The UK equity market hit fresh highs this week and, while no-one wants to get in at the top of any market, there are many reasons to believe that this rally might only just be getting started.

With the benefit of hindsight, we would all have boosted our domestic equity holdings months ago, but some investment professionals think now still seems like a relatively opportune moment to get in on the action.

While many catalysts have converged to produce the recent rally (including an improvement in economic data, imminent rate cuts and voracious share buybacks) there are plenty more irons in the fire yet to make an impact.

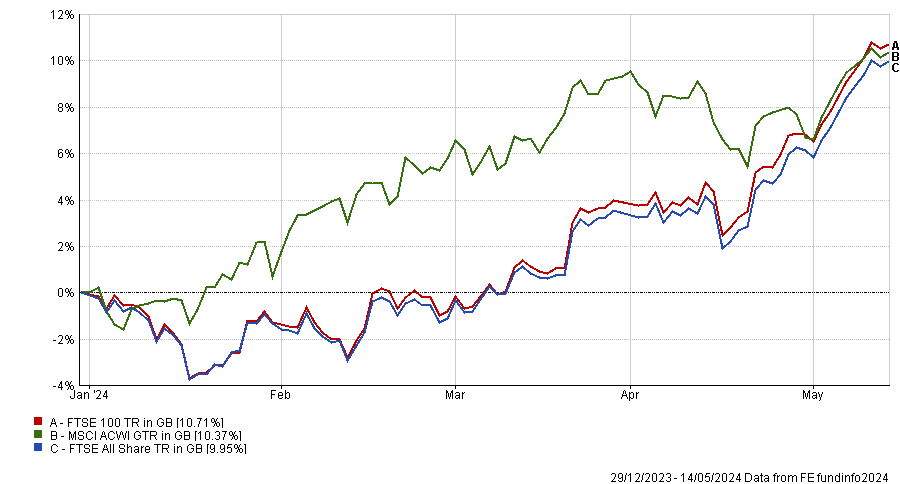

FTSE 100 and FTSE All Share vs MSCI ACWI, year-to-date

Source: FE Analytics

One factor that could really move the dial would be inflows.

As Artemis Income’s Nick Shenton pointed out, the UK stock market has “been making all-time highs on a total return basis for a while [but] it’s not doing so from an extended position where it’s widely owned or the shares don’t [offer] value. We think it bodes quite well that it’s starting to make all-time highs without the aid of international investors coming back to the UK market, or even domestic investors”.

Meanwhile, private investors continue to pull money out of UK equity funds, channelling it instead into passively-managed global and US equity funds. Asset managers are bullish about the prospects for US large-cap stocks and European equities but not the poor old UK. Even wealth managers such as Coutts are turning their back on the UK – at precisely the wrong time, in my view.

The UK government is doing its best to stem the tide of outflows, launching the British ISA which is not expected to move the needle massively, but is a step in the right direction. It proves there is political will to take action to support the stock market, which is why Man Group’s Henry Dixon called the British ISA announcement in the spring Budget “a faint line in the sand moment”.

Jack Barrat, who co-manages Man GLG Undervalued Assets with Dixon, said the chancellor’s call for UK pension funds to disclose their allocations to domestic equities should give the stock market more “sunlight” and “greater attention”.

If the government were to go one step further and abolish stamp duty, that could encourage investors back into the stock market.

