When investors think of Artemis, the areas that usually come to mind are the UK, multi-asset income, and the firm’s SmartGARP franchise.

The latter stands for Growth at a Reasonable Price and “SmartGARP” is the in-house software tool that screens the market for attractive stocks – a process that has evolved over the past 30 years and has not been without periods of difficulties.

Not every strategy can be winning all the time, however and below, Trustnet explores which areas Artemis has been excelling and struggling in in recent years.

When Director of Fairview Investing Ben Yearsley thinks of Artemis, he thinks active UK equities “with non-suit wearing (scruffy) fund managers”.

In his words: “They were the first real anti-establishment fund group, despite the founders all being well established in the Scottish fund management scene.”

An Artemis spokesperson also identified the long tenure of fund managers as one of the strengths at Artemis, which is reflected in the long-term performance (over five years) of “the vast majority of our funds”.

Beginning with the positives, UK equities, bonds and US equities are “the clear winners” at Artemis, according to Yearsley, and the data confirmed it.

All UK strategies have achieved a first performance quartile against their peers over the past 10, five, three and one years, with the only exceptions being Artemis UK Special Situations, which fell to the second quartile over 10 years and third over three; and Artemis Income (Exclusions), which was in the second quartile over three years.

Source: FE Analytics

As mostly value-based strategies, all these funds have been propped up in the currently market, which is much more value-style-oriented, said Yearsley, who added: “Artemis is well suited to a strong UK market.”

The Artemis Income fund is designed to be a core holding and investment director at Pharon Independent Financial Advisers Andy O’Shea has supported it since its launch in 2000.

“This fund fulfils its role very well, having delivered good levels of total return with below average volatility. With an unwavering focus on large-caps, it is an ideal candidate to use alongside something like Gresham House UK Multi Cap Income, and together get a proper multi-cap exposure,” he said.

“The claim to be a core holding is cemented when you consider that over the past 11 discrete calendar years, the fund has outperformed its peer group average in no less than nine.”

UK Select, managed by Ed Legget, is another value fund which has performed strongly, together with the UK Smaller Companies fund, whose manager Mark Niznik has more of a blended style, but remains skewed towards value.

Elsewhere, Yearsley was also a fan of Artemis Global Income, managed by Jacob de Tusch Lec, and the Global Emerging Markets fund, managed in the SmartGARP platform.

Both were also highlighted by O’Shea, together with the European Equity fund. He described it as “very impressive” for its quant-based, trend-following investment process that places high emphasis on revisions to earnings per share and individual share price momentum while seeking cheap stocks that are growing faster than the market using quantitative data rather than fundamental analysis.

Over the past nine discrete calendar years, the emerging market fund has outperformed its peer group average in seven, while the European fund has outperformed its peer group average in seven out of the past 11.

Another stand-out strategy was the multi-asset Monthly Distribution fund, which never fell below the first quartile of the IA Mixed Investment 20-60% Shares sector.

Moving to the more challenged areas, Artemis admitted that “where we do identify issues with individual funds, we actively look to do something to improve the outcomes for investors” – and one such case was Artemis Positive Future in the IA Global sector.

Launched in April 2021, is has had “a disappointing track record” among a difficult market for strategies focusing on positive environmental and societal impact. Peaking in October 2022 with £41m of assets under management, today, the fund only contains £7.9m.

The four original fund managers, who joined from Kames in 2020, left in March 2024 and were replaced by the head of impact equities Sacha El Khoury, who joined Artemis from Columbia Threadneedle in March 2023.

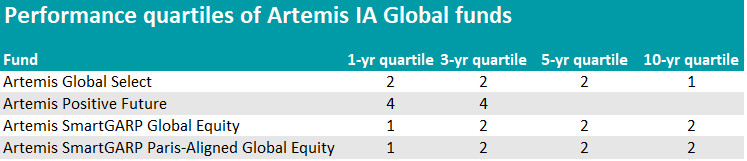

IA Global was a sector with less consistent results for Artemis, as the table below shows.

Source: FE Analytics

However, the track record of Global Select was a responsibility of Simon Edelsten until his retirement from the firm in 2023 and was replaced by a new head of global equities, Alex Stanic, who joined from JP Morgan.

An Artemis spokesperson stressed that Edelsten also recruited two additional global equity managers – Natasha Ebtehadj from Columbia Threadneedle and Swetha Ramachandran from GAM – meaning the fund “now has more managers with greater combined experience than was previously the case”.

New fund managers were also appointed to the two other strategies that underperformed their sectors, Artemis Strategic Assets and European Select.

In June 2023, David Hollis took over the former vehicle with the goal to deliver a portfolio with less volatility in a more systematic multi-asset approach using highly liquid underlying instruments such as exchange-traded funds (ETFs) and future and options.

The fund retained the same objective – to grow the value of the client’s investment by greater than 3% above the Consumer Price index per annum after fees over a minimum five-year period – and in the 12 months since Hollis took over, the fund has met its objective with lower volatility.

“The fees on the fund were also reduced last year to reflect the lower running costs with the investment process,” Artemis noted.

As for European Select, it changed its strategy in September 2023, removing an exclusions policy that restricted investment in any company deriving a meaningful proportion of revenue from defence, alcohol, tobacco, gambling, nuclear power, and fossil fuels, with performance significantly improving since then and the fund rising to the top quartile of its sector over one year.

Kartik Kumar was appointed to run the fund in January 2023.

Source: FE Analytics

Beyond fund management, there has been continuous speculation about the ownership of Artemis, which is “probably putting investors off”, according to Yearsley.

At the beginning of the year, rumours had re-surfaced about a potential sale of the business, but the fund house denied.

Asset managers previously covered in this series: Jupiter, Schroders, Liontrust.