Nothing excites value managers more than good businesses trading at cheap prices, with bottom-up stock selection being at the heart of the investment process of many value-focused investment funds.

But knowing where to look is not always easy. At present, the UK, Europe and South Korea seem to be going through a popularity crisis, with many experts interested in companies from these markets.

Below, we collected a sample of stocks that have recently been on value managers’ radars.

UK companies

Sarah Ketterer, chief executive officer and portfolio manager at US-based Causeway Capital Management, highlighted plane engine maker Rolls Royce, the top holding in the Causeway Defined Growth fund.

As flying hours dropped in 2020, the company’s cash flow turned negative, which had an impact on the balance sheet, but it was during this crisis period that Ketterer began to accumulate a lot more of the stock.

“The reason why we were so bold with it is because this company has a fantastic competitive position. It is effectively in a duopoly with GE Aerospace. When earnings collapsed, the stock looked like it was very high-multiple, but that's where the opportunity is the best,” she said.

“Yes, flying hours have improved because planes are back in the sky, but it's what the management team did to make the business more efficient that brought in results. It was never in a situation where it would go insolvent, it had businesses to sell and very valuable assets, so it was just a question of getting the balance sheet recapitalised and focusing on being more efficient”.

Source: Causeway

Also on the manager’s radar was Prudential, which she highlighted for the growth momentum in its Asian business, improving capital management and its valuation, as the stock is trading on 12-year low price-to-book and price-to-tangible-book ratios.

