UK banks may not garner as much attention as the mighty Nasdaq or the mainstream S&P 500 index but they have proven to be a more rewarding investment than the US tech-heavy markets over the past three years.

This may come as a surprise, especially given the recent strong returns of the so-called Magnificent Seven stocks (Amazon, Alphabet, Apple, Meta, Microsoft, Nvidia and Tesla) and the powerful narrative surrounding artificial intelligence (AI).

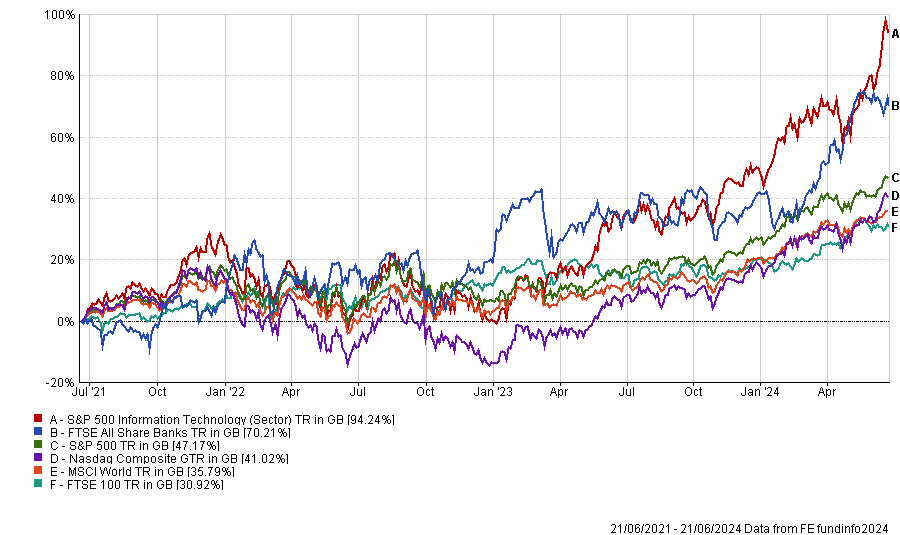

Yet, the FTSE All Share Banks index has returned 70.2% over the past three years, while the Nasdaq Composite and the S&P 500 have ‘only’ made 41% and 41.2% respectively over the same period. The S&P 500 Information Technology, which is a pure technology index, was the exception to the rule as it slightly outperformed domestic financials.

Performance of indices over 3yrs

Source: FE Analytics

UK banks were arguably not the most obvious candidates to outperform the two popular US indices, as they have faced the double whammy of being listed on the unloved UK stock market and belonging to a sector that has faced numerous regulatory headwinds across developed markets since the global financial crisis (GFC).

Graeme Forster, portfolio manager at Orbis Investments, said: “This prolonged water torture peaked in 2020 as UK short and long yields collapsed to zero in the wake of Covid. Bank shares collapsed with them, hitting historically low valuations.”

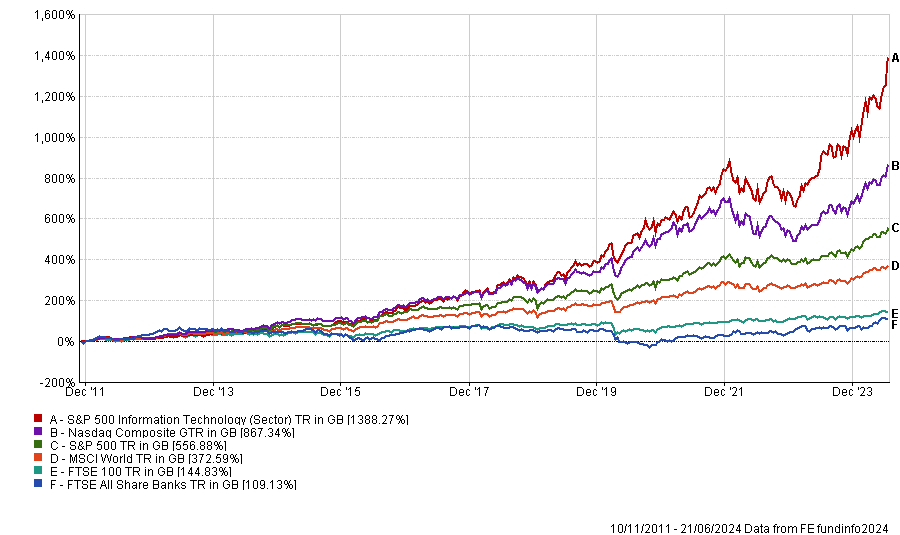

While the post-GFC era has been torturous for UK banks, tech-dominated indices have thrived in this environment, reaching new highs amid Covid lockdowns.

Julian Bishop, co-lead portfolio manager of the Brunner Investment Trust, said: “This was due to a combination of excitement around the pace of digitalisation around Covid and low interest rates, which theoretically increase the present value of longer-duration growth stocks.

“The Nasdaq subsequently saw a correction in 2022, but has since recovered and is now enjoying new highs once again as the narrative around AI continues to build.”

However, the rapid rise in interest rates has been a turning point for UK banks, as their profitability is highly sensitive to interest rates.

Bishop added: “As interest rates have risen, banks have been able to charge customers a higher interest rate.

“They have also received far more interest income on their deposits at central banks. As depositors will have noticed, these higher interest rates have not been passed on to current accounts which still pay a meagre amount.

“The net result is a significant increase in net interest income at the banks, most of which is pure profit. Given the much improved balance sheets at most European banks, this has allowed large dividend payments and buybacks.”

Performance of indices over 15yrs

Source: FE Analytics

Although the explosive gains we’ve seen over the past three years are not likely to be repeated, Forster believes that UK banks could continue to deliver above-normal performance.

He explained valuations remain subdued and capital discipline has improved, while regulatory pressure is unlikely to get worse.

“A key determinant for the shares will be whether interest rates settle comfortably above zero, which will depend on the path for inflation. My view would be that inflation over the next decade will be structurally higher than the previous one,” Forster added.

He also liked Irish banks, which he said were an even more attractive investment option, noting that they have performed in line with, or better, than UK banks over the past few years while also having a better chance of delivering returns exceeding their capital costs in the future.

Foster explained: “This view is based on a general rationalisation within the Irish market, a direct result of an extremely punitive post-GFC regulatory environment.

“Lending into the Irish economy has become prudent and rational, leading to a healthier demand for loans from credit-worthy borrowers and a robust profitable banking system.”

Performance of indices over 3yrs

Source: FE Analytics

Not all are as hopeful for the domestic banks, however. Bishop does not believe that UK banks will continue to deliver the same level of outperformance going forward. Assuming conditions remain favourable, he expects them to continue paying dividends, but with a more modest level of growth.

Yet, he also expressed some concerns about the prospects for US tech names. He concluded: “The Nasdaq’s key constituents, on the other hand, will need to continue to post impressive growth rates and augment their barriers to entry to satisfy the elevated expectations that come with far higher multiples.”