Investors buying an active fund are betting on a manager’s ability to provide returns in excess of a benchmark.

To outperform an index, the best approach is arguably to build a significantly different portfolio, although it also comes with the risk of considerable underperformance if the manager’s stock selection does not work.

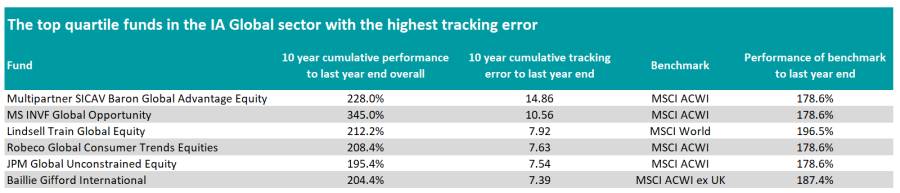

Below, Trustnet researches the funds in the IA Global sector that have delivered the best returns over the past 10 years (to year-end 2023) without hugging their benchmark.

To do so, we have selected the global equity funds that made top quartile returns but sit in the bottom quartile in terms of tracking error (meaning that they deviate the most from their benchmark.)

Most of the funds matching our criteria have a bias towards growth, the investment style that has been in favour over the past decade.

Source: FE Analytics

For instance, Multipartner SICAV Baron Global Advantage Equity, which is the top quartile global fund that deviated the most from its benchmark, has an explicit mandate of looking for growth companies of all sizes around the world.

Over the past 10 years, the fund managed by Alex Umansky returned 228% with a tracking error of 14.86.

As of 31 December 2023, only three of the fund’s top 10 holdings were also part of the 10 largest constituents of its benchmark, the MSCI All Country World Index: Nvidia, Amazon and Tesla.

In addition to the three US mega-caps, MercadoLibre, Coupang and Shopify feature among the fund’s largest positions.

MS INVF Global Opportunity, managed by FE fundinfo Alpha Manager Kristian Heugh, provided the highest return of the funds in our list. It delivered an impressive 345% in the past decade and had a tracking error of 10.56.

The fund’s objective is to deliver capital appreciation by investing globally in high quality companies that the manager deems to be undervalued at the time of purchase.

The top five holdings include Uber Technologies, ServiceNow, MercadoLibre, Shopify and HDFC Bank, with none being a top 10 constituent of the MSCI ACWI.

Another growth fund that made the cut is Lindsell Train Global Equity, which rose 228% in the period measured, with a tracking error of 7.92.

Manager Michael Lindsell and FE fundinfo Alpha Managers Nick Train and James Bullock look for companies with excellent cash generation, free cash flow and inefficient valuations, without paying much heed to the index. As such, the portfolio looks very different from its benchmark.

Analysts at Rayner Spencer Mills Research (RSMR) said: “The strict quality criteria tends to focus on a small number of areas, including consumer franchises, media /software/internet, healthcare and long-standing domestic brands.

“Accordingly, the fund has sector overweights to consumer defensives, healthcare and IT. These come at the cost of areas of the market that the quality criteria tend to prohibit.”

Baillie Gifford International, managed by Malcolm MacColl, Spencer Adair and FE fundinfo Alpha Manager Helen Xiong, also matched our criteria. Over the past decade, the fund has returned 204.4% and it has a tracking error of 7.39 relative to the MSCI ACWI ex UK.

The fund looks for well-managed companies benefiting from sustainable competitive advantages and whose shares have the potential to at least double over a five-year investment period.

Analysts at RSMR said: “There is an open-minded approach to growth, recognising that companies grow at different rates and at different times. Stocks are categorised into one of three profiles: Disrupters, Compounders and Capital Allocators.”

They also noted that Baillie Gifford International differs from its stablemates, as it takes a more nuanced approach to growth, with the managers prepared to invest in more cyclical parts of the market.

The analysts added: “Whilst it still has a bias to growth, the fund looks outside of disruptive names and invests across a larger number of sectors.

“The fund aims to capture the best growth opportunities across different sectors and industries as long as a company is growing across economic cycles, and to fully utilise the vast network of investors at Baillie Gifford through its scout system.” (Baillie Gifford refers to its analysts as scouts.)

Other top quartile funds with a high tracking error include Robeco Global Consumer Trends Equities and JPM Global Unconstrained Equity.

Moreover, GAM Star Disruptive Growth was also a top quartile performer over 10 years in the IA Global sector that sits in the bottom quartile in terms of tracking error. However, the fund has failed to beat its benchmark, the MSCI World Growth.