Emerging markets companies

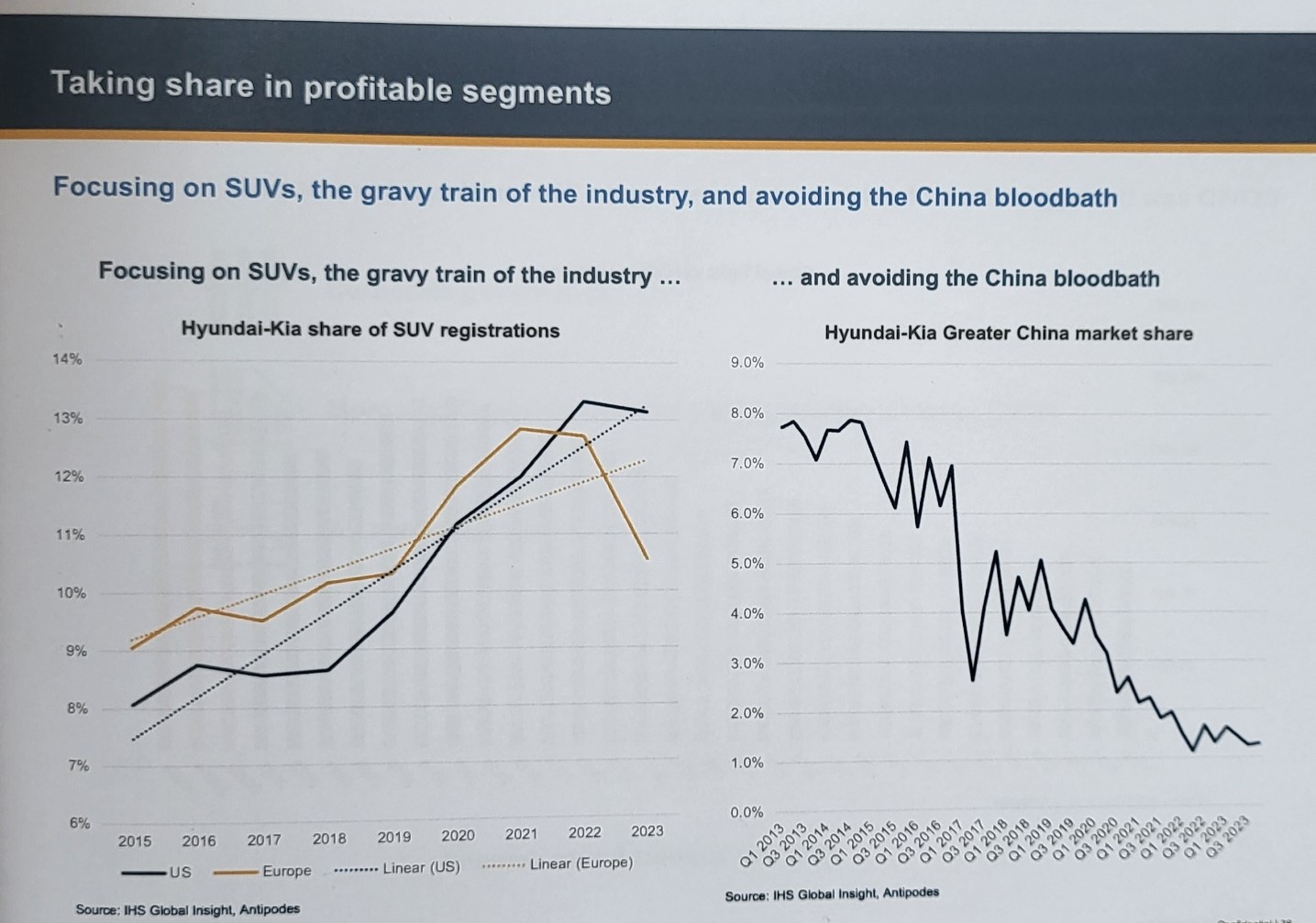

CIO and global portfolio manager at Antipodes Jacob Mitchell went for automotive manufacturer Hyundai Motor, in a market, South Korea, that has recently been gaining attention from value managers.

The company has been hurt by its position in China, with its market share in steady decline. But Mitchell said this was “a blessing in disguise”.

“Hyundai famously pivoted towards India, which has been an amazing success. India is in the early innings of auto adoption in what you can call a structural growth in terms of auto penetration,” he said.

The manager is particularly excited about Hyundai’s leading incumbent position together with Toyota and Honda, which are much better positioned, he said, compared with Tesla.

“Because of the saturation in the high-end electric vehicle market, Tesla's margins over the past 18 months – excluding deferred income and environmental credits – have gone from 18% to 2%. There is very little room left for it to actually invest,” he said.

“On the other hand, for the leading incumbents such as Honda, Toyota and Hyundai, margins are up over that period, so their ability to continue to incrementally invest is very strong.”

European companies

Clive Gillmore, chief investment officer (CIO) of Mondian Investment Partners, selected a stock that he said is the inverse of what people might think is exciting – Italian energy infrastructure company Snam.

Snam is in the business of transportation and storage of gas and re-gasification, that is changing imported liquefied natural gas (LNG) back into gas.

“Pretty straightforward and, frankly, pretty boring,” said Gillmore. This is compounded by Italy’s poor economic growth outlook and predictions of dwindling gas demand in Europe.

But in the stock, Gillmore sees an underappreciated growth story and a strong investment case both in the short- and long-term.

In the short term the case is “very positive”, with the company having “strong stability and visibility of earnings” in a 100% regulated industry. But the long-term too is better than people think, said the manager. Firstly, because dwindling gas demand accounts for only half the picture.

“Just like for the tube network, peak demand is what matters – not those who travel at 2:30pm, but at 6pm. Even though there might be a decline in overall gas use, peak demand is expected to increase. On top of that, Italy could also benefit from a chunk of the gas market moving away from Russia,” he said.

“Secondly, this is a utility company which earns money on return on its capital risk, and its capital expenditure is going to increase as gas companies invest in greener solutions to align with European Union stipulations expecting a move away from gas.”

Ketterer added a few more European picks, including Gucci’s parent Kering and rolling stock manufacturer Alstom SA.

The former is undergoing a re-vamp with less wholesale exposure, store remodels, marketing, talent hires and increased product quality. It is also poised to return “significant” capital to shareholders between 2025 and 2028, she noted.

Alstom SA meamwhile is improving on a “misstep” with the 2021 acquisition of Bombardier Transportation in an attempt to strengthen its global position in rail stock and signalling. It is now on a path to reduce net debt and achieve operational, commercial and cost efficiency, she said.