It can be challenging for new funds to make a name for themselves. This is especially true in the IA Global sector where they have to compete against around 560 rival strategies, with many having a longer track record and enjoying a good reputation among investors.

While difficult, it is not insurmountable, as some ‘young’ funds investing in global equities have already caught investors’ eyes, thanks to impressive early performance.

Below, Trustnet looks at the 12 funds launched in 2020 that sit in the top quartile of the IA Global sector in terms of performance over three years.

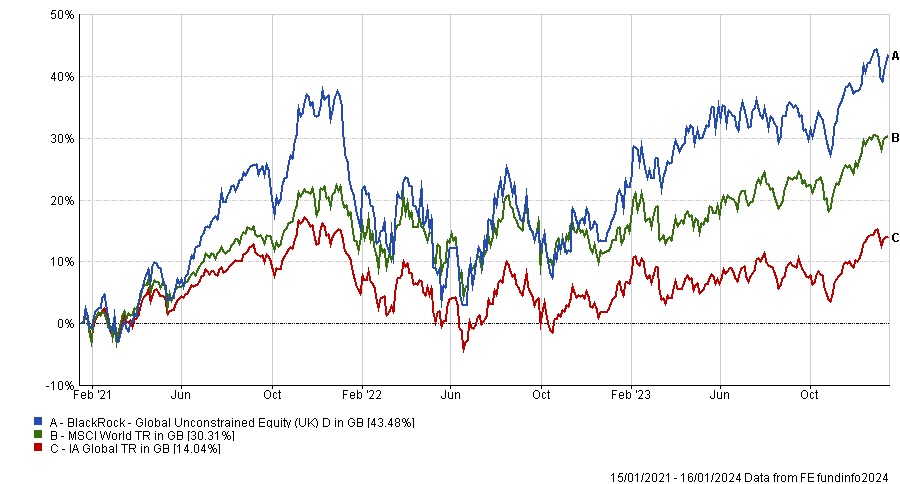

The best performing new fund reflecting our criteria is BlackRock Global Unconstrained Equity (UK), managed by FE fundinfo Alpha Manager Michael Constantis and Alister Hibbert. Over the past three years, it has returned 43.5% to investors.

Darius McDermott, managing director at FundCalibre, said: “BlackRock Global Unconstrained Equity (UK) is a concentrated, high-conviction fund, targeting extraordinary companies across developed markets. It takes a long-term approach which filters out short-term noise in the marketplace.

“Although relatively new, it is backed by some of the most experienced and top-performing equity managers of the past decade. Alistair Hibbert and Michael Constantis have delivered exceptional performance for investors throughout their careers, and we have no hesitation in backing them on this fund.”

Performance of fund over 3yrs vs sector and benchmark

Source: FE Analytics

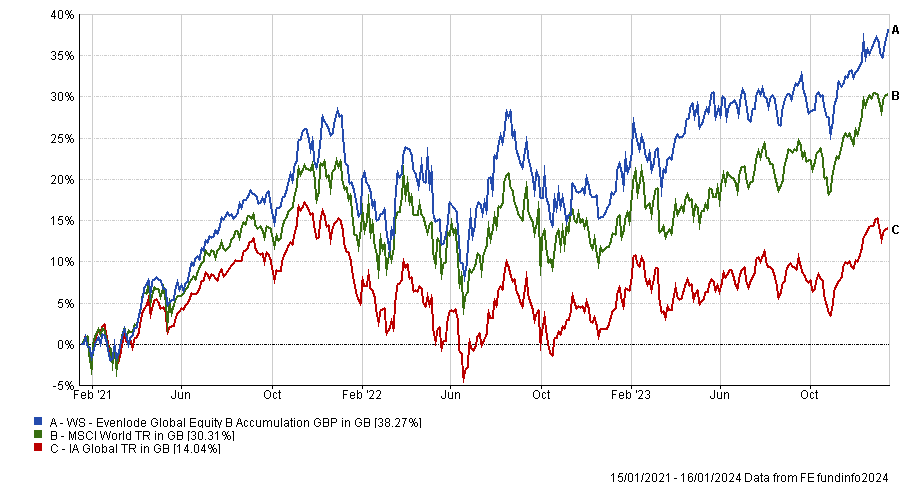

Another young top performer with a quality-growth approach has been WS Evenlode Global Equity, managed by FE fundinfo Alpha Manager Chris Elliott and James Knoedler.

