Even following the market pullback in April, risk appetites have remained largely intact thus far in 2024, even as the potential trajectory of interest rates has grown increasingly murky. Persistently sticky inflation readings and more-recent signs of economic weakness have markets reconsidering how many federal funds rate cuts will happen this year – or if any will happen at all.

Evolving interest rate expectations have been a prime driver of risk assets thus far in 2024, as they were in 2023. While confidence in a potential US Federal Reserve pivot fuelled rallies across a range of risk assets beginning in late 2023, ‘higher for longer’ has re-emerged as the dominant policy narrative in 2024 as macroeconomic readings have tempered expectations around the timing and magnitude of federal funds rate cuts.

Swaps traders entered the year expecting six cuts totalling 1.5 percentage points during 2024 but now see only one 0.25% cut.

While the enthusiasm for risk assets that emerged toward the end of 2023 persisted through the first quarter of 2024 – especially for large-cap growth names – year-to-date to 30 April, the Russell 2000 Value Index is down 3.7%, lagging the 0.7% loss for its growth analogue and the 6.0% gain for the S&P 500 Index.

Yet even with dampened expectations for rate cuts, signs of market complacency remain widespread. Measures of implied equity market volatility have subsided after an April spike and tight credit spreads, upbeat corporate earnings forecasts and rich multiples for some stocks suggest optimism.

Potential for choppiness

Despite generally resilient equity markets, we believe there are reasons to be wary in the current environment. Tight labour markets and wage growth may trigger still higher inflation ahead and rates that remain higher for longer can be challenging for smaller companies with relatively limited access to capital.

The tight-money environment can also dampen merger and acquisition (M&A) activity by private equity vehicles, historically a source of support for small-cap valuations.

Beyond monetary policy, the escalation of geopolitical risks or unforeseen local political developments – there are federal elections scheduled for more than 70 countries in 2024 – could upend positive market momentum with little advance warning.

Meanwhile, massive swells of public debt in most developed economies combined with a general lack of fiscal discipline have the potential to spark a sudden and painful reconsideration of risk premia.

Relying on investment discipline, not Fed policy

In the small-cap space, volatility may provide us with the opportunity to acquire fundamentally solid companies at valuations that may be distorted by cyclical forces.

There are a number of ways in which US-based smaller companies could receive a boost from a Fed rate cut, from greater operational and financial flexibility to an uptick in M&A activity – but even so, none of our investments are based on the assumption that a much-desired central bank pivot will come to pass.

Regardless of the Fed’s actions, it seems likely that small companies that are cheap for a reason will continue to face a challenging operating environment, while many of those with solid businesses and catalysts for improvement may progress toward fuller valuations.

By controlling what we pay for these assets, we seek to construct a portfolio that is a little cheaper than the market on a valuation basis while being well-positioned for strong upside should our investment theses play out.

Prospects for revaluation

At the end of the day, investors can control only which stocks they buy and how much they pay for them. They make these choices without knowing what the economy is going to look like down the road, the policies that will be implemented, the trajectory of interest rates or the direction of oil prices. All these factors are unknown, so investors make one real choice only – what to buy and how much to pay. If this decision proves wise, they stand to be rewarded.

We believe those who devote their efforts to identifying and investing in good businesses at attractive valuations may see the most success over the long run.

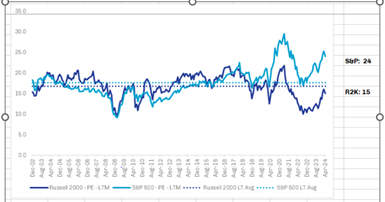

Even following strong gains over the past year, US small-cap valuations continue to suggest an environment with available opportunities. The Russell 2000 Index trades at more than a 10% discount to its historical average and a 38% discount to the S&P 500 Index.

As the chart below shows, a discount for small-cap stocks is a relatively recent phenomenon. For most of the period between 2003 and 2017, small-caps traded at a premium to large-caps, and depressed small-cap valuations have historically been followed by rallies.

Trailing price-to-earnings multiples of US small-caps vs S&P 500

Source: FactSet, data as of 30 Apr 2024

Even within an overall valuation discount for small-caps, however, selectivity remains key. Given that 44% of the companies in the Russell 2000 were unprofitable as of March 31, 2024 – versus only 7% of the S&P 500 – we think sorting the wheat from the chaff is a worthwhile endeavour in the broad and diverse small-cap universe.

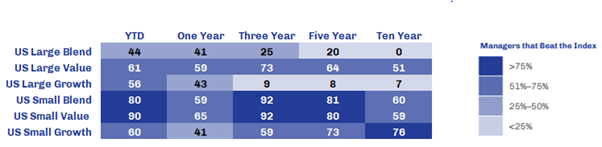

As Warren Buffett (quoting Benjamin Graham) once said, a “wildly fluctuating market means that irrationally low prices will periodically be attached to solid businesses”. Smaller companies are one of those markets and we believe that their volatility and inefficiency create opportunities for active managers to potentially generate alpha, more so than any other equity asset class, as the table below shows.

Active manager success rate versus index

Source: Morningstar, data as of 30 Apr 2024

Navigating uncertainty ahead

Our focus going forward remains on separating strong businesses from those that are cheap for a reason. With the US in an election year, small businesses may have concerns about the regulatory burden, government spending and debt levels, and how these might affect interest rates.

The Fed’s success rate in its previous attempts to engineer a soft landing is an obvious reminder that uncertainty persists, and conditions are likely to become more challenging as the accumulated impacts of policy tightening continue to mount, especially among smaller companies with more limited access to capital.

In the face of these challenges and concerns, our focus remains on separating strong businesses from those that are cheap for a reason. With catalysts for growth or improvement, we look for sound businesses that may be positioned for solid returns.

Bill Hench is head of the small-cap team at First Eagle Investments. The views expressed above should not be taken as investment advice.