UK shares should return at least 10% this year, according to Jupiter fund managers Adrian Gosden and Chris Morrison, managers of the GAM UK Equity Income fund (soon to be Jupiter UK Multi-Cap Income).

The much-maligned domestic market could finally come through an inflection point during 2024, allowing it to enjoy the type of turnaround seen in Japan, which has rebounded strongly in recent years and attracted the interest of high profile investors such as Warren Buffett.

Share buybacks will play a big part in the UK’s turnaround story. Before 2020, companies bought around £10bn-£20bn of their own shares back per year, but this rocketed in 2020 to close to £60bn, the managers said. In 2023 companies invested around £50bn in themselves and this year Gosden and Morrison expect the figure to be slightly higher.

“The market capitalisation of the FTSE 100 is around £2trn. That works out around 2.5% coming back to shareholders just from buybacks,” said Morrison.

At a stock level it can be even starker. Take oil giant BP for example, which has announced through buybacks and dividends it will return $12bn over the next two years, roughly 15% of its market capitalisation.

“Barclays has said it is returning £10bn over the next three years in the form of dividends and buybacks combined. That is 40% of its current market capitalisation,” Morrison noted.

It is not just large-caps doing this, he added. C&C, which makes Magners and Bulmers cider, is returning €150m through buybacks and dividends over three years – more than 20% of its market capitalisation.

Last week Funding Circle, a £100m company lending to small and medium-sized enterprises, announced it would buy back £25m worth of shares. The stock price rose more than 50% on the day.

Combining this with dividends, which are expected to be around £80bn, this adds another 4% return to investors this year.

“So the dividend and buybacks comes to around 6%, which is a very healthy starting point,” Morrison said.

Gosden added that, with share price improvements, this should equate to a total return of around 10% this year, higher than the 8% long-run average for the UK stock market.

“Using the cash output from the companies you would expect a stronger return than average,” he said.

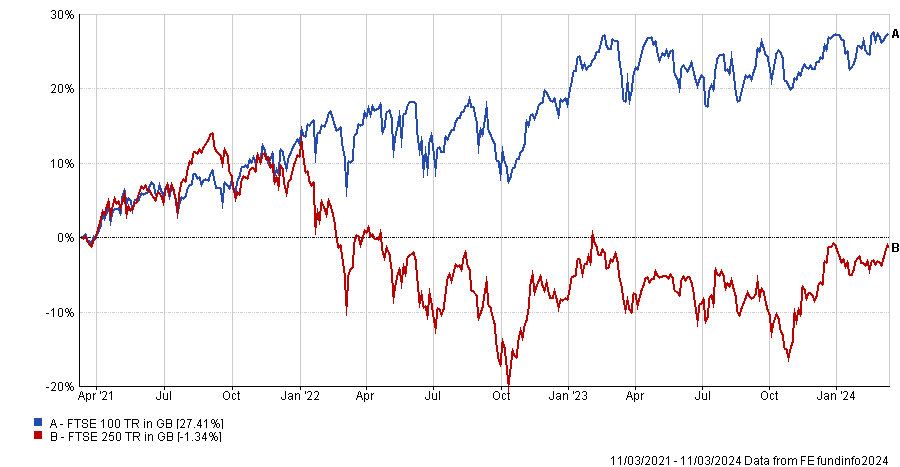

Yet there could be even bigger gains to be made in some areas of the UK market, such as mid-caps, which have underperformed their large-cap rivals by almost 30 percentage points over the past three years, as the below chart shows.

Performance of indices over 3yrs

Source: FE Analytics

The catalyst for change will be inflation, Gosden predicted. “In November US CPI was 0.1% less than people thought and UK mid-caps went up 3% that afternoon. If you were in the pub you missed it. In December, UK CPI was less aggressive and the mid-cap market went up 2% that afternoon. So that’s 5% on two CPI prints,” he said.

“In January UK CPI came in at 4%, not 3.9% as we had all hoped, and it went down 2%. The UK is super sensitive to this. We think inflation will hit 2% this summer. We are currently at 4%. That will help the UK market.”

The second catalyst will be the aforementioned share buybacks – and in particular how they will affect pension funds.

Gosden said for the past 20 years pension funds have been selling their UK stocks because “they were told to by consultants who said they needed to immunise their portfolios and didn’t need the volatility”.

Outflows from UK pension funds have totalled around £400bn over the past 20 years, he said, highlighting the BAE Systems pension fund, which once had £6bn in UK equities, but now has less than £500m, as an example of this.

Meanwhile, companies themselves recognise how attractively valued their shares look and are keen to buy back more, but they will need to buy those shares from someone, and Gosden can imagine a situation in the not too distant future when pension funds have no UK shares left to sell.

“UK companies are coming this year with a third tranche of £50bn purchases and we believe there will be an inflection point. There won’t be any [shares owned by pension funds] left, so they will come to us – and we are different. We will say ‘you can’t have it’,” Gosden noted.

“This is just maths. It has been selling every day for 20 years and now the sellers don’t have much left. We think this will cause an inflection point in the UK market.”