Their primary focus is on quality companies that can achieve sustainable growth over time with minimal capital reinvestment. Such companies typically possess intangible assets that create high barriers to entry, offer products and services valued beyond price, operate in growing markets and proactively reinvest in their core competitive advantage.

McDermott said: “In essence, Evenlode's investment approach revolves around identifying market-leading companies with high cashflow returns on capital, manageable business risks and limited financial leverage.

“The aim is to generate returns through the growth of fundamental value over time, driven by the favourable economics of the underlying business and organic compounding of free cash flow.”

Costwolds-based Evenlode Investment also manages older strategies WS Evenlode Income and WS Evenlode Global Income. Simon Evan-Cook, fund manager at Downing, explained that WS Evenlode Global Equity shares some similarities with its elders, even though it is not an income strategy.

He added: “Having launched the boutique soon after the financial crisis, they have grown their team and process in a sustainable way that should serve as a blueprint for other aspiring boutique managers.

“They are quality-growth fund investors, and this fund is no different. Their heritage as dividend investors gives them a natural sensitivity to valuation considerations, although this particular fund has no dividend requirement. This process, as well as good execution, has helped them to excel in growth-friendly markets, while hold their own in periods when their style has been out of favour.”

Performance of fund over 3yrs vs sector and benchmark

Source: FE Analytics

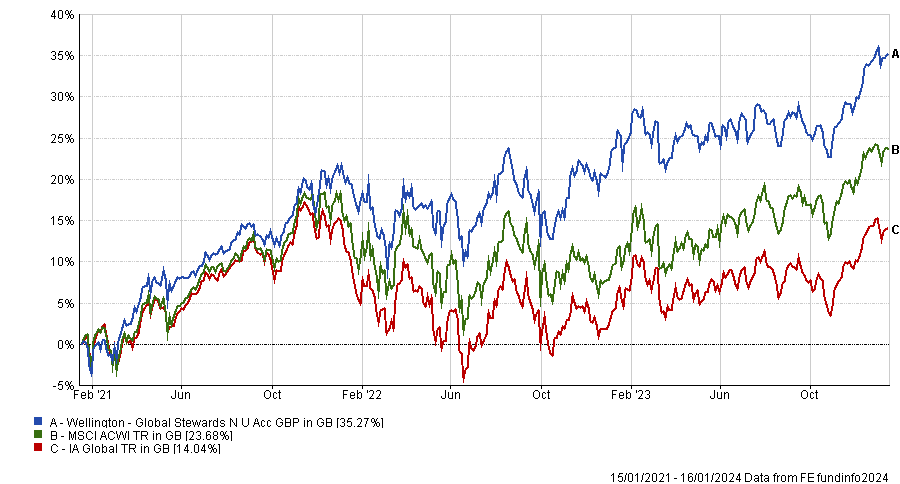

Wellington Global Stewards has also done well over the same period. Managers Yolanda Courtines and Mark Mandel focus on high-quality businesses too, but apply an ethically sustainable filter in their investment process.

Evan-Cook noted, however, that the fund has a “very slight” bias to the value style of investing, as Courtines and Mandel invest in the most attractively valued companies that make it through their research process.

He added: “While it’s technically a new fund, this company and its philosophy is anything but new (Wellington was established in 1928). These are the kind of details that are missed if your fund selection process relies blindly on screens and data.”

Performance of fund over 3yrs vs sector and benchmark

Source: FE Analytics

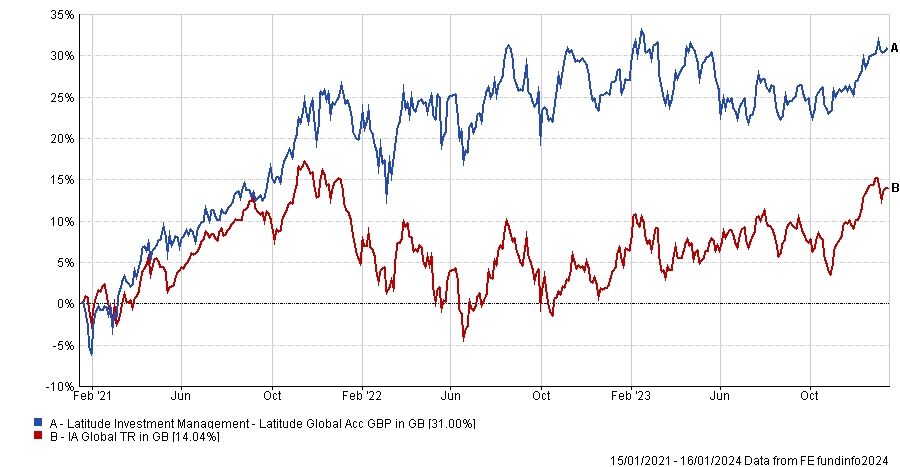

Another young global fund blending value and quality growth factors is Latitude Global Equity, managed by Freddie Lait.

