When James Watt invented the steam engine, people marvelled at its efficiency, but as they used the new technology, they started to fear they would run out of coal.

British economist Stanley Jevons kept a cool head and predicted in his 1865 book, ‘The Question on Coal’, that increased efficiency would drive greater use of the technology and that far more deposits of coal would be found. History proved him right.

Economists call this the Jevons paradox, which happens when better efficiency leads to increased demand and a higher rate of resource use, contrary to mainstream expectations.

Applying this paradox to today’s markets can give investors an edge in recognising areas that are set to flourish, according to Cole Smead, manager of Smead US Value UCITS.

“There's the myth in our cultures that technology will cause us to do more by depriving ourselves. Technology makes us more efficient, but the Jevons paradox continues to play out,” he said.

“I hear time and time again people saying that technology will make our use of energy so much more efficient and therefore we're going to use less energy. The Jevons paradox says that's impossible, and it's also never happened historically.”

An example is gasoline demand, which has never been bigger in the United States, and the same goes for the number of miles driven.

Similarly, people thought the LED light bulb would save energy but instead, we quadrupled the number of light bulbs in our houses and energy demand continued to go up.

“It's a perfect picture of the Jevons paradox. You did not see a decline in consumption like people would have thought,” he observed.

How the Jevons paradox translates to investing

There is one area where demand is accelerating but supply is being cut, making it a great investment opportunity, according to Smead. That area is electricity production – in particular through fossil fuels.

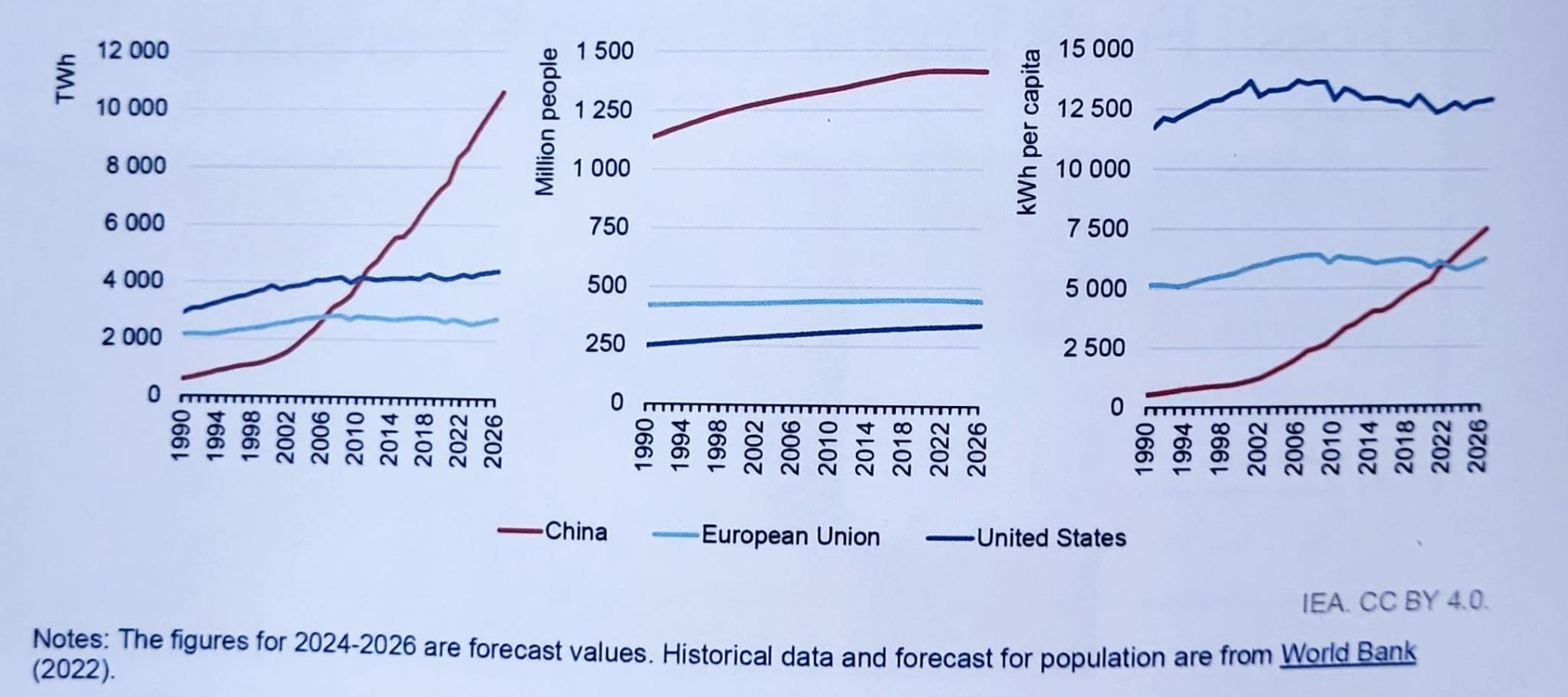

Total electricity demand (left), population (centre) and electricity consumption per capita (right)

Source: Smead Capital Management, International Energy Agency

“Technology causes us to do way greater things and become more efficient. But more efficient doesn’t mean that demand is going down, in fact the curve of electricity use is ever growing,” the manager said.

