The opportunity set in fixed income is the greatest it’s been for more than a decade, according to Al Cattermole, co-manager of the Mirabaud Sustainable Global Strategic Bond fund.

With yields much higher compared to the past 15 years, there are now “opportunities that investors didn't have before” to make good risk-adjusted returns, he said.

His conviction is reflected in the Mirabaud Sustainable Global Strategic Bond fund’s 60% allocation to investment-grade credit and senior financials (debt that must be repaid first by a company if it goes out of business) – its highest weighting since Cattermole started managing the fund 11 years ago.

“Investment grade is yielding nearly 6% in the US and it's a similar level for global,” he said.

Investment-grade bonds also offer protection against an economic downturn. If a severe recession occurs and central banks cut rates dramatically, he thinks investment grade bonds could deliver double-digit returns.

Catrermole also believes that high-yield bonds would hold up relatively well in a recession, despite spreads being tight.

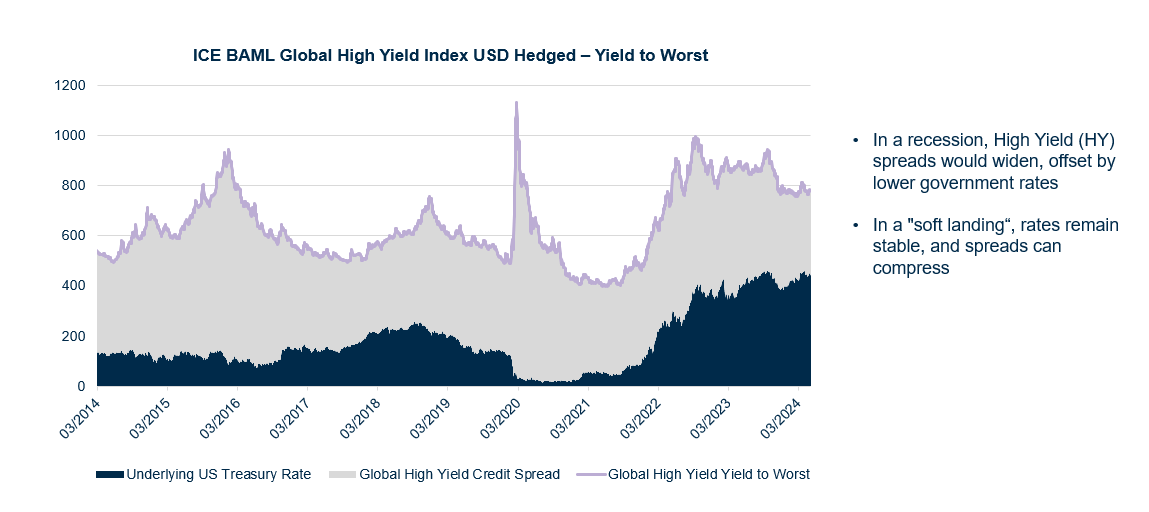

Today, global high-yield bonds are yielding 7.8%, as measured by the ICE BAML Global High Yield index. This is comprised of 350 basis points (bps) of credit spread and 432bps of underlying government rates, as the chart below shows.

High government rates provide protection in a recession scenario

Source: Mirabaud Asset Management, ICE BAML, Bloomberg, data to 31 May 2024

An 8% yield is attractive, but with credit spreads close to 10-year tights, many investors do not feel this compensates them for the risk of a slowing economy, he said.

But they are wrong to think so, according to the manager. “We agree that in a recession scenario (not our base case, but it is in the range of outcomes) credit spreads will increase (let’s say +200bps to 550bps). However – if we do move into a recession the underlying government rate will also fall as central banks cut rates quickly (on average eight cuts/200bps in the first year),” he said.

“This means over 12 months we have +200bps of credit spread but also -200bps in underlying rates movement, and the overall yield on the index is unchanged. In this situation you make the coupon return of the index (around 6.5% running yield or 7.8% yield to worst currently) – so even in a recession scenario, high yield delivers better than cash returns.”

Whether a recession occurs or not, treasury yields and credit spreads should move in opposite directions in next phase of the business cycle, allowing “a bit of a buffer no matter what happens”.

Cattermole reduced his high-yield exposure to 20% last year due to higher recession worries, but he recently increased his allocation again to approximately 30%.

As for the manager’s next move, it would “probably be to reduce credit and increase duration”, as the fund’s dynamic approach allows the managers to change duration frequently.

“The next phase would be moving into a more recessionary position, but if you do that now and the recession is not until 2026, you’ve move too early,” he noted.