Chinese equities recovered from their doldrums and soared to the top of the charts in April, but experts are wondering whether this is merely a “dead cat bounce”.

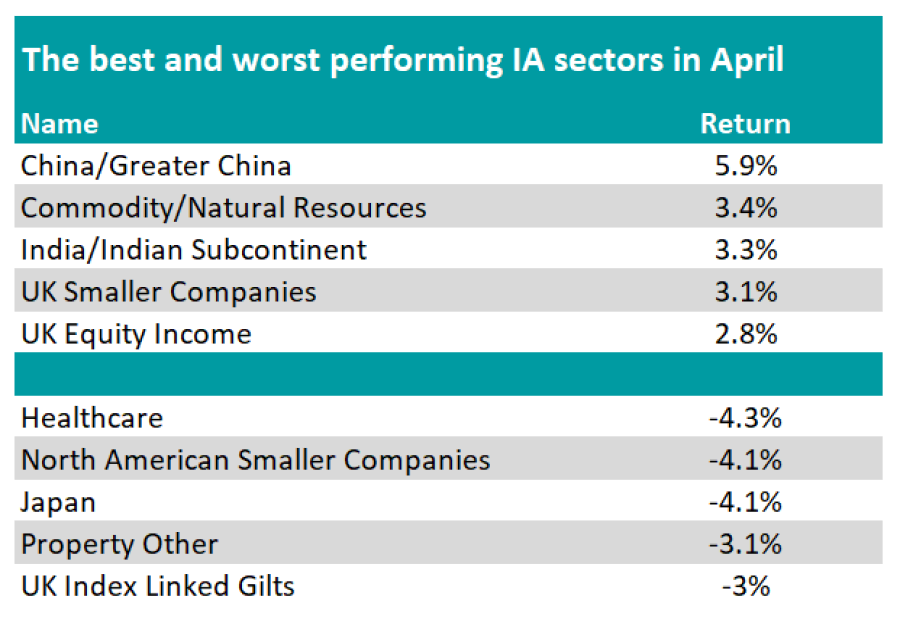

IA China/Greater China was the best performing sector in April, with the average fund gaining 5.9%.

It is the second time this year, following February, that the sector has claimed the top spot. However, the main reason for this outperformance appears to be the market's cheapness, with Chinese equities trading at nearly 20-year lows.

Ben Yearsley, director at Fairview Investing, posed the question: “Is this a dead cat bounce or are investors starting to see real value in China?”

India – China’s main rival in the emerging markets – also had a robust month. The IA India/Indian Subcontinent sector ranked as the third best performer in April, with the average fund returning 3.3%.

Although its two poster children outshone other markets, the IA Global Emerging Markets sector only returned 1.4% last month, making it the seventh best-performing sector.

Source: FE Analytics

The UK, another unloved and cheap market, also had a strong run in April, with the FTSE 100 hitting an all-time high. As a result, IA UK Smaller Companies, IA UK Equity Income and IA UK All Companies all feature among last month’s six best-performing sectors.

Yearsley said: “BHP’s bid for Anglo American plus other decent results and continued buybacks are propelling one of the most unloved markets higher. Interestingly, some fund managers don’t think the UK market has reacted yet to £50bn a year of share buybacks as it’s pension funds that have been selling to fund the purchases.

“Now they’ve almost run out of UK equities, where will companies get their shares from to repurchase? Will this finally ignite the market?”

At the foot of the table, IA Healthcare was April’s worst-performing sector, followed by IA North American Smaller Companies and IA Japan, which was impacted by the weak yen.

“The Bank of Japan disappointed markets with no further action to either support their currency or up rates. Consequently, the yen was again the weakest of the major currencies falling 3.03% against sterling,” Yearsley said.

Source: FE Analytics

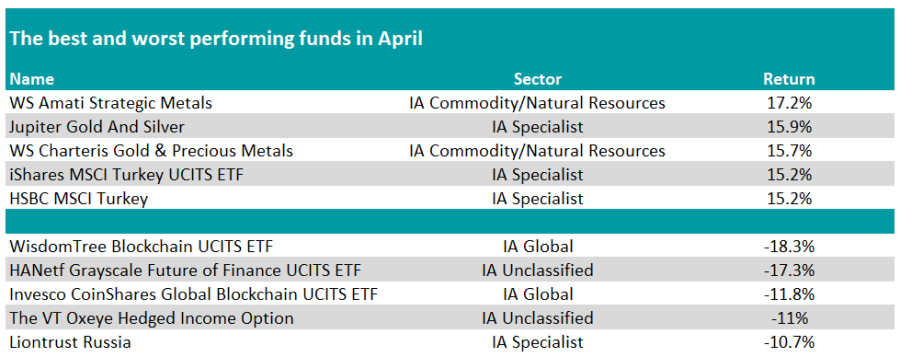

At the fund level, funds specialising in precious metals once again claimed the top spots, mirroring their performance from last month.

