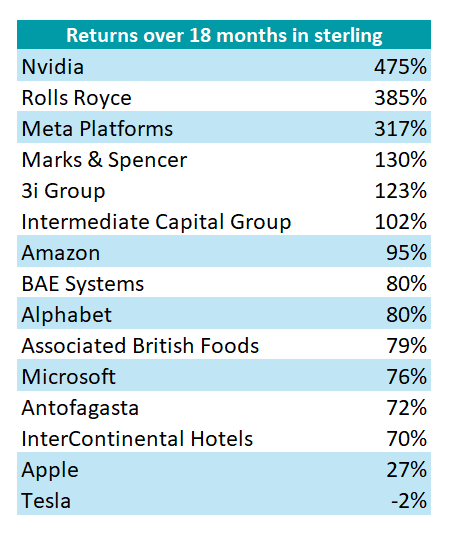

The Magnificent Seven have dominated headlines, so it may come as a surprise that a handful of British companies have delivered returns close to, or even exceeding several of the American tech behemoths over the past 18 months, whilst trading on far lower multiples.

Rolls-Royce has returned 385% over 18 months, beating six of the Magnificent Seven (Nvidia being the exception) and outperforming Meta Platforms’ 317% rise in sterling terms.

Marks & Spencer, 3i Group and Intermediate Capital Group all exceeded Amazon, whose shares rose 95% in sterling terms over 18 months.

Associated British Foods and BAE Systems performed in line with Alphabet, while Antofagasta wasn’t far behind Microsoft.

Dan Coatsworth, investment analyst at AJ Bell, said: “Some 41 FTSE 100 stocks have delivered a better return over the past year and a half than Apple and 79 have beaten Tesla. That is proof that the UK market is alive and well and that strong returns are not restricted to the go-go-growth segment of the US stock market.”

Returns for well-known US and UK stocks over the past 18 months

Sources: AJ Bell and SharePad, data for 18 months to 23 May 2024, total returns in sterling

Imran Sattar, portfolio manager of the Edinburgh Investment Trust, agreed. “There is a perception that the UK market is essentially made up of low growth and lower quality businesses; we strongly disagree. It is possible to build a well-diversified portfolio of advantaged UK businesses with high returns and good growth prospects at a discounted valuation.”

Below, Trustnet explores why the UK’s strongest performing companies have done so well, highlighting the stocks that have beaten five of the Magnificent Seven over the past 18 months.

Rolls Royce

Rolls Royce is a turnaround story and its new chief executive Tufan Erginbilgic, who joined on 1 January 2023, deserves much of the credit for cutting costs and maximising profits.

Rolls Royce has also benefitted from the post-pandemic recovery in air traffic, said Stephen Anness, head of global equities at Invesco. “The resumption of international travel, as well as the management turnaround story beginning to take shape, meant it produced a total shareholder return of 221.6% for 2023, matching Nvidia.”

Coatsworth added: “The engineer continued to issue bullish trading updates and that fired up the share price.”

Marks & Spencer

M&S has beaten expectations multiple times in the past year, Coatsworth said. Earlier this month, the retailer announced strong full-year results, with a 33.8% increase in adjusted operating profit and a 9.4% increase in total sales. It also introduced a 3p dividend.

James Henderson, co-manager of the Henderson Opportunities Trust, Lowland Investment Company and Law Debenture, was an early convert. “We began adding to M&S early in its recovery, which has helped our funds as the bears have turned slowly bullish. Marks’ recent results were very good – much better than the best estimates by analysts,” he said.

M&S has generated strong cash flow, which has enabled it to reduce debt and start paying a dividend again, but now the retailer is embarking on the “next stage of the story”, he continued.

“It is now spending half a billion pounds on improving the offer – upgrading its stores and investing in the online infrastructure. After a period of rationalisation and store closures, this is the next phase and is essential if M&S is to continue its growth,” said Henderson.

3i Group

Nick Shenton, co-manager of the Artemis Income fund, said 3i Group has been the best performing stock in his portfolio over the past year. The £28.5bn investment company produced a total return of 85.5% in 2023 and has been “a tremendous performer over the very long run”.

Anness attributed 3i’s rapid growth to its stake in Action, Europe’s fastest-growing non-food discount retailer, heralding it as “one of the brightest companies on the continent”.

“The cashflow generation of this underlying company has been incredible: the payback period for each newly-opened store is roughly one year. Action currently has more than 2,300 stores and plans to open 400 a year by 2026. We think it could have a 20-year runway for further expansion in Europe alone,” he said.

Intermediate Capital Group

Intermediate Capital Group (ICG), which manages private equity, private debt and real assets funds, has enjoyed a strong 18 months and is one of Jefferies’ “top picks”, said equity analyst Julian Roberts. “We view ICG as a quality compounder with plenty of long-term potential.”

ICG released its results yesterday for the year ended 31 March 2024, surprising on the upside. “We believe new guidance of $55bn of fundraising over the next four years is likely to be taken well, and $13bn of funds raised in the past 12 months compares with $12.4bn expected by analysts,” Roberts said. This included client commitments of almost $1.5bn across three first-time funds.

The firm announced an 11% increase in its fee-earning assets under management to $70bn and a 16% increase in third-party fee income to £578m, well ahead of consensus expectations of £540m.

Associated British Foods

Associated British Foods has performed strongly as inflation cooled, with share buybacks providing further support.

Primark’s owner benefited from its conglomerate structure, Coatsworth said. “Its interests across retail, agriculture, grocery and food ingredients means risks are spread across different industries. When one segment is not doing so well, other parts of its business are there to pick up the slack, and we’ve seen that dynamic at work in recent years.”

BAE Systems

The defence sector was thrust into the spotlight by Russia’s invasion of Ukraine. With geopolitical tensions on the rise, governments around the world have been increasing their defence spending, which has driven a rally in BAE Systems’ shares.

Defence projects tend to be highly complex, involving multiple companies in different countries, said Jason Hollands, managing director of Bestinvest. This means that BAE Systems benefits from global rather than just domestic military expenditure.

Defence order books are multi-year in nature and therefore relatively insensitive to the economic cycle, he continued, which “makes defence ‘defensive’ from an investment perspective”.