The SDL Free Spirit fund has completed a “stealth” purchase of a new holding in Nichols plc – better known for its main brand, the fruit cordial and soft drinks Vimto.

Eric Burns, who manages the small-cap sibling of SDL UK Buffettology, said he built the position slowly and “under the radar” to avoid disturbing the share price and was therefore able to buy at “consistent prices, rather than going in aggressively and moving the price against you”.

Burns made his first purchase on 8 May and has built his position in Nichols up to a 3% weighting in the £68.4m portfolio, which now holds 27 stocks.

Listed on the alternative investment market (AIM), Nichols is “an example of a steadily growing business” whose revenue and profitability have been growing “not spectacularly, but nicely,” the manager said.

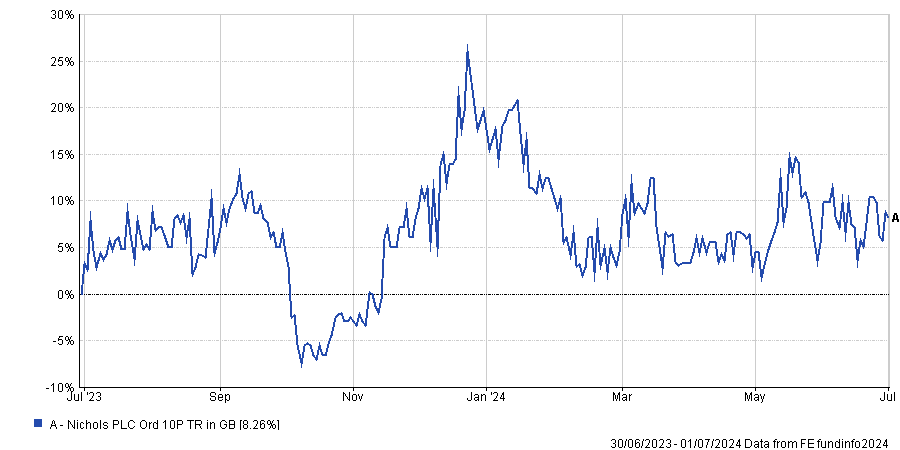

Performance of stock over 1yr

Source: FE Analytics

Vimto has “brand power” and a big following in the Middle East, especially in Saudi Arabia. At Iftar, the fast-breaking evening meal during Ramadan, people traditionally have a glass of Vimto cordial with their meal, Burns said.

His main reason for investing in Nichols now is a strategy pivot. The company is exiting some low-profit activities within the more capital-intensive ‘out of home’ segment (think soda fountains at cinemas and leisure centres, which were badly hit by Covid) to focus on its core UK packaged and international soft drinks markets.

“They are still in the ‘out of home’ market, but they've substantially rationalised it and diverted their investment attention to the other two sides, which for us is the main thrust of the business,” said Burns.

The manager is expecting the operating margin, return on equity and cash conversion to improve over the next one to five years, especially because the starting valuation is “very attractive” and because it has a cash position of £60m, which could come into use for a special dividend, share buybacks or “a sensible small acquisition”, the manager speculated.

“We think we have spotted the inflection before others as the shares are hardly expensive, trading on a current year cash-adjusted price-to-earnings ratio of around 13x and providing a free cash flow yield of around 6% and growing.”

Other recent moves in the SDL Free Spirit portfolio include exiting a company called EKF Diagnostics on the back of “amber flags following a few changes at the C-suite level” and “squandered chances” from the windfall during Covid.

Two more holdings are “on the naughty step” and being cut, Burns revealed.

One of these had two profit warnings and did an acquisition funded by debt, going from a net cash position to a geared position, which “exacerbated the downside”.

“With Free Spirit, we tend to be fairly small shareholders, so when we've tried to engage with management and not been heard, as in this case, that's a real negative.”

On the opposite side of the spectrum, Burns and his team started to build another new holding during June, a business “where we believe there is a sea change in capital allocation taking place for the better under a relatively new CEO”. He declined to name the stock as he builds a position slowly and steadily over the coming months.

Performance of fund against sector and index over 1yr

Source: FE Analytics

The Free Spirit fund has had a positive run since it launched five years ago, beating the IA UK All Companies sector with a 28.9% return. It subsequently fell into the third quartile over three years, when it lost 10.1%, and over 12 months, as shown in the chart above.

“Performance over the last one and two years has been painful, and we say that as managers with skin in the game, as we are all invested in the funds ourselves,” Burns said.

“But because our process is set in stone, there's not an awful lot of levers we can pull. With hindsight, if we'd have pivoted to oil and gas two and a half years ago, the performance would have been a lot better, but our methodology doesn’t allow that, and we're willing to sacrifice the short-term to stay true to our values and deliver in the long term.”