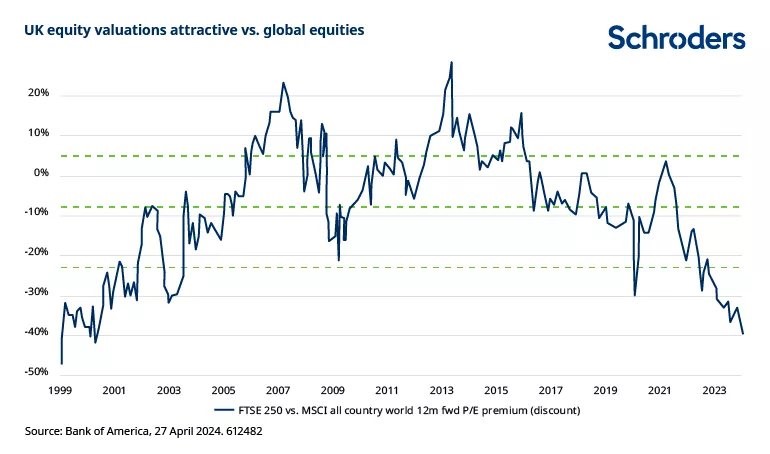

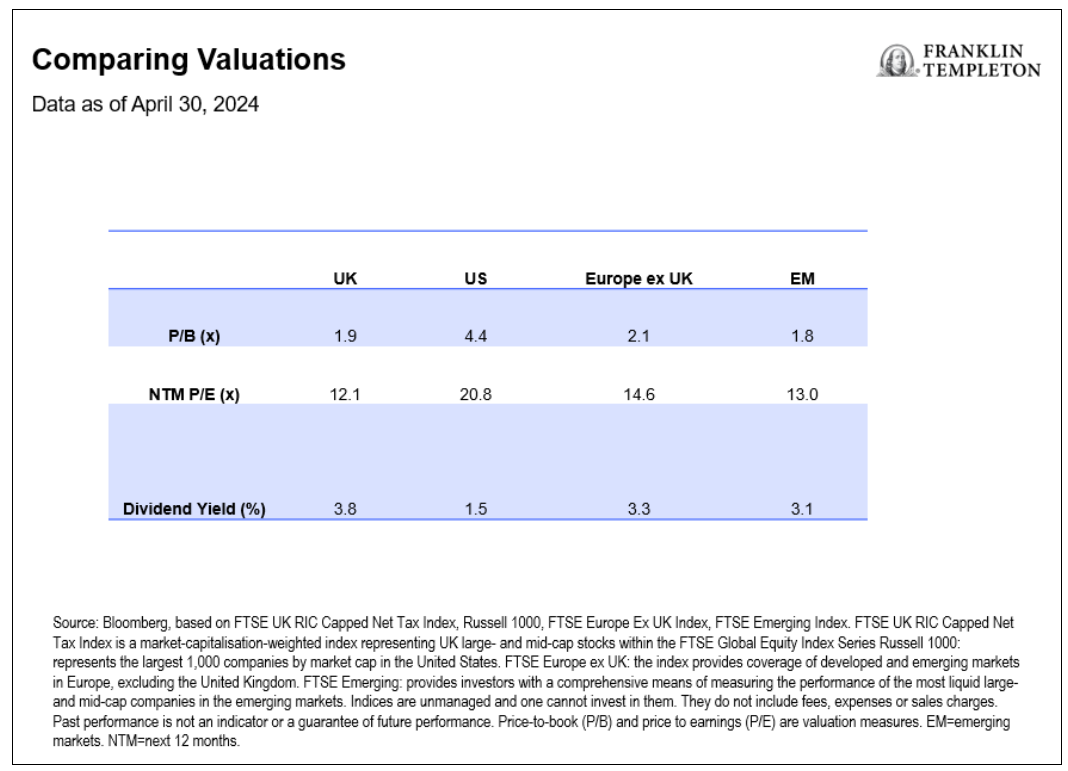

Valuations remain attractive despite this year’s gains, as the chart below shows.

Marcus Weyerer, senior ETF investment strategist, EMEA at Franklin Templeton, said: “With a price-to-book ratio of less than 2.0, UK equities are currently trading at a discount of more than 50% compared to US equities. Additionally, in terms of forward price-to-earnings, they are closely aligned with emerging market levels. Furthermore, the UK has long been considered a haven for income investors, and it currently boasts a dividend yield of 3.8%.”

Cheap valuations in a cheap currency have sparked a “frenzy” of merger and acquisition (M&A) activity, according to James Lowen, manager of JOHCM UK Equity Income. Five of his 60 holdings have been approached by bidders this year alone.

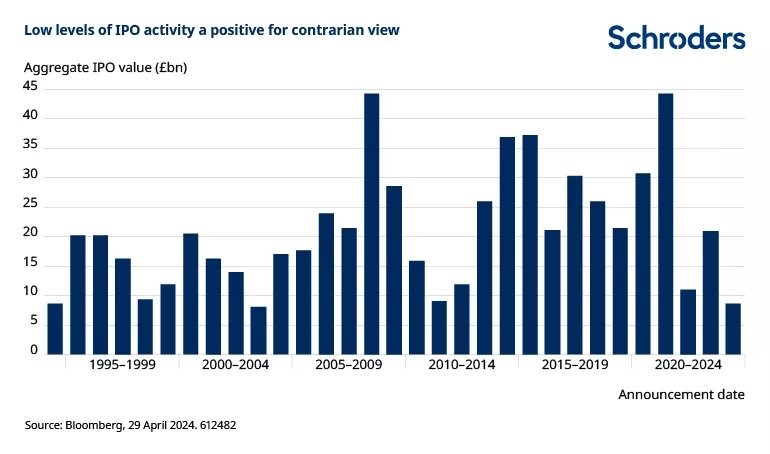

There has been a dearth of initial public offerings (IPOs) but if valuations were to surge, British companies might become more confident about going public here.

And if valuations better reflected what public companies are worth, management teams might be less eager to move their listings to the US.

A pickup in IPOs would create a virtuous circle, according to Graham Ashby, a UK all-cap fund manager at Schroders. “History clearly shows that increased UK IPO activity typically corresponds with a short-term peak in the equity market – witness the high levels of IPO activity in 2008 and 2021, compared with current depressed levels,” he said.

Meanwhile, companies themselves are cognisant of the value in their own cheap shares, so have been buying them back in droves. Buybacks – along with companies being taken out by foreign acquirers or moving their listings abroad – are gradually shrinking the size of the UK equity market.

Ashby observed that “less supply when demand may be set to increase” could eventually drive up prices. Quoting Warren Buffett’s maxim of being greedy when others are fearful, he concluded: “It may be time to get greedy.”

The overall cheapness of the UK market masks the fact that some of the UK’s largest stocks already appear expensive, Lowen warned. The seven “expensive defensives” (AstraZeneca, GSK, Diageo, Unilever, LSEG, British American Tobacco and RELX) look overvalued and comprise a fifth of the FTSE 100, which represents “a big danger lurking under the surface” for passive investors.

Other areas such as banks, insurers, miners and small-caps offer greater opportunities. That is why Lowen believes actively-managed strategies that can deviate away from the FTSE 100 index’s largest names would be a better way to play the UK recovery.

FE fundinfo head of editorial Gary Jackson set out to find the best performing active UK equity managers this week and found 21 funds that beat the mighty MSCI All Country World index over three years.

Five funds even outperformed the MSCI ACWI by more than 5% (Invesco UK Opportunities, BNY Mellon UK Income, UBS UK Equity Income, Invesco FTSE RAFI UK 100 UCITS ETF and Ninety One UK Special Situations).

This is no mean feat, dominated as the global index is by the US, which has outperformed the UK mightily.

If these fund managers can surpass global equities during a period where the UK has been a laggard, what might they be capable of at the helm of a more buoyant opportunity set?