WS Amati Strategic Metals led the pack with the highest return at 17.2%. It was closely followed by Jupiter Gold And Silver and WS Charteris Gold & Precious Metals, the latter maintaining its position at the top of the table for a second consecutive month.

Yearsley said: “Gold hitting an all-time high has finally had an impact on gold equities as well as other related areas. Silver has been on a tear as well.

“Also, in the broader commodity space, copper is responding to a shortage in supply and an increase in demand due to decarbonisation and electrification. The price of copper rose about 15% in April.”

Passive funds tracking the MSCI Turkey index also had a strong month.

There was no discernible trend at the bottom of the table. WisdomTree Blockchain UCITS ETF was the worst-performing fund, as it fell 18.3%, while The VT Oxeye Hedged Income Option made its second appearance in a row among the laggards.

“It’s a fund that has featured regularly at both top and bottom of the tables,” Yearsley said.

Source: FE Analytics

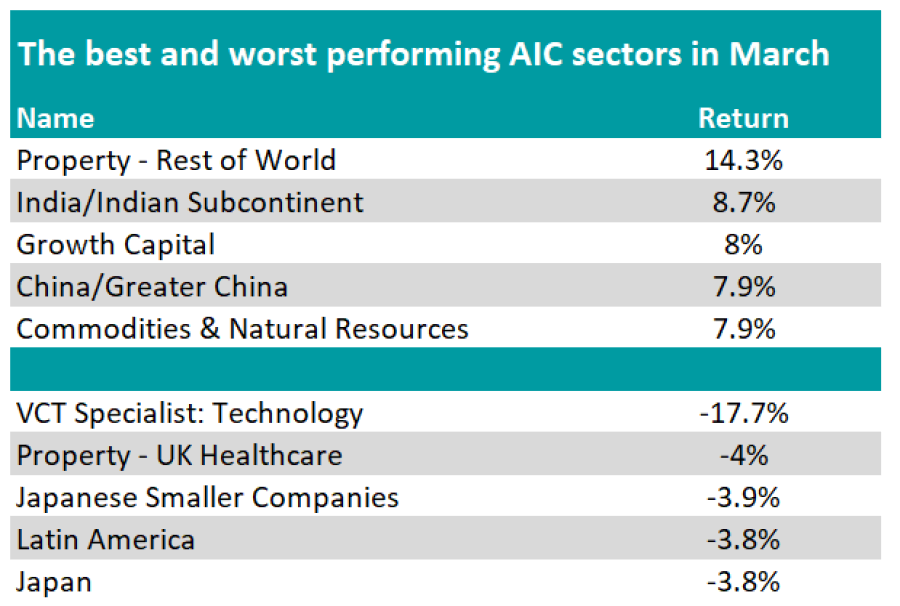

In the world of investment trusts, the IT Property – Rest of World sector claimed the top spot, followed by the IT India/Indian Subcontinent and IT Growth Capital sectors.

Meanwhile, at the bottom of the pile, we find IT VCT Specialist: Technology, IT Property – UK Healthcare, and IT Japanese Smaller Companies.

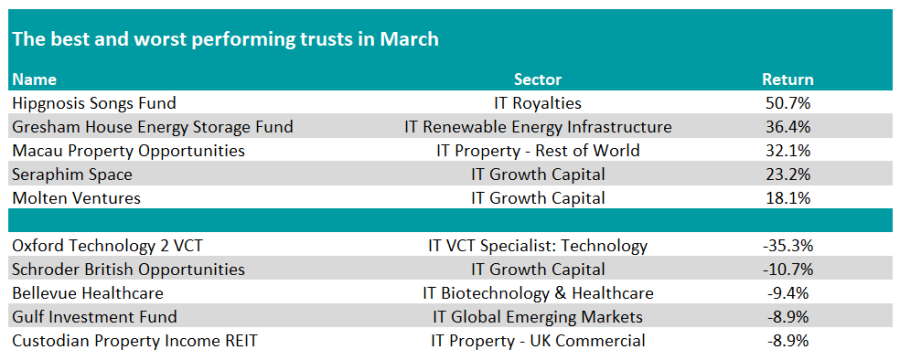

Looking at individual funds, Hipgnosis Songs Fund took the crown, after returning 50.7% in a single month. The music royalties trust has been at the centre of a bidding war, culminating in Blackstone agreeing on 29 April 2024 to acquire it for roughly $1.6bn.

Yearsley said: “Hipgnosis is finally being put out of its misery with bid and counterbid propelling it to the summit last month with a gain of 50%. Obviously, context is everything and it only means it’s a few pennies above the IPO price. Such is the ignominy it has had over the last year or so. The whole episode does leave an unpleasant taste for many.”

Source: FE Analytics

Other top performers in April include Gresham House Energy Storage Fund, Macau Property Opportunities, Seraphim Space and Molten Ventures.

Conversely, Oxford Technology 2 VCT, Schroder British Opportunities, Bellevue Healthcare, Gulf Investment Fund and Custodian Property Income REIT were the worst performing investment trusts.