Going against the grain is no easy feat – especially when it involves being underweight the US – but IBOSS chief investment officer Chris Metcalfe believes it is the right choice, arguing that too many managers are concerned about “career risk”.

His fund range has taken some extremely counter-consensus positions, including around half the weighting to American companies as his peers.

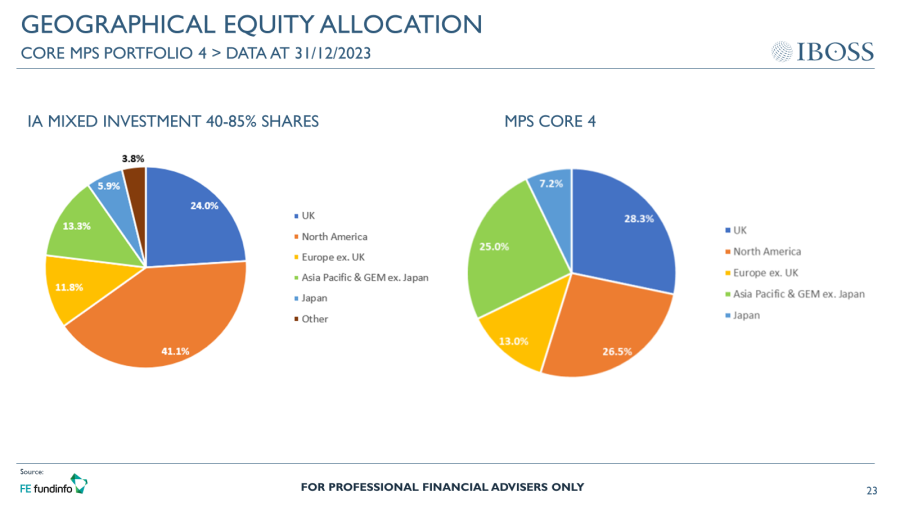

His Core MPS Portfolio 4, for example, has around 26% of its equity portion invested in in American stocks, while the average fund in the IA Mixed Investment 40-85% Shares sector has around 41.1% of its stock allocation to the US market.

Source: IBOSS

“I would rather have difficult conversations. We have a duty to clients to not chase markets up. Our duty is to the client not to the benchmark,” he said.

“I think we are still right to not have a 40-50% weighting to one country – I don’t care which one it is,” he added, noting that no country is infallible.

Metcalfe said even America has had periods where it has struggled. This was the case in the decade from 2000 to 2010 when the US market “went nowhere” – something he described as the “lost decade” for these stocks. During this time the S&P 500 lost 14.1%, although the period includes both the tech bubble and the financial crisis.

Another area he sees a clear sign of career risk is in the bond space. For much of the past decade his model portfolios have used passives, but he has been adding active managers in recent years.

Previously, with low interest rates and little inflation, active managers were unable to add much alpha and had few tools to work with.

“We think there is a real opportunity for the strategic bond managers and corporate bond managers to harvest volatility. Now they have credit quality and duration to play with so they have a full toolkit,” he said.

This worked well during the bond rout towards the end of last year, when the IBOSS’ low-risk portfolios in particular did well.

However he admitted to being “frustrated” with some of the strategic bond managers who “didn’t go as short duration as they could have done” before interest rates started to climb two years ago.

“Again that comes to career risk. When the bond market started selling off they were still buying 10-year treasury yielding 0.5% because everybody was,” he said.

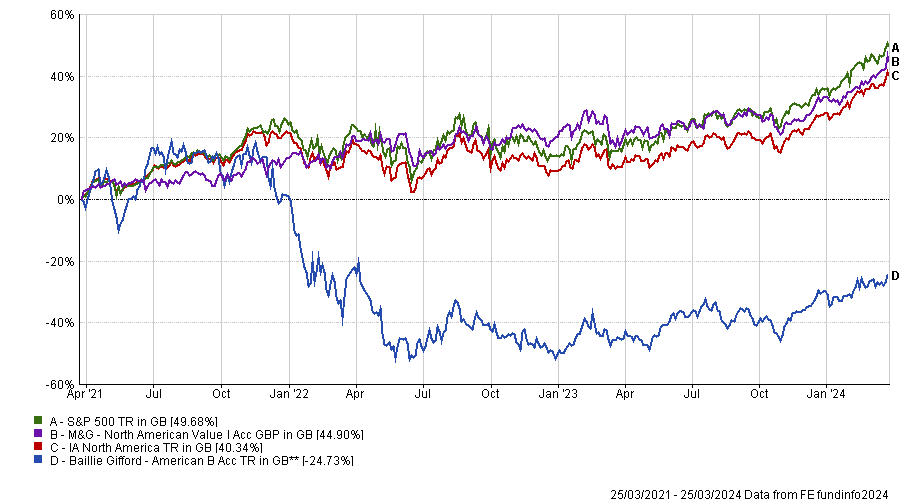

Some of Metcalfe’s positions have caused him to field difficult questions from clients. One such call was not owning Baillie Gifford American when the fund was flying – but he said calls for the fund to be added to the portfolio have gone silent since its drop in recent years.

“We have thousands of clients so get a lot of feedback, which is nearly always pointing out what we got wrong. For quite a few years it was why are we not invested in Baillie Gifford American. Those emails stopped but we didn’t get any saying ‘thank goodness you didn’t invest because its down 40%’,” he noted.

Instead, three years ago he bought M&G North American Value, which at the time sat in the 75th percentile of the IA North America sector.

Performance of funds vs sector and benchmark over 3yrs

Source: FE Analytics

“There were a lot of raised eyebrows at the time. It would have been easier to just increase the S&P 500 index tracker. To us it looked to be full of opportunity and since we brought the fund in it has been third percentile in the US,” he said.

Another contrarian position is to UK mid and small-caps, where the fund has a relative overweight position through funds such as Fidelity UK Smaller Companies, WS Gresham House Multi Cap Income and Polar Capital UK Value Opportunities.

Metcalfe said the UK is “second to China in needing some better PR” to attract investors back, noting that it has been a hard sell since Brexit.

“Even if we get good data, by the time it gets to the front pages it is generally negative again,” he said.

Performance of indices over 3yrs

Source: FE Analytics

Yet this is where the opportunity lies. “The above chart of the FTSE 250 versus the FTSE 100 shows how much the UK has come off. It is pretty well positioned in both relative and absolute return terms,” Metcalfe concluded.