“And while natural gas has sucked up a bigger share of the total growth, we have slowly been moving away from coal, but move is not relevant whatsoever.”

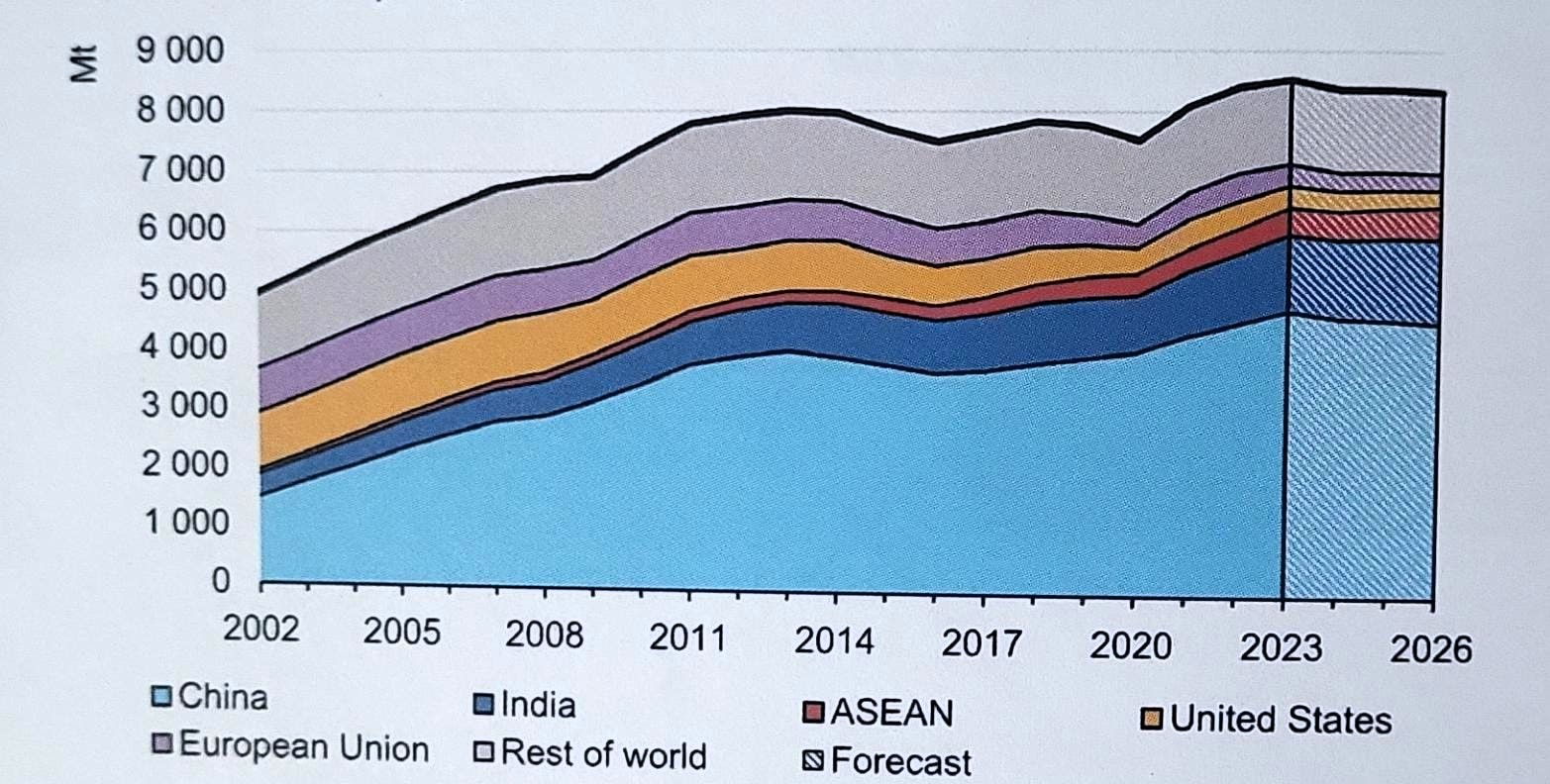

To illustrate this point, he showed the chart below.

Global coal consumption, 2002-2026

Source: Smead Capital Management, International Energy Agency

“About 13 years ago, the International Energy Agency predicted the world was at peak coal usage. So far, it’s 13 years off and growing. These organisations are wicked smart, but they can be very wrong,” he said.

“If you ever get into a world where supply is dwindling and demand picks up, you can make some fabulous money.”

The manager highlighted three stocks that he believes are poised to benefit from this supply/demand discrepancy.

The first is South African coal exporter Thungela – admittedly a cyclical business that has had periods of underperformance, but it comes with “a nice little buffer”, as 60% of the stock is in net cash.

This means firstly that the company would need to burn a lot of cash before investors make a loss, and secondly, that it can buy back its own shares. The impact of buybacks on return on equity (ROE) is “one of the most underappreciated ideas in the stock market”, Smead added.

If half of Thungela’s cash was used to finance share repurchases, its adjusted ROE could grow by 30%, he calculated.

Finally, the market is overlooking pure play Canadian oil sands producer Meg Energy and US oil company Ovintinv, Smead said. Jevson’s paradox is at play again, with capital expenditure on oil declining in the western world, shrinking supply for industry, butat the same time, demand is increasing.