Veteran stockpicker Peter Saacke is to step down from running the Artemis SmartGARP global equity funds at the end of June to pursue a career as a maths teacher, the firm announced today.

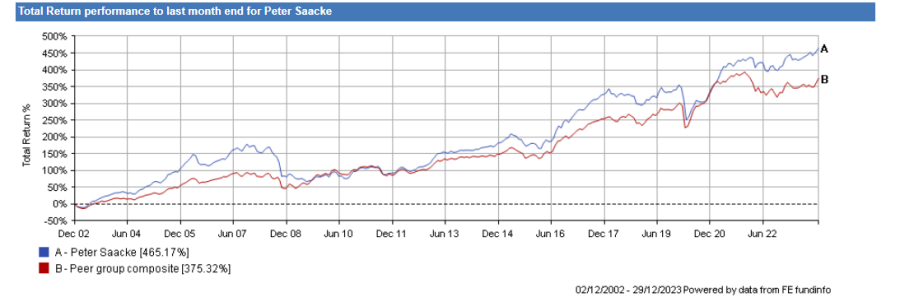

Saacke, formerly a university teacher, will return to his former career after more than 25 years in finance. Data from FE Analytics going back to 2002 – when Saacke was first named as a manager on the Artemis SmartGARP European Equity – shows that he has been a proven winner for investors.

Over his career he has returned 465.2% across his portfolios, while a comparable peer group composite has made 375.3%.

Source: FE Analytics

During his tenure the SmartGARP strategy, which buys companies that can grow, but refuses to overpay (GARP stands for growth at a reasonable price), it has increased assets under management to around £1bn.

He is to be replaced as lead manager on the £497m Artemis SmartGARP Global Equity fund by co-manager Raheel Altaf, who joined the team in 2014 and was made co-manager in 2022.

The £172m Artemis SmartGARP European Equity fund meanwhile will continue to be managed by co-manager Philip Wolstencroft, who has headed the fund since its launch in 2001.

Saacke said: “I benefited from receiving a free university education in the UK, and – like many of my peers in our industry – I have been a beneficiary of trends that led to rising inequality in our society. In my eyes, the best way to combat inequality is via education, so I am hoping to make a small contribution and give a little bit back.

“I hope that once I have found my feet as a maths teacher I can also introduce courses in financial literacy for mathematicians and non-mathematicians alike and bridge the gap between the ‘real’ world and the world I have had the privilege of being part of during the past 25 years.”