Several industries are set to flourish as we enter the third quarter of 2024, with Europe and the UK being the key beneficiaries, according to Helen Jewell, chief investment officer at BlackRock fundamental equities, EMEA.

The opportunity is so great that European shares could overtake their US counterparts in the near term. “European shares have lagged those in the US over the past decade. We now believe that, at least in the short to medium term, this dynamic could reverse,” she said.

Jewell pointed to four tailwinds set to spur Europe’s resurgence. Firstly, earnings growth momentum is likely to continue as companies have significantly reduced their debt levels and invested in future growth, while profitably remains robust despite the higher energy, materials and labour costs of recent years.

Second, the European Central Bank’s initial rate cut is already proving beneficial for companies and consumers. This “should continue to provide a boost to an economy that is already showing signs of life”, with the composite purchasing managers’ index rising in the past six months.

Further impetus should come from favourable valuations. European shares currently trade at a roughly 40% discount to US peers, versus a historical average of about 20%. She also pointed to the high quality of many European companies, which have been able to grow their earnings regardless of macroeconomic or central bank policy fluctuations.

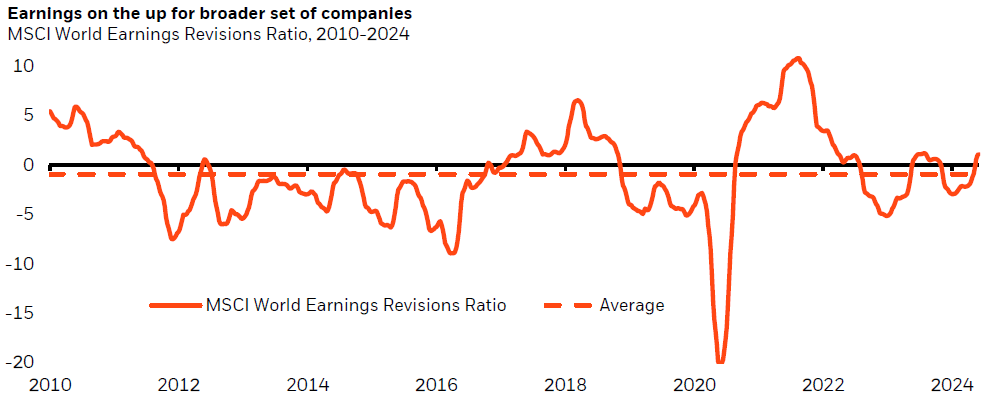

Finally, Jewell expects market leadership to broaden across several sectors, as the chart below shows.

Source: LSEG DataStream, BlackRock Investment Institute.

“The earnings revision ratio for global stocks is back above zero – which means a greater number of companies are seeing upgrades to earnings forecasts than downgrades,” she said.

“Simultaneously, rate cuts may support more cyclical areas of the market, so even as artificial intelligence (AI) remains in focus, we expect to see a broader set of winners for active managers to unearth – a ripe environment for stock selection.”

Jewell highlighted several cyclical sectors she expects to benefit from falling rates and healthier economic activity, as well as long-term structural changes such as decarbonisation, reshoring, and the rise of AI.

First, the renewable energy sector should recover as some of the headwinds that have constrained activity begin to ease. Higher rates have hindered the financing of renewable energy projects and rising inflation has put pressure on raw material costs.

Meanwhile, the secure income streams that utilities deliver will become more attractive to investors once cash savings rates drop below 4-5%.

Construction volumes are set to rebound from their 14-year lows in Europe. As the supply of some materials remains constrained, a strong pricing environment should benefit construction and construction material companies, as well as providers of energy efficiency solutions. Buildings account for 40% of global carbon emissions, Jewell explained, and as governments and businesses race to hit net-zero targets, these companies “are well placed to deliver strong earnings over the long term”.

Semiconductors should continue to flourish due to structural advantages. “Different parts of the semiconductor industry have been in different cycles. While smartphone and PC chips have seen the beginning of a post-Covid recovery, electric vehicle sales growth is slowing and there are some concerns,” she said.

“In the long term, data-centre demand will boost several companies within the semiconductor industry. Increased capital expenditures in 2024 will benefit semiconductor companies, especially those in Europe that have dominant positions in the semiconductor equipment market.”

Other sectors where BlackRock sees opportunities include: luxury goods, where pricing power for the best-managed brands remains strong; banks, which are being supported by share buyback programs, even as rates come down; and healthcare, given that some of the world’s most innovative and profitable healthcare companies are domiciled in Europe.