Sometimes it is easy to overthink things. That has been the case for the Trustnet team’s fund picks so far in 2024, with all of our selections failing to match the returns of the MSCI World index throughout the first half of the year.

Of course, there are still another six months to go and all can change again from here, but at the halfway mark we thought it was a good chance to review how our picks have got on.

It has been a real mixture of some excellent selections and some not-so-good ones. The top performer has been the RTW Biotech Opportunities trust, selected by news editor Emma Wallis.

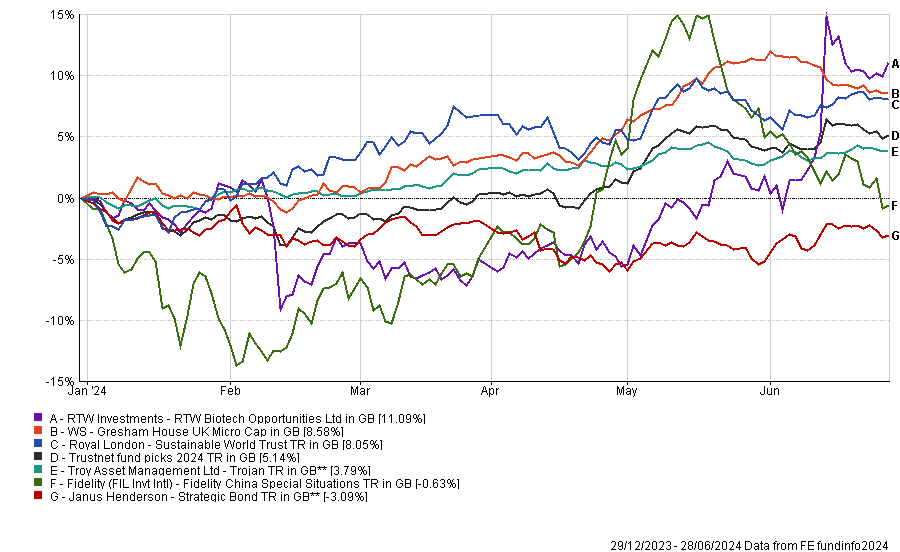

Performance of fund picks and overall Trustnet portfolio vs MSCI World in H1 2024

Source: FE Analytics

With an 11.1% return, it is just 1.6 percentage points behind the MSCI World index but has made a very respectable gain. This year, the trust is third within the seven-strong IT Biotechnology & Healthcare sector.

It has been a busy six months for the trust, which has been helped by strong clinical data from one of its holdings Rocket Pharmaceuticals, as well as the acquisition by Merck of its former largest holding Prometheus Biosciences at a 75% premium to the share price.

Following the trust’s full-year results in March, Gavin Trodd, research analyst at Deutsche Numis, said: “We believe that the fund possesses a strong, well-resourced management team that is well placed to capitalise on market dislocation in the biotech sector.”

On a discount of some 31% back in March, this has narrowed significantly to 21%, giving the trust a boost in share price performance, with much of its total returns so far this year made in the past month. If the trust can continue this momentum, it could be the clear winner by the end of 2024.

In second place so far this year is editor Jonathan Jones’ selection of WS Gresham House UK Micro Cap, which has made 8.6%, still some 3.5 percentage points behind the MSCI World index.

The fund has been an above-average performer in the IA UK Smaller Companies sector, sitting in the second quartile among its peer group.

UK small-caps have come roaring back so far this year as the expectation of interest rate cuts, depressed starting valuations and a pick-up in merger and acquisition (M&A) activity has helped to bolster the beleaguered part of the market.

Government intervention could be the key for the sector in the second half of the year, with hopes that business-friendly policies could entice investors back to the UK. If this happens, the fund could leapfrog RTW Biotechnology Opportunities.

However, perhaps our best pick so far this year has been the Royal London Sustainable World trust. Despite making the third-highest returns (8%), it is the only selection in the top quartile of its sector (IA Mixed Investment 40-85% Shares).

Picked by senior reporter Matteo Anelli, the fund has benefited from the rise of the ‘Magnificent Seven’ stocks, with Alphabet and Microsoft its two largest holdings. A relatively low weighting to bonds (16.6%) has also been a positive for the fund.

If the big US stocks can continue to thrive, and if there is a resurgence in environmental, social and governance (ESG) investing, the fund may be well placed for even more gains in the second half of the year.

Heading further down the list, Trojan is in fourth place, selected by former Trustnet journalist Matthew Cook. The fund is designed to protect investors in times of market difficulty but is expected to lag when stocks fly higher, as they have done so far in 2024.

It sits in the fourth quartile of the IA Flexible Investment sector year-to-date with a return of 3.8%, but any market wobbles in the next six months should benefit the strategy.

This was followed by reporter Jean-Baptiste Andrieux’s selection of Fidelity China Special Situations. The trust has been the worst performer of the three options in the IT China/Greater China sector, although it has only made a small loss of 0.6%, around 6 percentage points behind the MSCI China index.

A notable event during the period was the transaction with the abrdn China Investment Company. Although a good long-term deal for the trust, there may have been some investments that required selling off, which could have impacted performance.

The trust is one of the most highly geared (27%) in the Association Investment Companies (AIC) universe, so if Chinese stocks have a strong second half of the year, then it could leap up the table.

In last place is head of editorial Gary Jackson, whose selection of Janus Henderson Strategic Bond has been the third worst performer in the IA Strategic Bond sector so far in 2024, losing 3.1%.

John Pattullo, co-head of the global bonds team at Janus Henderson, is to retire in March 2025, with Jenna Barnard remaining in place and Nicholas Ware, portfolio manager of the Fixed Interest Monthly Income fund, becoming a named portfolio manager fund at the start of July.

Bonds were expected to perform well at the start of the year, with interest rates forecast to come crashing down, but this has yet to happen. The fund could come back, however, if rates start to drop. There are some concerns though that rate cuts could be pushed to 2025, suggesting the pick may have been one year too early.