The US and global equity markets became even more concentrated in the second quarter of this year, with a handful of companies delivering the bulk of returns.

Apple, Microsoft and Nvidia – the three largest stocks in the US – now comprise 20.4% of the S&P 500 index, a weighting that has not been this high for at least 40 years, according to John Plassard, senior investment specialist at Mirabaud Group.

Market concentration was an issue last year when artificial intelligence (AI) propelled the Magnificent Seven to new heights but it has intensified in the past couple of months, said James Knoedler, co-manager of Evenlode Global Equity.

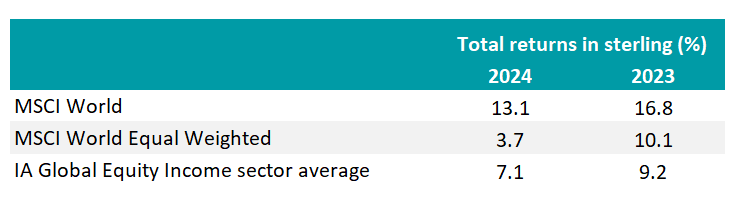

The MSCI World has risen 13.1% this year to 26 June in sterling terms. However, the MSCI World Equal Weighted index only gained 3.7%, which shows how the largest stocks have delivered a disproportionate share of performance. “It’s really unusual to see this level of dispersion,” Knoedler observed.

Last year, the difference between the MSCI World and its equal-weighted sibling was less stark – 4.7 percentage points over 12 months compared to 9.4 percentage points this year so far. In other words, there was a smaller gap between the best and the rest last year.

Total returns of indices last year and YTD

Source: FE Analytics

It has not always been so. During the past decade, the equal-weighted global index has lagged its market-cap sibling by about three percentage points, and over 30 years their performance is more or less the same, Knoedler said. “It’s not like Moses came down from Mount Sinai with the eleventh commandment that you’re always going to have equal-weighted underperforming.”

What this means for active managers is that their relative performance has hinged upon whether they own enough of the largest companies in their benchmarks, which is counterintuitive given that active managers are supposed to deviate from the benchmark and find even better stocks.

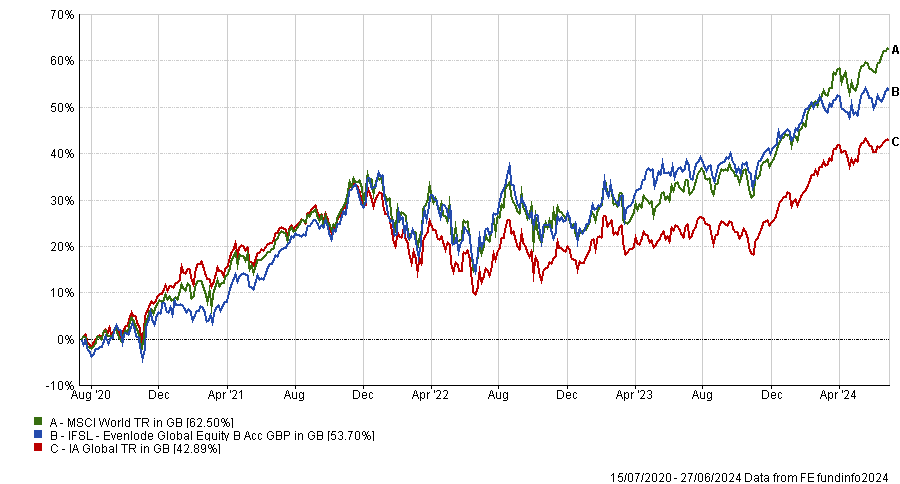

As a case in point, the fundamentals of the companies in the Evenlode Global Equity fund are solid, delivering double the earnings and revenue growth of the benchmark in the past quarter, yet the fund has underperformed on a relative basis.

“It has been a tricky year after, frankly, three and a half years when things went pretty well,” Knoedler acknowledged. “You have these moments in markets which test your conviction that your philosophy and processes are set up the right way.”

Performance of fund vs benchmark and sector since inception

Source: FE Analytics

The market has been behaving unusually due to two seismic events, Knoedler believes. “You have occasional one-off shocks that occur in the market and we've had two that've happened within a year."

One of those events was Nvidia creating $60bn of free cash flow “out of nowhere” over the past 18 months. The other was the US Federal Reserve calling the top of the hiking cycle at the end of 2023 – a major shock that drove a powerful rally in companies geared to interest rates and economic cycles.

As a result, global equity markets have cycled through three stages since late last year. “What goes bonkers initially is stuff that's very highly linked to rate policies, so the small regional banks in America and European small-caps. And they actually faded as this year has gone on because rates haven't come down as quickly as hoped,” Knoedler said.

In the first quarter of this year, those sectors passed the baton onto large banks, industrials, cyclicals and retailers – “stuff where we're not really present”.

The rally excluded the companies Evenlode favours, which have durable competitive advantages and deliver predictable cash flows.

“I think it just reflected the notion that winter was over, you could get out of the igloo and you didn't really need defensive, predictable, cash flow growth companies as much, and you could try other stuff,” he reflected.

This was followed by “a remarkable narrowing of the index” in the past few months, but Knoedler and co-manager Chris Elliott expect the short-term phenomenon of extreme concentration to dissipate eventually, making way for broader-based stock market performance and a return to fundamentals.

“It's not a bad time to be an investor. There are a lot of good quality companies out there and they're doing pretty well,” Knoedler concluded.