s money is in the second quartile (33.4%) or the third quartile (35%) with just 12.7% of assets under management in bottom quartile funds.