Evan-Cook explained that Lait and his team look for high-quality companies, but have a contrarian streak that pushes them towards companies trading on more attractive valuations.

He added: “The benefits of this type of approach, if you can pull it off, are demonstrated well by their track record, as they were able to perform well in 2022 while some other global quality-oriented funds were dragged through the mire.”

Performance of fund over 3yrs vs sector

Source: FE Analytics

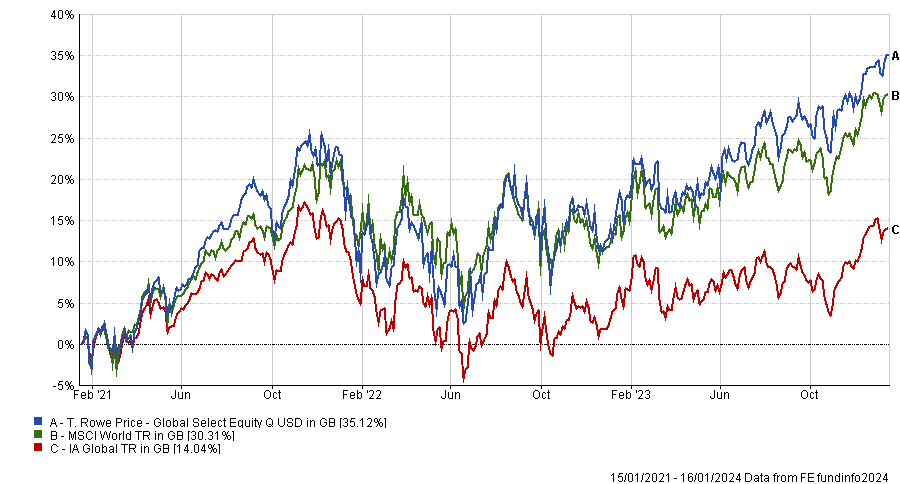

Unlike the previous funds, T. Rowe Price Global Select Equity focuses more on mid- and large-caps rather than mega- and large-caps. The companies in this fund tend to harness secular and cyclical themes, disruptive innovation or are turnarounds.

McDermott said: “This is a more concentrated strategy that occupies the middle ground between T. Rowe’s growing impressive stable of global growth and value funds - and seeks to offer investors consistent returns in any environment.

“Performance has been noteworthy versus the benchmark over the past three years. We view this fund run by Peter Bates as one to watch and could potentially complement a global strategy.”

Performance of fund over 3yrs vs sector

Source: FE Analytics

A range of passive funds also had a good run over the past three years, with the best performing being SPDR MSCI World Value UCITS ETF. This exchange-traded fund (ETF) tracks the MSCI World Value index, which is constructed along three variables: book value to price, 12-month forward earnings to price and dividend yield.

This style of investment came back in favour in 2022 after a long period of lethargy in the 2010s. Kevin DiCiurcio, senior investment strategist at Vanguard, forecasted in 2021 that value would outperform growth over the next 10 years in the US, but Keith Ashworth-Lord, manager of CFP SDL UK Buffettology believes that this style rotation was just a “little blip” and that investors should not switch to value in their portfolios.

The growth style bounced back in 2023, while value lagged after its outperformance in 2022, but it is not an indication that this dynamic will continue in 2024 and beyond.

Source: FE Analytics

Three passive funds with an environmental, social and governance (ESG) bias also made strong performance over the same period. The funds in question are Amundi MSCI World ESG Universal Select, JPM Carbon Transition Global Equity (CTB) ETF and Amundi MSCI World Climate Paris Aligned Pab.

Those three funds hit a rough patch in 2022 when value, a style often associated with oil, energy and tobacco, led the market. Yet, good performance resumed in 2023.